Your essential guide to duty-free shopping at the airport

If you're like me, you frequently browse the items strategically placed near the checkout lane at grocery stores as you wait in line, asking yourself if you need to add just one more item to your cart. Most recently, I indulged in this impulse shopping at Trader Joe's by buying a box of gluten-free Joe-Joe's (the store's version of Oreos).

This idea of buying things you don't necessarily need also runs through my mind frequently at airports thanks to duty-free shops, which entice me with the allure of saving money by shopping sans an import tax on goods transported internationally.

I most recently shopped duty-free items at Paris-Charles de Gaulle Airport (CDG) after spending a week trying to find simple shortbread cookies and plain chocolate for my mother for Mother's Day to no avail.

Not only did I find some at the duty-free store in CDG's Terminal 2, but I also realized if I was getting something for her, I should probably get something for my dad, too, which led to me buying two boxes of cookies and a chocolate bar. Nearly five months later, she's still talking about them.

Whether your next international trip happens to coincide with shopping for a loved one or you want a preflight snack, here's everything you need to know about duty-free shopping.

[table-of-contents /]

What is duty-free shopping?

If you've ever flown internationally, you've likely at least noticed (if not shopped for) duty-free items at the airport while on your way to another country. In fact, some larger airports, including Heathrow Airport (LHR) and Los Angeles International Airport (LAX), have close to 20 duty-free stores to choose from.

What exactly does it mean to be "duty-free," though? It all comes down to taxes.

Duty-free stores are ones that allow outgoing travelers to shop without being taxed locally, meaning they can purchase select items customs-free so long as they transport them across international borders, according to U.S. Customs and Border Protection. They are typically located in international terminals, though regular terminals with international flights may also have duty-free shops.

Travelers can buy a range of luxury items at these stores, including food, alcohol, tobacco, accessories, fragrances and beauty products like cosmetics. Some of the most common duty-free store brands are Dufry, DFS Group, International Shoppes, Duty Free Americas and World Duty Free.

Along with duty-free stores, you can also shop duty-free at some airport retail stores. For example, high-end British fashion brand Burberry notes on its website that "items can be purchased tax-free in selected airport stores," including at LHR.

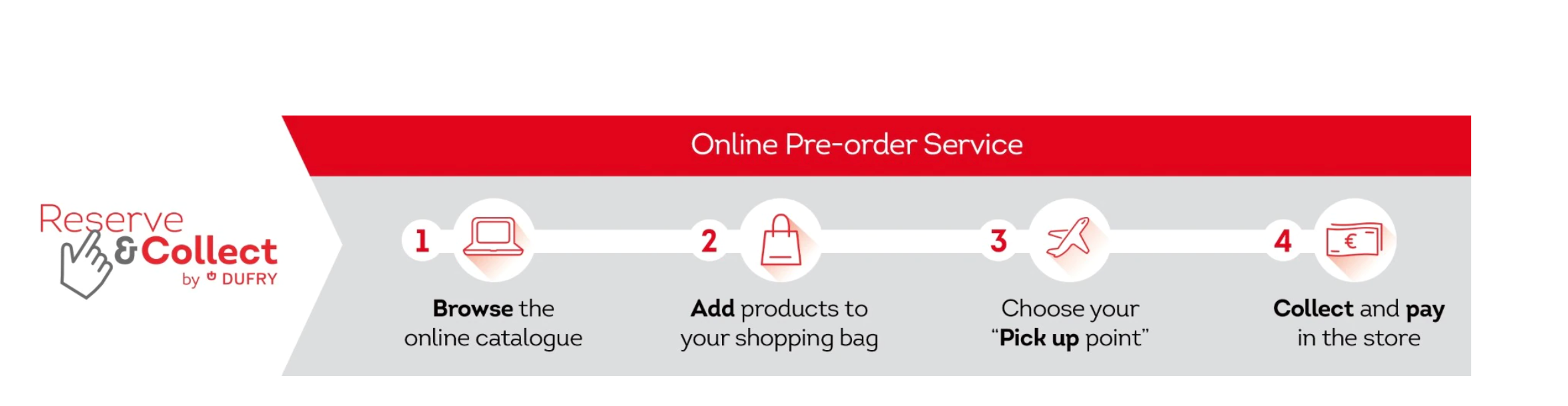

Travelers can also purchase duty-free items online from both duty-free stores and individual retail outposts. Once they decide which items to purchase, they can choose a reserved time to pick up their order.

