Why are so many people being double-charged to use the NYC subway?

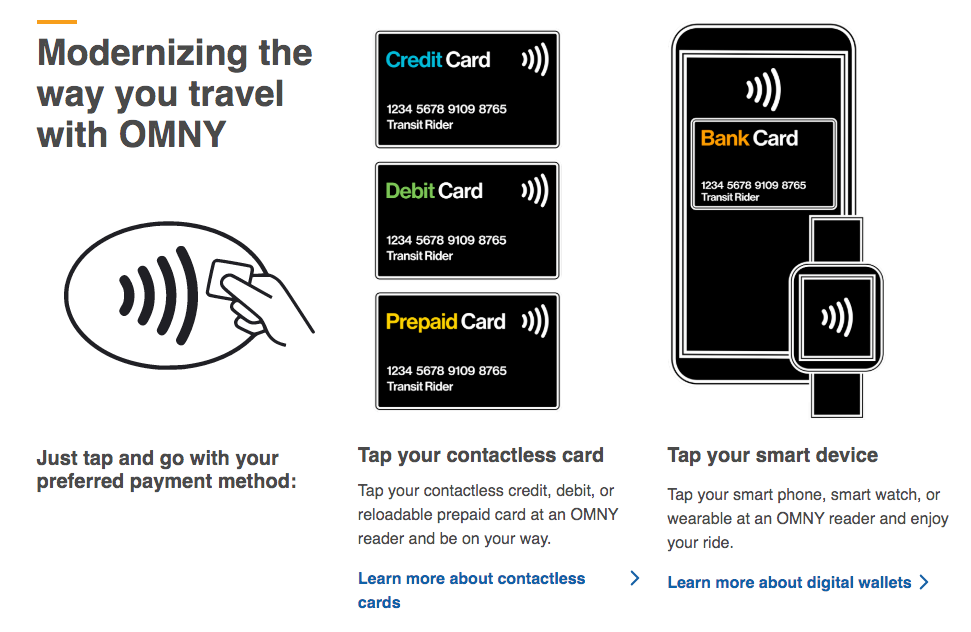

Late last year, I visited London and marveled at the efficient contactless payment system the Tube uses. I became even more excited to adopt New York City's contactless fare system -- called OMNY -- when I returned home from London. OMNY started its rollout in May 2019 and is expected to be available across MTA buses and subways in late 2020.

I am a heavy user of Apple Pay, connecting it to any account that will let me, and using it as my main form of payment at stores. My Apple Watch with Apple Pay has been one of my favorite purchases in years, so you can bet I'm going to be one of the first people to enthusiastically use OMNY.

One of the main differences between the London and New York systems is the portal for contactless payment. In London, they use small plastic yellow terminals, while in New York they are introducing small iPad-like screens. Introducing a fragile terminal in New York seems like an obvious flaw, and before the system is even fully rolled out I counted at least 2two broken screens at the Union Square subway stop.

As a member of TPG's social media team and a millennial that likes to photograph everything, I wanted to snap a quick photo of the broken terminals while passing though at a low traffic time. After taking the photo, I kept my phone in my right hand and used my left hand to reach over and swipe my unlimited Metrocard. Before the card could register, my phone authorized the contactless payment.

How could it do this? Apple Wallet has a feature called "Transit Express." Once toggled on, it's designed to authorize transit payments without additional authorization.

I'm not the only one this is happening to. For some, this double-payment is happening even while their phone is safely in their purse or pocket.

Since I use my Apple Watch daily, I'm surprised this has only happened to me once.

In a Twitter reply to an OMNY double-pay complaint, MTA is encouraging subway customers to disable Transit Express while using the subway system.

Maybe I toggled the function on when I was in London. Maybe it slid on when I added my new Amex Gold card to my Apple Wallet. However it got turned on, let my mistake be a lesson to you. Unless you're going to use Apple Pay at the OMNY terminals, make sure this feature is turned off.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app