5 lesser-known things that affect your credit score

Editor's note: This post has been updated with more recent information on credit card scores. It was originally published on Oct. 2, 2015.

Earning points and miles through lucrative credit card bonuses can open up amazing travel options. But to really work this hobby to your advantage, you need a solid credit score. Today, TPG Contributor Michelle Lambright Black goes back to basics with a look at several things that you may not even realize are influencing this all-important number.

There are many mysteries in the universe, perhaps none bigger than how a credit score is calculated. It's critical to understand exactly how those three-digit numbers are calculated because your credit score influences many areas of your life — including your ability to qualify for attractive credit card offers.

If you experience a credit score decrease and don't understand why it happened, it can be maddening. Below, I'll break down five lesser-known factors that can influence your credit score to help you better understand the credit scoring process and avoid some common mistakes.

High credit utilization

Paying your bills on time is the most important factor in your credit score. But your credit utilization ratio is nearly as influential in terms of credit score importance.

Credit utilization is a measurement of the relationship between your credit card limits and balances.

If your credit report shows a credit card with a $10,000 limit and a $5,000 balance, your credit utilization ratio is 50%. As an equation, credit utilization is equal to balance divided by credit limit multiplied by 100. Here's a look at the formula and an example of how it works:

Credit Utilization Ratio Formula |

|---|

Credit Card Balance, Credit Limit X 100 |

Credit Utilization Ratio Example |

|---|

$5,000 (Balance), $10,000 (Limit) = 0.50 X 100 = 50% Credit Utilization Ratio |

Why do credit scoring models include your credit limit utilization? It has to do with risk prediction. Statistics show that people who use bigger portions of their credit card limits are more likely to pay bills late. The lower your utilization ratio, the lower your credit risk. In general, lower credit utilization ratios translate to a better credit score. If you want a good credit score, you should pay off your statement balance every month (preferably before the statement closing date on your account).

Utilization ratio is equal to balance/credit limit. The higher the ratio, the more warning signs that begin to appear to the gods of credit scoring. A good percentage is thought to be below 25%. Ironically, 0% isn't a good ratio to have either; creditors like to see that cards can be managed responsibly, and zero indicates that credit is not being used at all.

A big part of this ratio is when your balances are reported to credit agencies. Depending on the date, your utilization ratio could appear higher than usual. A good way to keep this low is by making multiple payments in a month. Sometimes, banks do you a favor by raising credit limit, which has the benefit of automatically lowering your utilization ratio.

Although it seems counterintuitive, it's actually beneficial to have certain kinds of debt, such as mortgages and other loans, as long as you're submitting the minimum payments in a timely fashion.

Closing old credit cards is tricky

Although strategic credit card closings might be part of your long-term points-and-miles strategy, you need to be careful. Closing credit cards can backfire and hurt your credit score instead of helping it. When you close an unused credit card (especially one with a zero balance), you might accidentally increase your credit utilization ratio.

Scoring models, like FICO and VantageScore, don't just measure your credit utilization on individual credit cards. They measure your overall or aggregate utilization ratio. When you close a zero-balance credit card, you may trigger an increase in your overall credit utilization.

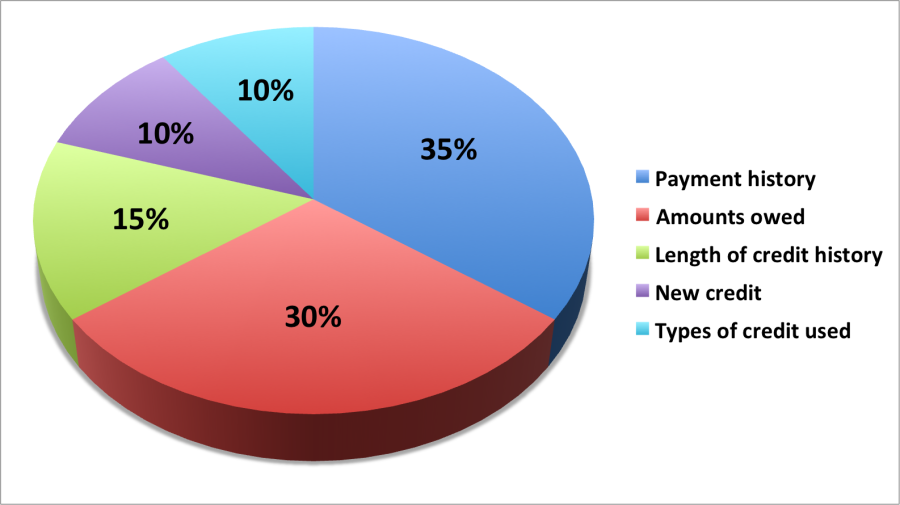

Credit utilization represents approximately 30% of your FICO score. It's worth 20% of VantageScore 3.0 and 4.0 scores. So the balances you carry on credit cards and how they relate to your credit limits are a big deal. Pay your full statement balance each month (before the statement closing date if you charge high amounts), and your credit score should generally be OK.

