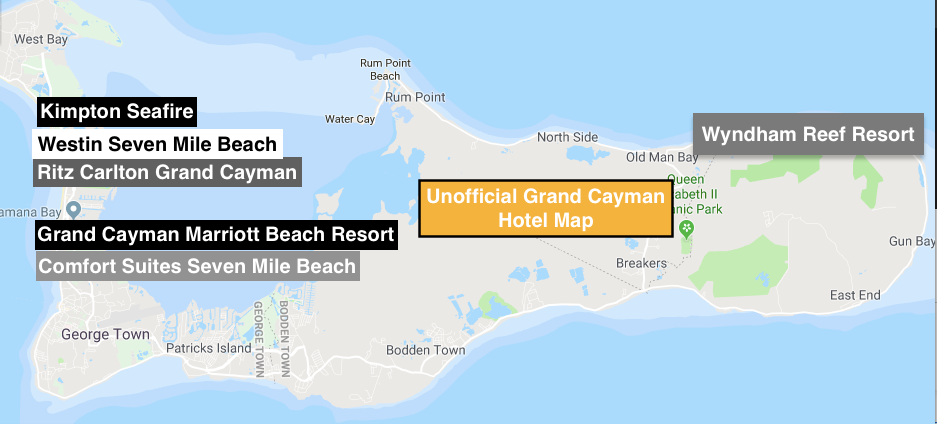

Where to Use Hotel Points in Grand Cayman

Grand Cayman is pretty much perfect family beach destination if you are looking for soft sand, clear water, a location just 450 miles south of Miami, and an island with the highest standard of living in the Caribbean. Probably like for many others, Grand Cayman first came on my radar thanks to the John Grisham book and subsequent movie, The Firm. In that work of fiction, the wealthy lawyers head to Grand Cayman, and while I don't remember all the details of what happened in that story, I do remember seeing prettiest blue water I could have ever imagined in the movie. That part of the fictional story was 100% fact.

After our spring break trip to the island, I can attest that Grand Cayman is indeed a picture-perfect beach playground, often for those in the upper-income brackets. Thankfully, you can enjoy their perfect beaches using your miles and points without having to have offshore bank accounts. If you want to put together a Grand Cayman beach trip using your hotel points like we did, here are a few tips and ideas.

Westin Grand Cayman Seven Mile Beach Resort

Standard award rooms at this well-located beachfront resort located on Seven Mile Beach start at 60,000 Marriott points per night for two double beds in a renovated room with a posted maximum occupancy of four.

There is a $65 per day resort fee that applies even to award stays. This resort is where we stayed on our family spring break trip, and it is the Grand Cayman points-friendly hotel that probably offers the best balance of award price, quality, and location, assuming you have Marriott points to use. Head here to read all of our thoughts about this beach-front property.

Kimpton Seafire Resort

This is the newest of the points-friendly hotels on Grand Cayman and one that I very much hope to visit in the future. The Kimpton Seafire Resort can be booked with 70,000 IHG points per night or with your IHG credit card anniversary nights(s). This hotel has 266 guestrooms and suites, all with private balconies and some with two queen beds to support a family of four. These rooms with two queen beds can be booked with IHG points, but are more limited than the rooms with king beds, so really plan ahead if you need two queen beds on points.

The Kimpton Seafire has two pools and a Camp Seafire that has programs for children ages 4-8 and 8-12 with rates that start at $50 for a half-day. I also love that they offer a Camp Seafire babysitting service for younger kids for $25 per hour, for up to three children. The Westin Grand Cayman had a great kid's club that my older daughter got to visit, but they didn't have any in-house babysitting services for those under four years old.

The Kimpton Seafire has a daily resort fee of $70, though it is possible this is not charged on award stays, especially on the "free night awards" from the IHG credit card. I think I need to go back and do first-hand research. The resort fee here includes dining for children under five, water sports toys such as paddle boards and water tricycles, valet parking, and use of a GoPro underwater camera!

Ritz Carlton Grand Cayman

This Tier 5 Ritz Carlton resort is a neighbor to the Westin Grand Cayman on Seven Mile Beach. This resort can be booked with 85,000 Marriott points per night + a $85 per night resort fee.

You can use your Marriott points here to book rooms with two queen beds for your family of four and then make use of their ocean-front location, pool, and fantastic kid's splash pad. I would love to stay here and enjoy that splash pad and high-end accommodations, but 85,000 Marriott points per night is a pretty big number and paid rates are near or beyond the four-digit mark per night.

Holiday Inn Resort Grand Cayman

A more budget-friendly Grand Cayman resort can be found in the Holiday Inn Resort Grand Cayman that is located on the North Sound of the Caribbean Sea. This resort is only 25,000 IHG points per night and offers use of a complimentary shuttle to nearby Camana Bay, Fosters Food Fair, Seven Mile Beach (5 minutes away) and George Town.

For your 25,000 IHG points per night, you can book a room with two double beds and a view of the ocean. With IHG points selling for a limited time as low as 1/2 a cent each, this could be a very affordable way to put together a Grand Cayman getaway.

Grand Cayman Marriott Beach Resort

The Grand Cayman Marriott Beach Resort is on Seven Mile Beach and rings in as a top-tier Category 9 Marriott that is available for 60,000 points per night. The Grand Cayman Marriott has a $60 per night resort fee that includes amenities such as a bicycle rental, welcome drink upon arrival, children's' beach toys, and more.

Remember that Marriott award stays of five nights in length are only charged for the number of points for four nights, so this means you could stay here for five nights at a cost of 240,000 Marriott points + the resort fee for your stay.

Comfort Suites Seven Mile Beach

Unlike most of the options listed, his hotel has standard rooms available with a posted maximum occupancy of up to five people consisting of two double beds plus a sofa bed. The spring travel dates I checked were 30,000 Choice points per night, but I have read that some dates do have lower award prices. Unfortunately, you can only book Choice award nights at this property about a month in advance, but if that works for you, then this could be another more budget-friendly points hotel option on Grand Cayman that even has included hot breakfast.

Wyndham Reef Resort - all-inclusive and room-only options

Of all of the points-friendly hotels in Grand Cayman, the Wyndham Reef Resort is the one furthest away from all of the others, located on the East End portion of the island. It is a Wyndham Rewards property where all hotel rooms are a flat 15,000 points per night and it has all-inclusive options. However, I was not able to find award rooms online when searching a variety of dates, though perhaps your luck would be better over the phone.

If you wanted to drive from the 152 room Wyndham Reef Resort to Seven Mile Beach, it would be about a 30 - 40 minute drive each way, so it is probably not an ideal if you want to spend the bulk of your time on the west side of the island. However, it is an option if you want to take in a different portion of Grand Cayman.

In part, because Grand Cayman is such a nice island with a high standard of living, most of the hotels you will find are solid options. This isn't where you are going to find a ton of excess hotel inventory that is not being cared for as it should be, but instead, you will find hotel rooms that can fit a variety of points or cash budgets. We very much enjoyed our stay at the Westin Grand Cayman, but there are other points-friendly hotels we look forward to exploring on return trips to the island.

Has your family stayed at one of the points hotel options on Grand Cayman? What were your thoughts on the property?

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app