Everything you need to know about British Airways’ fare classes

Editor's note: This story has been updated with new information.

Have you ever heard someone say something along the lines of, "I'm flying in J" and wondered what on earth they could mean?

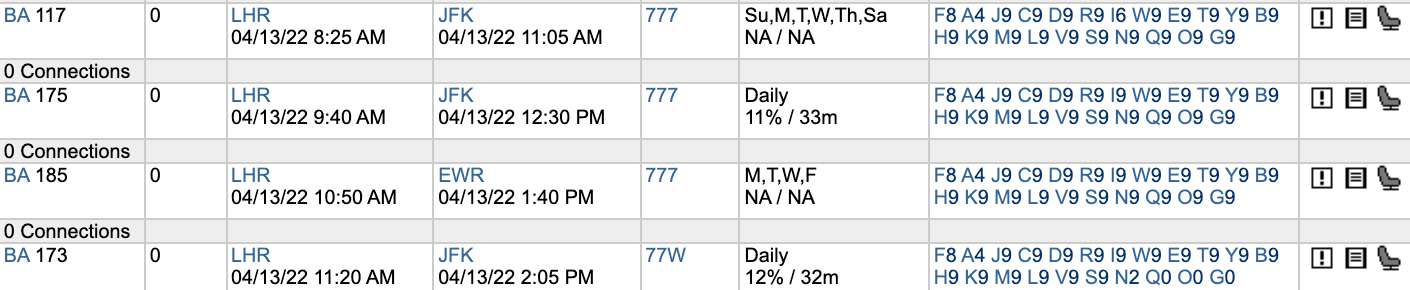

Or, have you checked your flight on ExpertFlyer and been surprised by the sea of letters showing for each British Airways flight when you know there are only four actual classes the airline flies — First, Club World/Club Suite (business), World Traveller Plus (premium economy) and World Traveller (economy)?

Follow The Points Guy on Facebook and Twitter, and to ensure you never miss anything, subscribe to our daily newsletter.

Why so many fare classes?

British Airways has 22 fare classes and four redemption classes. Revenue fare classes are bookable for cash whilst redemption fare classes are for Avios or mileage bookings.

Broadly speaking, the different fare classes within each cabin correlate both to the cost of the ticket as well as the flexibility of the fare offered. The lower classes usually sell first, so as a flight gets busier, the lower classes will fill up and BA will only sell higher, more expensive fare classes. Typically, the closer to your travel date, the higher the fare class — either because the plane has filled up anyway or because BA might only sell higher fare classes closer to the departure date, as it knows it can command higher prices for last-minute bookings.

BA's fare classes break down as follows:

- First: F (flexible) and A (discounted) as revenue fare classes and Z for reward redemptions;

- Club World (business class): J, C, D, R and I (with I being the cheapest) for revenue and U for reward bookings;

- World Traveller Plus (premium economy), W, E and T for revenue and P for reward bookings; and

- World Traveller (economy): Y, B, H, K, M, L, V, S, N, Q, O, G and P for revenue and X for reward bookings.

