3 reasons to fly premium economy (and 1 reason not to)

Cheap oil, fuel-efficient aircraft and more available routes have pushed economy fares down, often to record-low levels. But even as economy fares become more passenger-friendly, economy seats have become decidedly unfriendly. We're even seeing the world's top-rated airlines squeeze more seats into long-haul aircraft in a bid to wring out more money.

Enter premium economy, a growing class of service that, for customers willing to spend a little bit more, returns legroom to a bygone era.

Related: Best airline credit cards of 2019

But is the extra cost — often 30 to 100 percent of the cost of a coach ticket — worth it? Those who haven't flown in a true international premium-economy cabin may find it difficult to justify coughing up extra dough for the premium-economy fares, which are sandwiched between economy and business class on most airfare search engines like Google Flights, Kayak and Skyscanner.

Extra legroom is just the start of a long list of amenities airlines now offer in the middle cabin, and the upgraded service can offer excellent value. However, premium economy is not right for every passenger and every situation.

Here are three reasons to consider premium economy on your trip, and one very good reason not to.

You'll arrive feeling more rested

Unlike economy plus and preferred seats that just offer additional legroom, premium economy seats on long-haul flights feature dimensions similar to the recliners familiar to domestic first-class passengers. At 19 to 20 inches wide, these seats offer enough space to truly have an impact on sleep. A sleep study conducted by Airbus and The London Sleep Center even found that just one additional inch of seat width helped participants sleep an average of 53% longer during a long-haul flight.

Even though you won't be reclining in a flat bed in any premium-economy cabin, a combination of larger seat dimensions, wider armrests, adjustable leg rests and extra features, like upgraded bedding and noise-canceling headphones, almost guarantee you'll feel more rested upon arrival. If you have limited vacation time, premium economy could prevent you wasting the first day of your trip on catch-up sleep.

You can say goodbye to airport hassles

Airlines don't offer premium economy passengers the same level of airport service as business- or first-class passengers, but many perks are similar. Premium economy passengers enjoy dedicated priority check-in lines — I didn't have to wait in line during any of the three premium economy itineraries I flew last year — and board before the rest of the economy cabin, often through dedicated boarding lanes. Some airlines — including Air New Zealand, ANA, JAL, Singapore Airlines and Virgin Atlantic — offer priority baggage handling for premium economy passengers, even without elite status. That means your bags will be first to the baggage claim, along with those of business- and first-class customers.

Some airlines also grant premium economy travelers lounge access, JAL among them. Others, including Air Canada, offer discounted lounge day passes. (Of course, if you already have airline status or the right credit card, you won't need to rely on premium economy to get your lounge on.)

You'll earn more miles (or spend fewer miles)

While frequent-flyer programs often significantly cut the miles you earn for discounted economy-class fares, premium economy passengers earn at least 100% of miles flown. Plus, you'll get bonus mileage in many cases, even when purchasing deeply discounted premium economy tickets. For this reason, a $400 or $500 fare difference on a transatlantic flight might net as much as double the mileage.

An example: I'm flying Air Canada from Montreal to Shanghai soon. A six-day trip in January would run me $783 round-trip in economy (L class) and earn 7,069 Air Canada Aeroplan or United MileagePlus miles. The same trip in premium economy (N class) adds $682 round-trip, but according to wheretocredit.com also earns an additional 10,604 miles, equal to a $138 rebate (if you credit your miles to MileagePlus) or $148 (if you credit to Aeroplan), at our current valuations.

So, that means you're spending $534 for 28 hours of improved flight time. Definitely worth it in my book.

Of course, premium economy mileage redemptions are also priced between coach and business class. And premium economy likely will not be the most valuable cents per mile redemption you can make. This is because the cash price of a business class ticket can run many multiples of the cost of a premium economy ticket.

With dynamic pricing, it's hard to generalize about redemption rates. Here's an example with American AAdvantage miles. This is a flight in May from New York JFK to Madrid on American:

As you can see, premium economy is three times the cost of coach, plus an extra $228 in fees. No thanks. But in other cases the redemption math may make sense.

The reason NOT to fly premium economy: wild inconsistency

Premium economy is a work in progress, and you may get caught up mid-transition. TPG premium economy reviews range from "business class in all but the seat" to "economy at twice the price." Individual airlines define premium economy very differently. Some just add extra legroom to a lackluster coach offering, while others pull out all the stops.

Even on the same flight, service can vary widely. For instance, my upcoming Air Canada premium economy flight has "premium" meal offerings and boasts about both the upgraded food and china. However, they accompany the meal with wine from the economy class cart. I wouldn't expect the same wine served in business, but it does seem Air Canada could have found a happy medium.

