Citi Partially Delays the Devaluation of Price Rewind

Update: Some offers mentioned below are no longer available. View the current offers here. Citi has announced most of its credit card benefits and protections will end on September 22, 2019, including some of the benefits or protections explored in this story. For more details, see this story.

Citi is a TPG advertising partner.

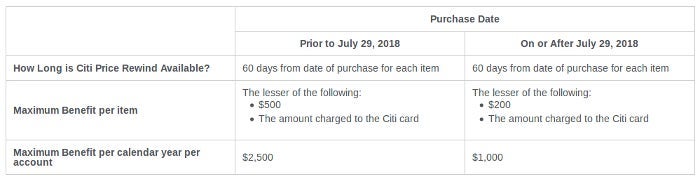

Citi Price Rewind is one of the easiest-to-use price protection programs offered by any of the major credit card issuers, so cardholders who utilize this valuable benefit were saddened when Citi announced a devaluation to the popular program back in April. However, it appears cardmembers have received a reprieve until the end of the year on one change: the maximum benefit per year per account will remain at $2,500 through the end of 2018. The maximum per item has already been lowered from $500 to $200 as previously announced.

Interestingly, the benefits guide for my Citi ThankYou Preferred Card and the Citi Price Rewind website both still state that the maximum benefit per year per account will be $1,000 from July 29 onward.

Chase is completely removing price protection benefits from all its credit cards on August 26. So, it's great to see that Citi is maintaining its Price Rewind benefit and that cardholders will continue to get the $2,500 maximum annual benefit through the end of the year. Plus, the 24-month extended warranty offered by many Citi-issued cards makes Citi credit cards excellent for purchases that might break just after their manufacturer's warranty ends.

Most Citi-issued cards offer the Citi Price Rewind benefit, including:

- Citi Prestige ($450 annual fee)

- Citi Premier® Card ($95 annual fee)

- Citi ThankYou Preferred Card (no annual fee)

- Citi® Double Cash Card (no annual fee)

The information for the Citi Prestige, Citi Premier® Card, Citi Premier® Card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

H/T: Doctor of Credit