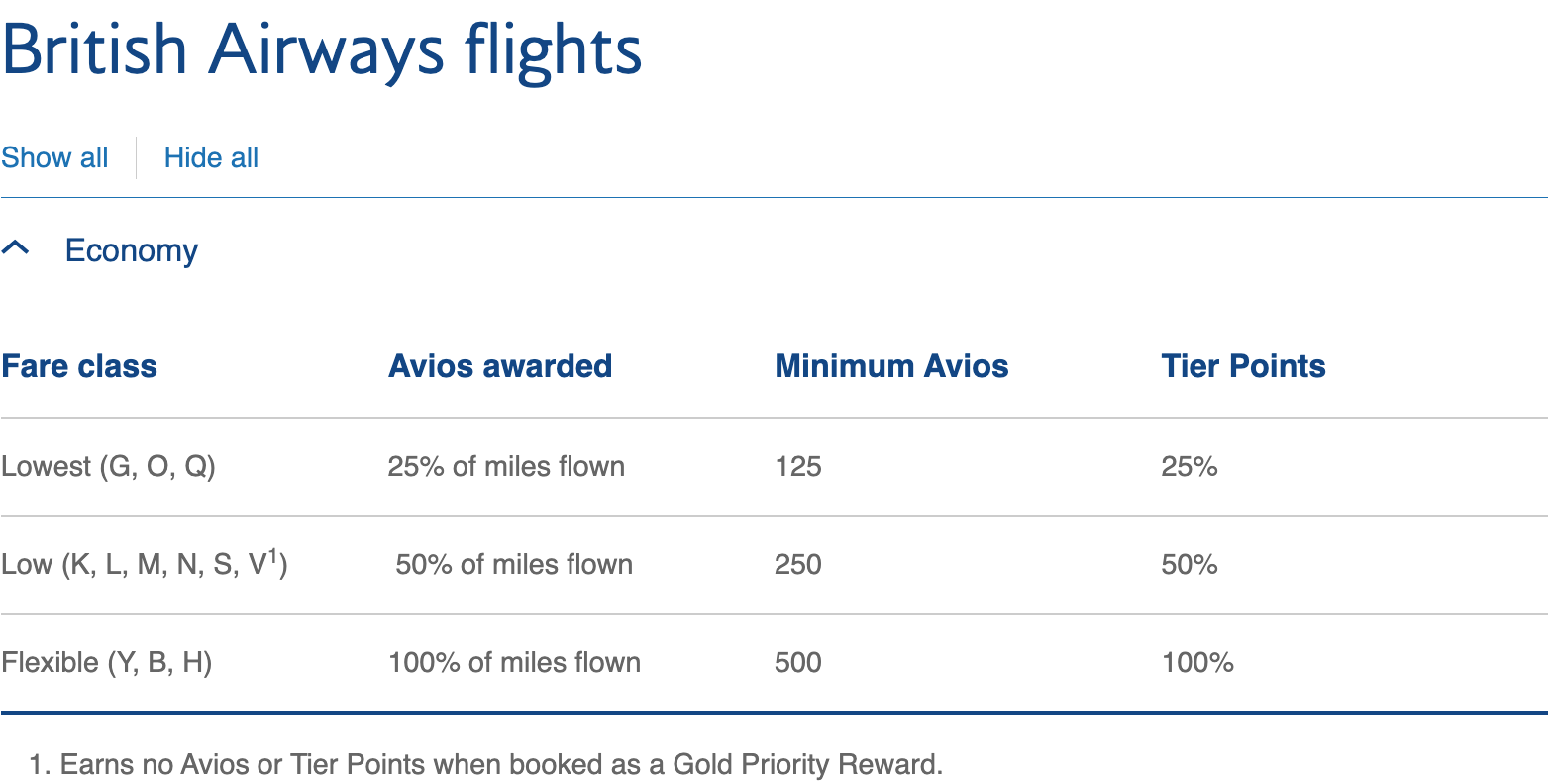

It's worth noting that based on which fare class you're booked in, the number of Avios you'll get in return will vary.

