Citi Clarifies Eligible 4th Night Free Properties, Adds Hostels

Update: Some offers mentioned below are no longer available. View the current offers here.

Citi is a TPG advertising partner

The Citi Prestige 4th Night Free benefit is one of the best credit card perks around. Just for booking your stay through the Citi Concierge, you'll receive the cost of the fourth night of your stay back as a statement credit. For better or worse, in July this credit will change to be based on the average nightly cost and won't include a credit for taxes.

There are no limitations on how much value you can get from this benefit, either annually or per stay. TPG's own Zach Honig scored a $1,490 rebate from one stay. However, that pales in comparison to the $4,554 rebate one cardholder got from this benefit during 2016. Even better, Citi has slashed processing times on the statement credit.

That said, there are limitations on the fourth night free benefit. You do have to book your stay through the Citi Concierge and must pay with your Citi Prestige card. You can't get the credit on multiple rooms and can't get two credits for an eight night stay at the same hotel.

Also, the Citi Concierge must be able to book it, so properties that require the traveler to book directly may be excluded. But, that's not the only type of property that's not eligible. The terms and conditions list the following properties as being ineligible: yachts, riverboats, cruises, campgrounds, castles, safaris, villas, apartment rentals.

Previous Limitations

Unfortunately, the property limitations seem to have been expanding over the last few months. During my recent trip to Japan, Citi wouldn't book a stay at an onsen — noting that "spas" weren't eligible for the benefit. In Taiwan, our stay at the sleek new Houze Hostel was similarly denied as it had the word "hostel" in the name.

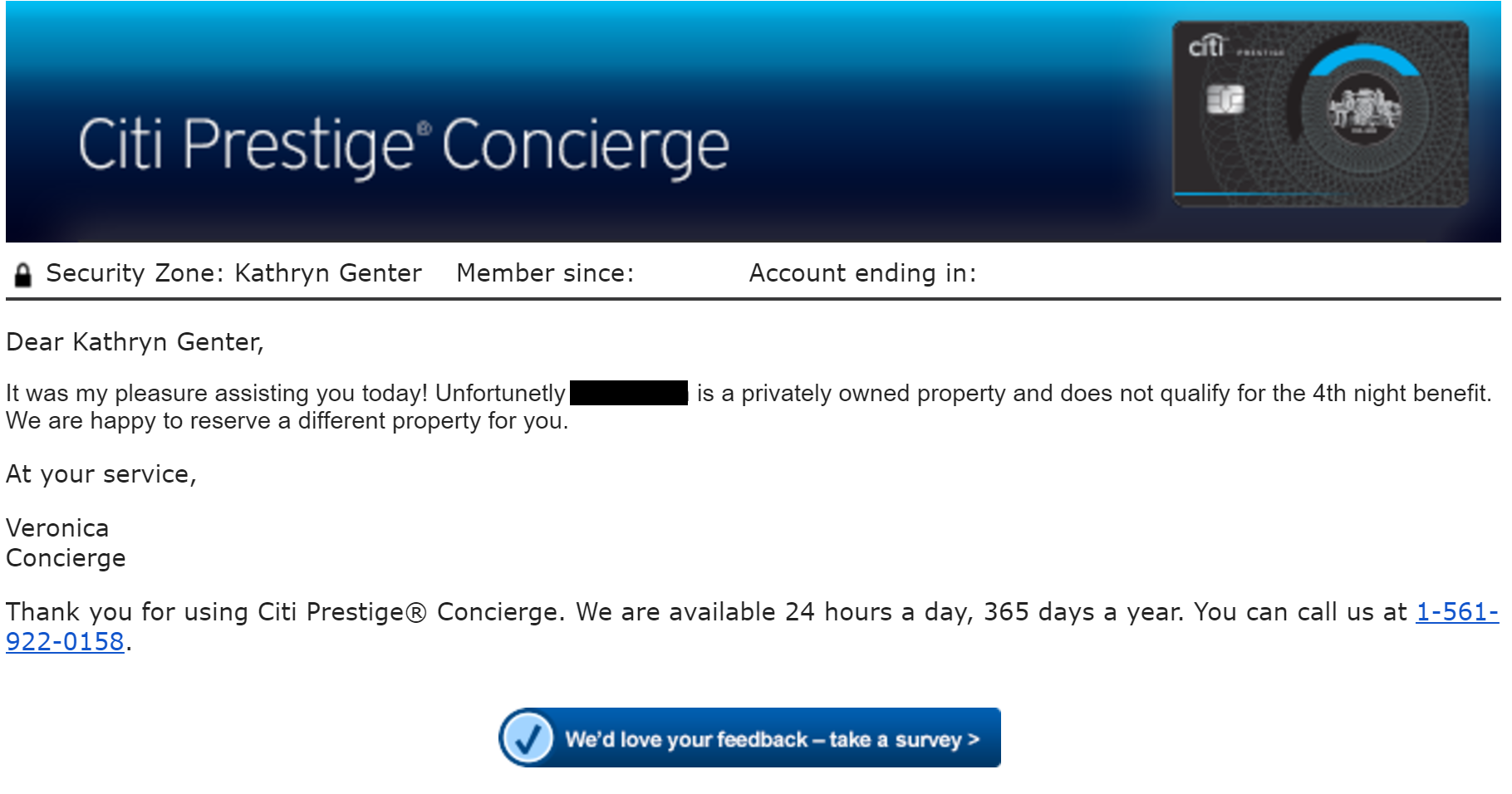

But, this week, the denials hit a new low. After the Citi Concierge helped us find a hotel in Miami — even noting in an email about the amount of the 4th Night Free benefit — the Concierge followed up to say that the hotel is a "privately owned property and does not qualify for the 4th night benefit."

So, we reached out to Citi for clarification on what types of hotels fall under the "privately owned property" category or are otherwise ineligible for the 4th Night Free benefit. Today, we heard back.

New Clarifications

This afternoon, I received a phone call from a manager from Citi Concierge. First, he apologized that the Miami hotel was denied "in error" and clarified that this is "definitely a covered property." He noted that the agent believed this hotel was a hostel and thus ineligible for the benefit.

It seems Citi and the Citi Concierge used this situation to clarify which properties are and aren't eligible. Starting today, all hostels will now be eligible for the fourth night benefit. Also, independent hotels — like the one we were trying to book — are explicitly included.

Going forward, the only types of properties that aren't eligible should be those listed in the terms and conditions ("yachts, riverboats, cruises, campgrounds, castles, safaris, villas, apartment rentals"). Even if the property type doesn't fall under this list, the fourth night benefit won't apply to timeshares and properties listed on Airbnb, HomeAway, FlipKey or similar owner-to-renter rentals.

We also received guidance for what to do if a cardholder has an issue with the Citi Concierge applying the 4th Night Free benefit to a particular stay. The cardholder should ask for the issue to be escalated to a manager, who can verify whether the stay is indeed eligible within the terms and conditions.

Bottom Line

While frustrated about past denials, we're pleased about Citi's prompt action to clarify which properties do and don't qualify for this benefit. Frugal travelers carrying a $450-annual-fee Citi Prestige — like me — can celebrate the new inclusion of hostels and independent hotels within the 4th Night Free program.

Have you had a 4th Night Free benefit denied by the Citi Concierge?

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app