Can you close a credit card with a balance?

Editor's Note

Applying for and opening a new credit card can be exciting because new cards usually offer a welcome bonus after you meet a minimum spend requirement in a specific period of time.

At the end of every billing cycle, you receive a statement — the money owed to the issuer — which we recommend paying off in full whenever possible. But what happens when you close a credit card with a balance? Does it hurt your credit score and affect future borrowing needs?

Here's what you need to know about closing a credit card with a balance.

Pay off a credit card or maintain a balance?

To avoid interest charges, it's best practice to pay off the credit card balance each month. When carrying a balance month to month, interest charges begin to accrue; this diminishes the value you receive from a card, such as points, miles or cash back rewards.

That said, you may maintain a balance on your credit card as long as you pay off the minimum statement balance (which we strongly advise against; if you're unable to pay off a balance in full, do your best to send in a payment for more than the minimum required amount).

The current balance on a credit card is not subject to interest charges until that month's billing cycle ends.

Can you close a credit card with a balance?

Closing a credit card with a balance is possible. However, there are some things to keep in mind.

When you close a credit card, you can no longer make purchases on the credit card and also forfeit transferable rewards points. Upon closing a credit card with a balance, you remain responsible for the balance and will continue to accrue interest on it while receiving billing statements.

If you are determined to close a credit card, it's better to pay off any current balance before doing so to avoid late fees, interest charges and the possibility of the debt being sent to collections if left unresolved. If the card has no annual fee, you're better off leaving the account open and leaving it for emergency use; if it does have an annual fee, you can consider downgrading to a card with no annual fee.

Another alternative to closing a card with a balance is to transfer the balance to an existing or new credit card. By transferring the balance on the card you wish to close, you can avoid paying a lump sum of the balance and avoid interest fees for a promotional period.

Check out TPG's best balance transfer credit cards to see how to take advantage of great offers.

Related: The best way to pay credit card bills

Impact of closing a credit card with a balance

Closing a credit card with a balance can hurt you in several ways, including negatively affecting your credit score and overall credit report.

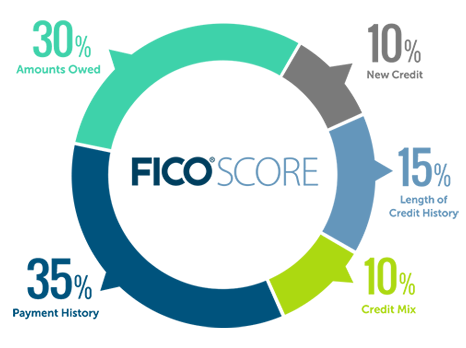

When closing a credit card, you reduce the length of your credit history and the average age of your accounts. Length of credit history makes up 15% of your FICO score, so expect a dip when you close a credit card.

If you close a credit card with a balance, you also increase your credit utilization, as this reduces your overall credit across all accounts. If the closing of a credit card pushes your utilization over 30% of the total available credit, you risk negatively affecting your credit score.

If you close a card due to a history of late payments, know that such incidents remain on your credit report for about seven years.

Closing a credit card with a balance can also affect you long term if you do not pay off the balance promptly. You'll continue to receive billing statements for any balances owed to the issuer.

If the balance remains unresolved for some time, the issuer can send it to a collections agency, and it will be reported to the three credit bureaus. This will negatively affect your creditworthiness in a big way.

Bottom line

It is possible to close a credit card with a balance. However, despite closing the account, you are still responsible for paying the balance and any associated late or interest fees. A better move is to pay off the entire balance of a credit card before closing the account.

If you can avoid closing a card by downgrading it to a no-annual-fee card or shifting its line of credit to another card with the same issuer, you may be able to protect your credit score and avoid dealing with future interest charges or negative marks on your credit report.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app