How does duty-free shopping work?

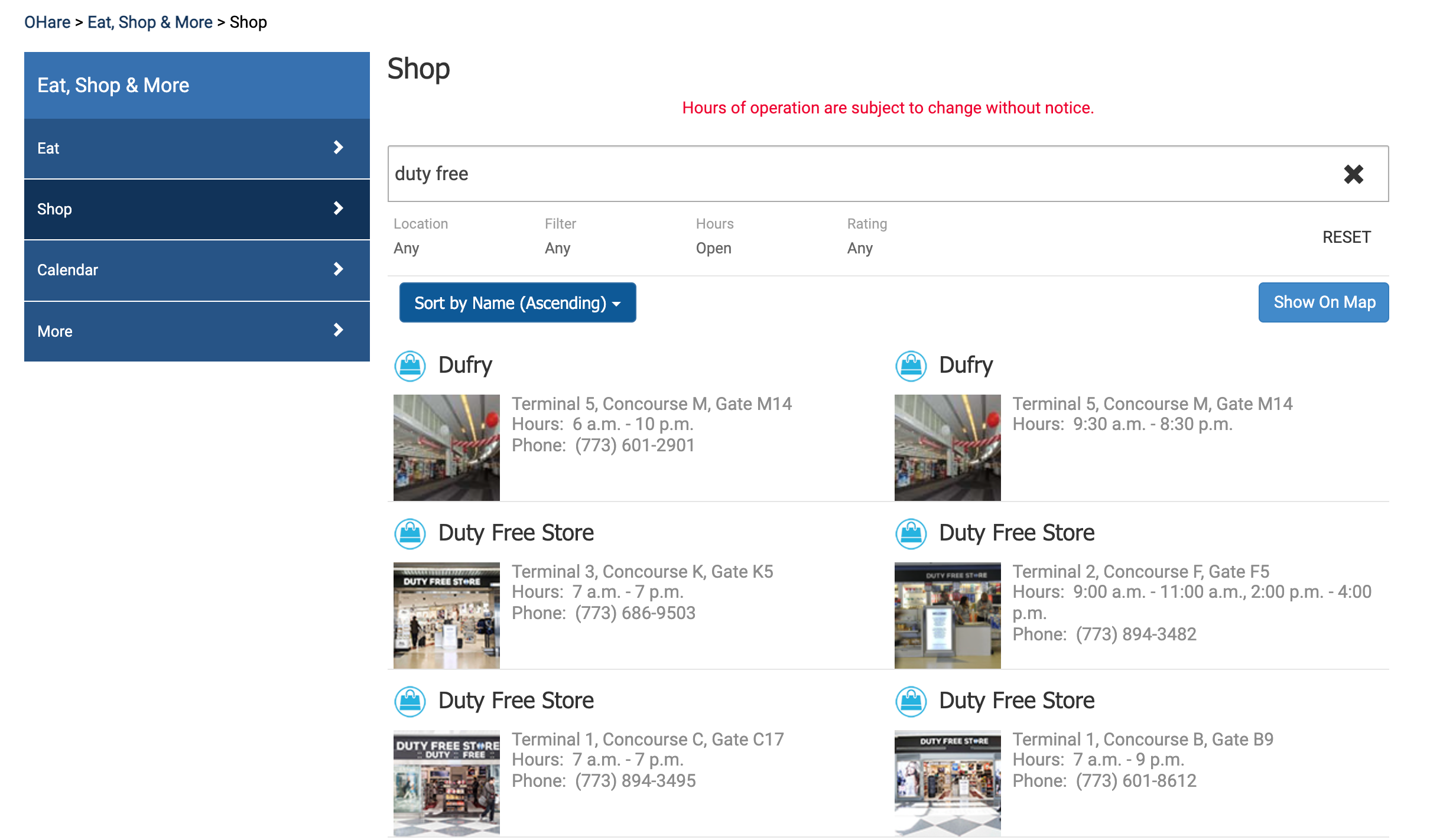

To buy duty-free items, you'll first want to locate the duty-free stores at your airport. Most airports list their various shops online, but you can also search for duty-free shops specifically, as shown below for Chicago's O'Hare International Airport (ORD).

Before heading to the duty-free store, be sure to bring your boarding pass with you, since you'll likely be asked to show this as proof that you are departing the country on an upcoming flight.