A common credit myth suggests that when you close a credit card, you lose credit for the age of the account. The average age of your accounts is, in fact, considered by the scoring models -- and older is better. However, as long as the account remains on your credit report, open or closed, it counts in FICO's average age of accounts measurement and it will stay on your credit report for about 10 years if it's a positive account.

Multiple inquiries might be bad

When a financial institution accesses your credit score, a record known as an "inquiry" is added to your credit report. Most inquiries stay on your report for 24 months. Certain inquiries, known as "hard" inquiries, have the potential to damage your credit score for 12 months. (Tip: Checking your credit score and report will never hurt you.)

The reason credit inquiries might damage your score is that studies show that people who apply for a lot of credit in a short period of time are riskier borrowers. Specifically, they're more likely to pay a credit obligation 90 days late in the following 24 months.

The logic is as follows: The more credit you apply for, the more it appears that you need money. If you apply for a lot of credit at once, it makes you look desperate for cash. This may raise a red flag with credit card issuers and other lenders.

Some people apply for numerous credit cards at once to accumulate a lot of points in a short period of time. This strategy can have negative implications for your credit score.

Sure, in the short term you might accumulate a boatload of points. But is putting your credit score at risk really worth it? In my opinion, no. The benefits don't outweigh the potential cost of damaged credit score.

Credit card issuers have also begun to crack down on churners in recent years. Cards that were once easily attainable are now being denied because of too many applications in the 18-24 months prior to application. Chase's 5/24 policy denies credit card applications if you've opened more than five credit cards in the previous 24 months. Other card issuers have rules that restrict sign-up bonuses.

The lesson: Be picky about which cards you open and use a smart credit card strategy.

Late payment may damage your credit score

This may seem simple, but it's worth stressing. It's critical to pay all of your credit obligations on time every month — including at least the minimum monthly payment on your credit cards. A single 30-day late payment has the potential to damage to your credit score. If you frequently make late payments or fall more than 30 days behind on a payment, the negative impact on your score could be more severe.

Payment history is worth 35% of your FICO score. With VantageScore, how you pay your bills is even more important, accounting for 41% of your credit score under the VantageScore 4.0 model. Payment history is typically the most important factor when your credit score is calculated, no matter who is checking or which scoring model is being used.

Where credit cards are concerned, it's best to pay your full statement balance every month. Doing so can protect your credit score from high utilization and save you money on credit card interest. But if you make a mistake and overspend, it's still critical to pay at least your monthly minimum.

Finally, remember that automated payments can be a great backup system to save you from oversights. Most card issuers allow you to schedule automatic payments either for the minimum due or your full statement balance. You can choose the option you're comfortable with.

I'm a big fan of automatic payments on credit cards and other bills. However, I set an alarm on my smartphone to tell me to log into my accounts on the day my autodrafts are scheduled to verify that the payments were, indeed, successful.

Errors beyond your control can still hurt you

The first four factors listed above are behaviors that may hurt your credit score. Once you know how credit scoring works, you can avoid those four behaviors and protect your credit. There is, however, another negative factor you should be aware of — credit reporting errors. Credit reporting errors can damage your score and there's not much you can do to prevent them.

Credit reporting errors are a bigger problem than many people realize. The Federal Trade Commission (FTC) released a study on credit report accuracy and found that more than 25% of consumers had an error on at least one of their credit reports.

You can't prevent credit reporting errors from fraud or identity theft or when creditors report bad information to the credit bureaus. Some credit reporting errors, like mixed files, are even caused by the credit bureaus themselves. But you can take steps to protect your credit and fix problems when they occur.

First, check all three of your credit reports from Equifax, TransUnion and Experian often. You're entitled to a free report from each bureau every 12 months via AnnualCreditReport.com. When you download your reports, go through them line by line. Make a list of any mistakes. Even errors that seem minor might be more relevant than you think.

If you find errors, you can dispute them with the credit bureaus. According to the Fair Credit Reporting Act (FCRA), the credit bureau has 30 days to investigate your dispute (45 days in certain cases). At the end of the investigation, the credit bureau must either verify that the item on your credit report is accurate or delete it. The Consumer Financial Protection Bureau (CFPB) provides a helpful guide to walk you through the dispute process.

Additionally, if you want to lower the chance of someone opening a fraudulent account in your name, consider freezing your three credit reports. You can freeze your credit for free and it will block future lenders from accessing your credit information. When you want to apply for legitimate credit in the future, you'll need to "thaw" your credit reports first. Although thawing your credit before new applications requires an extra step, it's well worth it for the added protection against this type of fraud.

Bottom line

Your credit score matters. Good credit can save you thousands of dollars throughout your life. Good credit may also help you to qualify for attractive offers from lenders, such as premium travel rewards credit cards.

If you currently have less-than-stellar credit, don't despair. There are still some travel rewards cards that you might qualify for now. In the meantime, keep a close eye on your credit reports, avoid the mistakes outlined above and study additional ways to improve your credit for the future. Staying on top of your payments can bring an excellent credit score within reach.

For more information on credit scores, see the following posts:

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app