United is improving the connecting experience with big tech upgrades

If you've ever been that person asking your fellow passengers to let you disembark before them, then this news from United Airlines will likely excite you.

The Chicago-based carrier announced on Wednesday a big expansion to its ConnectionSaver technology, which debuted back in 2019.

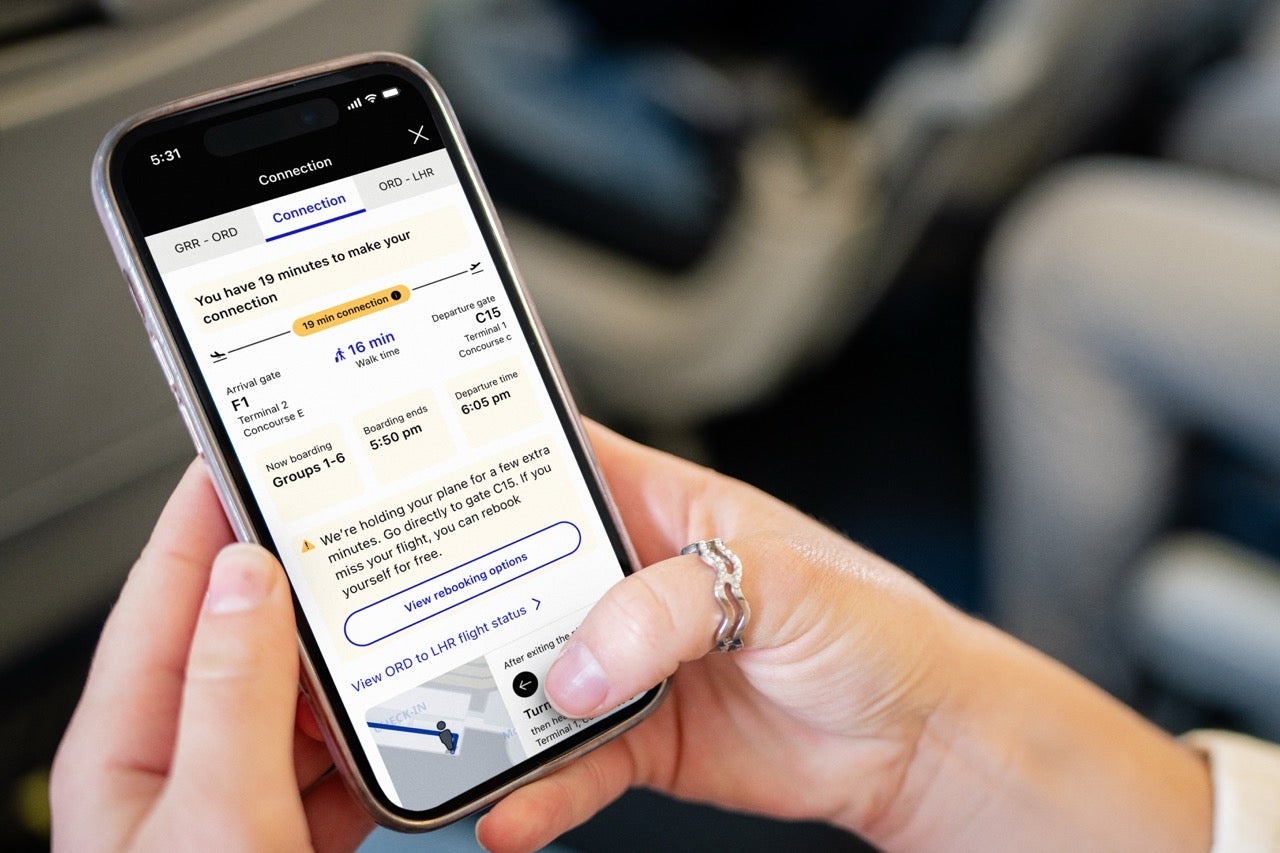

As part of the expansion, flyers will see an enhanced connection dashboard in the United mobile app that includes a slew of new features depending on the length of their connection.

Bargain hunting: When is the best time to book flights for the cheapest airfare?

Perhaps the most exciting enhancement is that travelers will receive a notification if their connecting flight is being held by ConnectionSaver. This is a tool that identifies tight connections and potentially holds connecting flights if the arrival time of the next flight wouldn't be significantly delayed by a short hold.

Since it debuted six years ago, ConnectionSaver has saved the day for more than 3.3 million travelers, according to United. (It's too bad United's competitors don't seem to be using similar technology yet.)

In addition to this new notification, travelers will see turn-by-turn directions with estimated walk times between their gates at all U.S. hubs, as well as tips for longer layovers and flight status updates.

If you don't end up making your connection, the app will offer a self-service rebooking experience that will allow you to confirm the next available flight or join the standby list for an earlier flight.

These features are currently available in English and Spanish, and support for additional languages will be introduced in the coming months.

Furthermore, the map technology will soon overlay your current location for even easier navigation between gates.

United said that more than 20 million flyers have already booked connecting flights for the summer travel period. The airline also beta-tested these new features during the spring with more 350,000 customers, 98% of whom made their connection.

"We know that giving people more information, in a transparent and easy-to-understand way, can help de-stress the connecting flight experience. Our award-winning mobile app is a game-changer during travel, and with these new features, our customers will have even more real-time details about their flight and as a result, have an even better experience flying United," David Kinzelman, United's chief customer officer, said about the new features.

Related reading:

- 6 things you need to know about United Airlines MileagePlus

- The best credit cards for United Airlines flyers

- What is United Airlines elite status worth?

- Maximize your airfare: The best credit cards for booking flights

- The best credit cards to reach elite status

- How to survive basic economy on United Airlines

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app