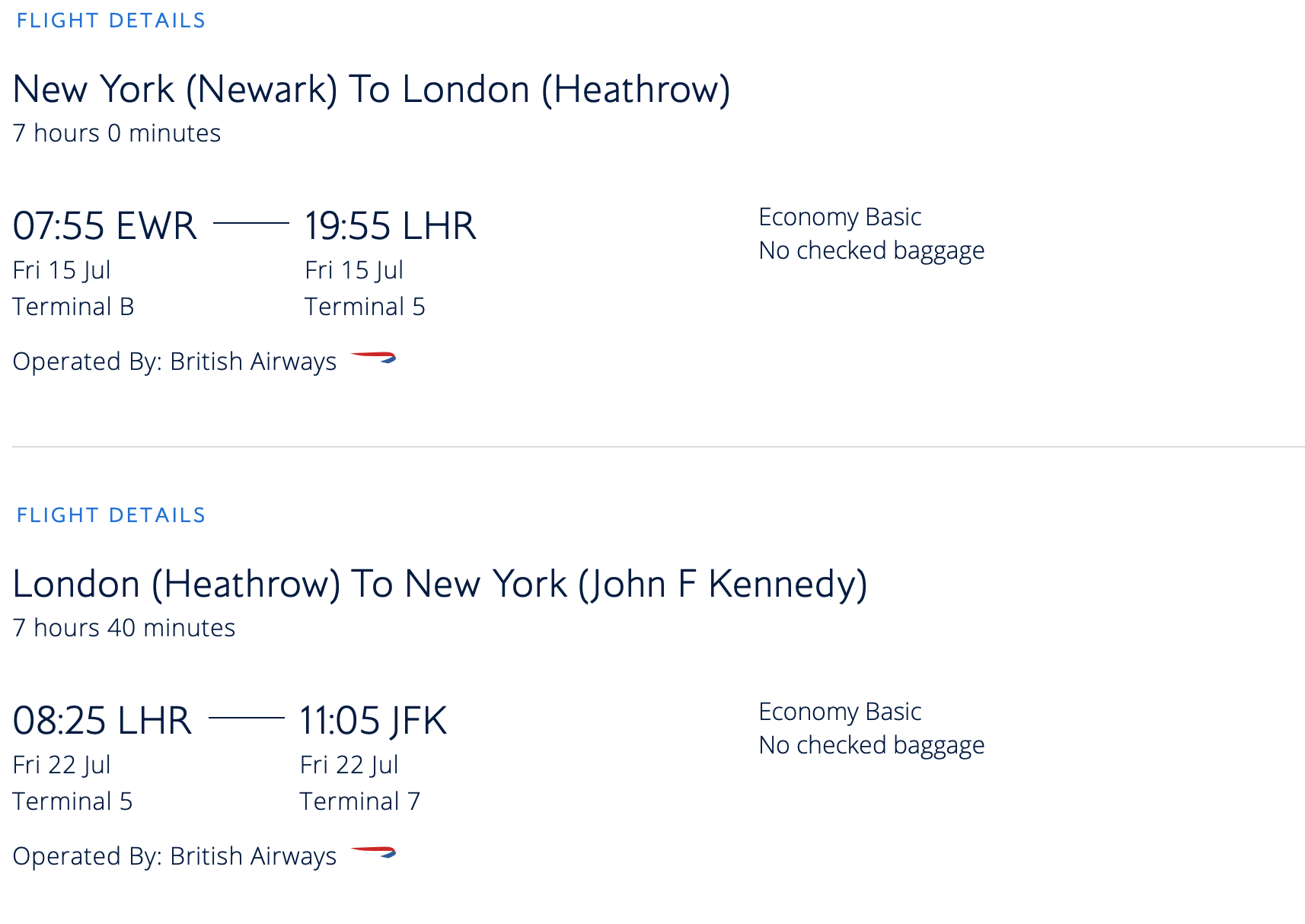

The table above shows the breakdown of Avios and Tier Points for BA's different fare classes. For example with the lowest economy classes (G, O and Q) you'll earn 25% of the miles flown and 25% of the Tier Points. A mid-range fare, such as this example roundtrip itinerary from Newark (EWR) to London (LHR), will earn you half of the miles flown. In this case, since it's an L class Basic Economy, you would earn 3,458 Avios.