If you buy liquids at the duty-free store, such as liquor, fragrance or lotions, you don't have to worry about them exceeding the carry-on limits for liquids set by airport agencies. Duty-free items are exempt from these size restrictions, so you can pack larger liquids in your carry-on bag when coming back to the U.S. This is the case even if you have a connecting flight.

To avoid any issues with bringing your items through security, keep each purchase in the tamper-proof plastic bag it's wrapped in by the duty-free store employee until you leave the airport. You'll also want to hold onto your receipt since you may be asked to show it as proof of your purchase.

Know, too, that countries place purchase caps on select items, such as tobacco and alcohol. They also limit the amount of money you can spend on international purchases without being charged a duty tax.

Currently, Americans can spend up to $800 within 31 days without being taxed for their purchases, according to the U.S. Department of Homeland Security. To verify duty-free allowances for your particular country, visit the Duty Free Americas website.

Are there deals with duty-free shopping?

Although you can potentially save money by buying duty-free items, how much you may save depends on the specific item and your location.

A 2019 TPG cost comparison of items from duty-free stores at more than 50 airports across six continents concluded that the prices of items at duty-free shops varied by location, and sometimes even between different duty-free shops at the same airport. For the most part, it's cheapest to buy alcohol in the Caribbean, cosmetics and fragrances in Europe and tobacco in Asia, according to the study.

To get the best price possible, do your homework before your trip. Research the prices of similar or identical items at airports with multiple duty-free shops ahead of time, and remember to also compare those prices to ones at non-duty-free shops.

Don't forget to consider the strength of the U.S. dollar to the local currency where the shop is located as well. You can do this by using a currency converter such as XE.

If you're traveling to Europe, also keep in mind that the duty-free shops are free of a value-added tax, so you can save up to 27%, depending on which country you're visiting.

"The key to a successful duty-free purchase is math," said TPG Executive Editor Scott Mayerowitz. "There are some good deals out there, but all too often I've found that I can get better prices at home. Know your prices and exchange rates. Don't be afraid to take out your phone and compare prices with online retailers."

Can you buy duty-free items outside of airports?

In addition to airports, some cruise ships like Royal Caribbean's new Wonder of the Seas and Norwegian Cruise Line's new Norwegian Prima have duty-free shops on board.

"All bigger ships have stores on board, usually a few, that sell everything from cruise line logo wear to souvenirs," said Gene Sloan, TPG's principal cruise writer. "Even if not specifically labeled duty-free, they are in theory all duty-free in the sense that there is no local tax as long as the ship is at sea in international waters. Typically, cruise ships will not open their onboard stores until they are out in international waters for just this reason — so they don't have to collect a tax."

Can you use miles to shop duty-free?

Even though you can use some airline miles at duty-free stores, you'll want to calculate how much value you can get from using miles on flights compared to duty-free items.

For example, you could spend 4,500 Emirates Skywards Miles for a $20 credit at a duty-free store at Dubai International Airport (DXB), which gets you just 0.4 cents per mile, way below TPG's current valuation of Emirates miles at 1.2 cents apiece. Before redeeming your miles this way, compare that earnings rate to the price of an Emirates flight using both Skywards Miles and cash.