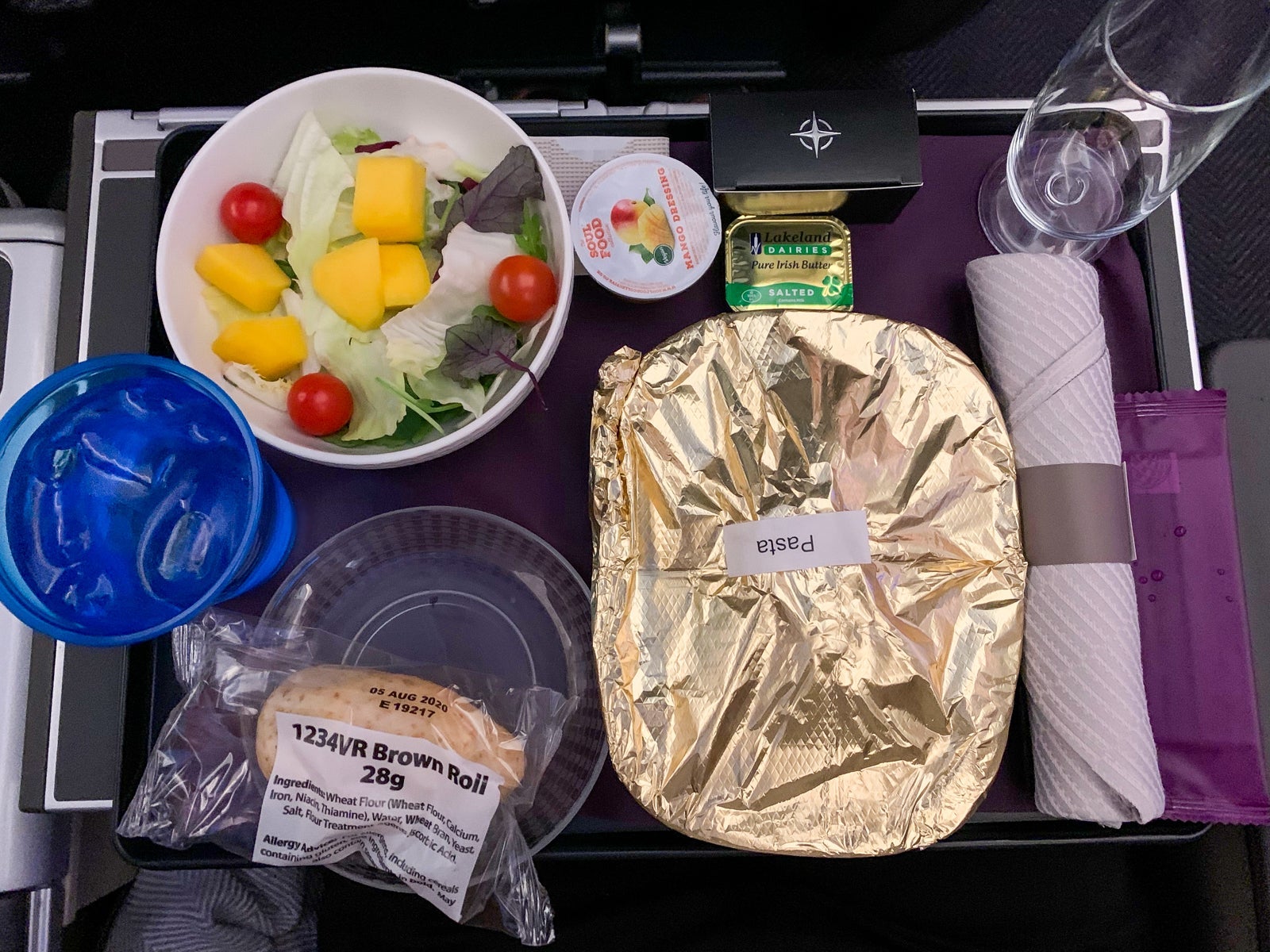

TPG travel analyst Zach Griff had two levels of service on the very same tray on a recent United premium economy flight. While his meal was served on china, the tinfoil and cellophane wrappers definitely took the service down several notches.

Bottom line

For a fraction of the cost of a business-class ticket, international premium-economy cabins can offer a significant upgrade for travelers with a few extra dollars to spare. However, not all premium economy is created equally.

TPG takes flight reviews seriously, and I think premium economy reviews could be the most important of all. Before booking a flight in the middle cabin, be sure to check out a review so you can decide if the upcharge is worth it for you.

Want to learn more about premium economy? Here are some related stories:

- Caught in the middle: Why can't airlines figure out service in premium economy?

- So close to greatness: A review of Japan Airlines in a Boeing 787-9 in premium economy from Tokyo to Dallas

- Not-so-Premium Economy: A review of United's Premium Plus Cabin from Newark to Hong Kong

- A wonderful surprise: A review of Norwegian's premium economy on the leased Evelop A330, New York to London

- A Fine Mess: A review of Virgin Atlantic's Premium Economy on the A330 from London to New York

With additional reporting by John Harper.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app