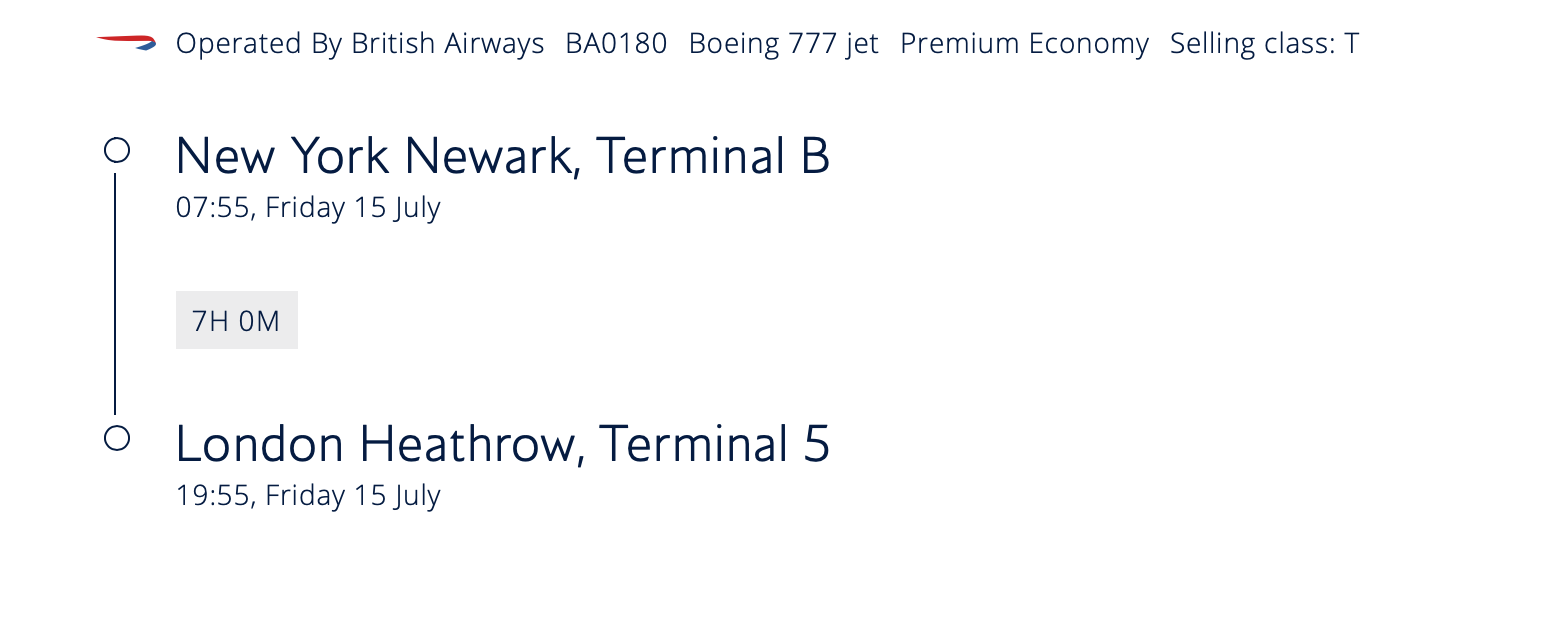

If I book the same flight but choose a Premium Economy seat (a T class fare), I would earn 100% of the miles flown in Avios, which in this case would be 6,916.

It's also worth noting that G class, one of the most heavily discounted BA fare classes in economy, is reserved for travel agent bookings, including BA holidays. That's why it sometimes pays to add a car or hotel to your booking — that way, you might be able to book into G even if booking the flight on its own would only let you book into a higher fare class.

What the numbers mean

In the example above, the sea of 9s doesn't mean that there are only nine seats available in each class. Nine is the highest number that can be displayed for BA (for some airlines it's seven), and the fare classes are all related. For example, if you book nine seats in O class, it's highly likely that there won't be nine available in Q and that number goes down. That's why you might see BA offer four seats for sale on a flight when there's actually only one left.

Looking at a week-long trip to New York in February next year, a return ticket in Y, which is a fully flexible economy class, costs £2,291. The same ticket can be had for £301 if choosing the cheapest option, O class. The latter does not allow any bags or seat selection, and nor does it allow any changes, whilst the former is fully flexible, as the passenger can change the time, date and receive a full refund if it needs to be cancelled.

Despite the £2,000 price difference between the two tickets, the seat and food for those two tickets would be exactly the same. Of course, there are good and bad seats in each — our guides help you pick the best seats in any BA cabin.

The crazy thing about the fully flexible example economy price is that discounted premium economy can be had for £587, and even discounted business class can be had for £1,333 — a saving of £700 from that fully flexible economy seat. Now, that's a sale price (and a decent one from London) and has no flexibility. In other words, you couldn't change dates nor get a refund.

![[UNVERIFIED CONTENT] Aerial view of one of Terminal 5 buildings of London Heathrow Airport and Boeing 747 and 777 aircrafts operated by British Airways at the gates on Wednesday, June 26, 2013. (Photo by Grzegorz Bajor/Getty Images)](https://i2.wp.com/uk/originals/2019/08/GettyImages-175377092.jpg)

Bottom line

Understanding fare classes and how you can use them in conjunction with ExpertFlyer can help you find cheaper flights. If the particular flight or day you are looking for doesn't have the price you were expecting or hoping for, it's worth having a browse on ExpertFlyer to find a date that has lower fare classes available. In addition to also helping you understand what you'll earn on the flight, you'll be able to impress your AvGeek friends at the next dinner party.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app