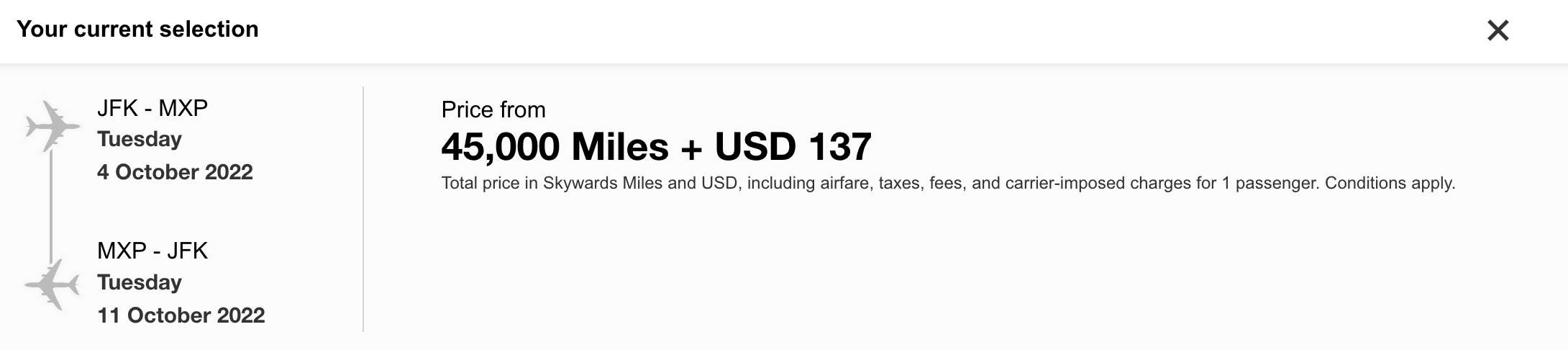

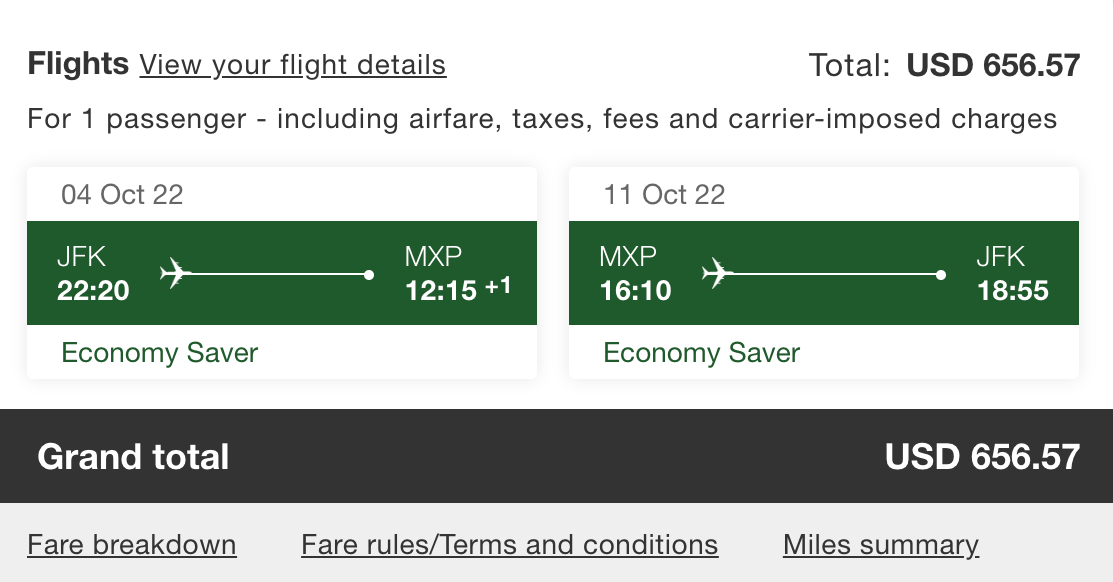

Instead of using your miles for duty-free purchases, you could book an Emirates flight from John F. Kennedy International Airport (JFK) to Milan Malpensa Airport (MXP) for 45,000 miles plus $137 in taxes or $655 in cash this October. Once you subtract the $137 in taxes and fees, you get a cash price of $518, which you would divide by 45,000 to get a value of 1.15 cents apiece, a much higher rate than the duty-free redemption option.

Even though using miles to book that flight would earn you less than what TPG currently values those miles at, it's still a better deal than using miles to shop duty-free, since you would earn almost three times the value in points by using points to book flights in this case.

Using your miles to book flights versus using them to shop duty-free is likely a better deal across airline currencies, but do the above calculation to make sure.

Bottom line

You may be asking yourself whether you should shop duty-free before you board your next international flight home. If you've done the appropriate comparisons and calculations, it should be clear whether it makes sense to buy duty-free based on projected savings.

While it may not always make financial sense to buy duty-free items, when it does, remember to use a credit card with zero foreign transaction fees when making your purchase. Also, keep in mind how difficult it is to find the item you're hoping to buy.

"I enjoy bringing home liquor, but I know the prices at my local store and if something is a good deal or not," Scott said. "Usually, I only buy local spirits that I can't find at home. And even then, I need to factor in the hassle of lugging home a bottle or two and risking that it might break along the journey."

If the value you'll gain from buying that item outweighs the inconvenience of bringing it home, it may be worth the investment — even if requires spending some extra money.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app