The Amex Gold Card Will Now Earn 4x Points at Restaurants

Update: Some offers mentioned below are no longer available. View the current offers here.

The American Express® Gold Card is one of our top picks for maximizing dining purchases, but since the 4x earnings on dining have been limited to US restaurants, it's been less attractive than other options for your trips abroad. That's why this news is huge: Card members will now receive 4 points per dollar spent on dining at restaurants in general.

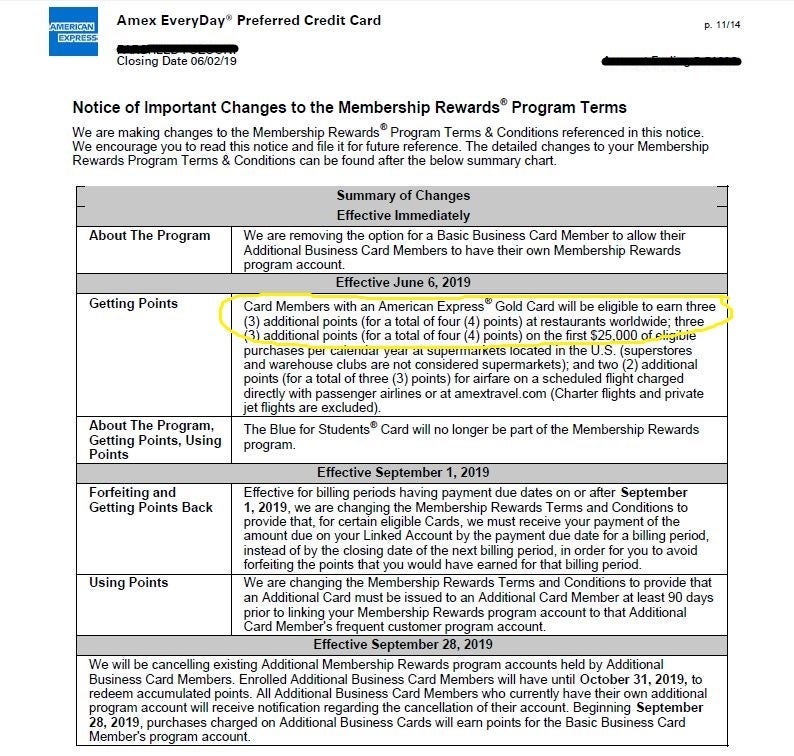

We learned of this change thanks to a TPG reader who shared this screenshot from their card statement:

According to the screenshot provided by the reader, the Amex Gold now earns 4x points on international dining purchases at restaurants as of June 6. Also note that the 4x earning rate on the first $25,000 spent at supermarkets each calendar year (then 1x) is still limited to supermarkets in the US. The card has a $250 annual fee (see rates and fees).

Based on TPG's valuations, 4x Amex points on dining at restaurants equals an 8% return on spending. That's second only to the Citi Prestige Card's 5x/8.5% return on dining worldwide. Before this change on the Amex Gold, the Citi Prestige and the Chase Sapphire Reserve (with 3x on dining; a 6% return) were our two top picks for dining purchases abroad, but this update nudges the CSR out of its second-place spot.

This is the Amex Gold Card's second refresh since October 2018, when American Express announced a limited-time rose gold card, 4 points per dollar spent at US restaurants and supermarkets and up to $120 in annual dining credits when paying with the Gold Card at participating dining partners including Grubhub, Seamless, The Cheesecake Factory, Ruth's Chris Steak House and participating Shake Shack locations. Enrollment required.

Dining is a top spending category for many card holders, both at home and abroad, so we're very glad that Amex has extended the 4x earning rate to international dining purchases. This change makes it easy to justify clearing a coveted spot in your travel wallet for the Amex Gold.

For rates and fees of the Amex Gold card, click here.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app