Where to Sit When Flying Singapore Airlines’ A350: Premium Economy

Update: Some offers mentioned below are no longer available. View the current offers here.

This Sunday, Singapore Airlines will begin operating its first nonstop flight to the US since 2013, when the airline discontinued its Newark and Los Angeles nonstops to Changi Airport. Those flights are scheduled to resume as well two years from now, once Singapore takes delivery of its A350-900ULR, but the San Francisco nonstop is a bit shorter, so the airline can serve that route with the A350 model available today.

Given that the San Francisco nonstop launches in just two days, it's time to start considering this flight when planning your award travel. Singapore partners with all four transferrable-points programs, so it's relatively easy and affordable to book an award flight in any of the plane's three cabins.

Yesterday, I gave you an in-depth look at business class, and today we're moving back to the airline's new premium economy cabin. Premium economy awards are fairly easy to come across, and they'll run you 55,250 miles (plus about $250) one-way from SFO. That's nearly twice the number of miles you'll need for coach, but on such a long flight, it can be worth the splurge.

You can boost your KrisFlyer balance via the programs and cards below:

- Citi ThankYou Rewards – Citi Premier® Card and the Citi Prestige Card

- American Express Membership Rewards – The Platinum Card® from American Express, the American Express® Gold Card and the Amex EveryDay® Preferred Credit Card from American Express

- Chase Ultimate Rewards – Chase Sapphire Reserve, Chase Sapphire Preferred Card and the Ink Plus Business Card

- Starwood Preferred Guest – Starwood Preferred Guest® Credit Card from American Express, Starwood Preferred Guest® Business Credit Card from American Express, Marriott Rewards Premier Credit Card and the Marriott Rewards Premier Business Credit Card.

Last week, I flew on the delivery flight of the exact same A350 that will operate SFO service, and given that the plane was nearly entirely empty, I had plenty of time to check out the seats in all three cabins. Since you'll be spending 16+ hours onboard this plane, you'll want to choose you seats very carefully. I'll dig into which you should pick below.

Premium Economy Cabin

Singapore's premium economy section is the smallest cabin on the A350-900, with juts 24 seats spread between three rows. It feels very intimate, and since Singapore's only been flying the A350 for a few months, these seats should feel "fresh" regardless of which aircraft you're on. The cabin doesn't have its own lavatory, so you'll need to head to the back of the first coach section each time you need to use the lav.

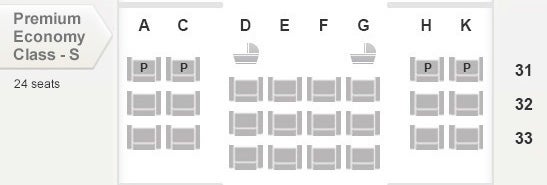

Premium economy seats are arranged in a 2-4-2 configuration, making this option ideal for couples — and, perhaps, families of four.

Each seat includes a leg rest and a footrest, up to 8 inches of recline and 38 inches of pitch.

Seats are 19 inches wide, compared to 18 inches in regular coach — while an extra inch doesn't sound like a lot, it can definitely make a difference on a long-haul flight.

Each seat has a bit of storage, a power outlet, two USB ports and a 13.3-inch HD touchscreen with the same fantastic content you'll find in business class and coach.

Premium economy passengers can also take advantage of the airline's Book the Cook service, making it possible to reserve in-flight meals before departure. For more on the Singapore Airlines premium economy experience, check out our A380 review.

Which Seats to Pick

Just as is the case in business class, the bulkhead seats are the ones to pick here. My first preference would be the paired seats, so in this case, you'll want to select 31A, 31C, 31H or 31K. If those seats are already selected and you're traveling solo, go with 31D or 31G. Bulkhead seats have a slide-out footrest (which I prefer), rather than the flip-down design available in non-bulkhead seats.

From there, I'd suggest selecting A and C or H and K seats in rows 32 or 33, since you'll only have one person to sit next to. Given how long the flight is to and from San Francisco, you'll likely want to stand up and walk around as often as practical — in that case, aisle seats are best, since you'll have easy access to get in and out.

Which Seats to Avoid

Naturally, the E and F seats are less ideal, since you'll have another passenger on both sides. The premium economy armrests are larger than those in coach, but you'll still likely end up bumping elbows with your neighbor when seating in an E or F seat.

Also, rows 32 and 33 are much more cramped than 31, since you'll have a seat in front of you.

Bottom Line

Singapore's premium economy isn't quite as roomy as domestic first class in the US, but it's definitely a big step up from coach. The ability to preorder your meal with Book the Cook is an added perk, the leg and footrests are welcome additions and the huge 13.3-inch touchscreen display can help keep you entertained for the duration of the flight.

Have you flown premium economy on Singapore's A350?

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app