Earn a 20% Bonus When Converting Marriott Rewards Points to AA Miles

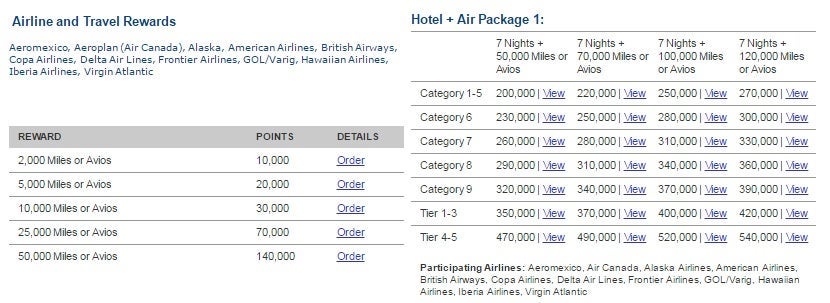

Now through November 14, transfer Marriott points to American Airlines and receive 20% bonus AAdvantage miles. Both the "airline rewards" and "travel package" (a.k.a. "Hotel + Air Packages") qualify for this 20% bonus.

Note that the 20% bonus will be applied by American Airlines once it receives the miles from Marriott. The terms and conditions note that "Bonus miles will be posted by American Airlines to the qualifying AAdvantage member's account within 7 business days after the initial conversion activity has been posted by Marriott Rewards." There's no limit to the number of transfers or points you can transfer.

The terms and conditions also note that miles won't qualify toward elite status qualification. American Airlines also won't count these miles toward Million Miler status.

Is It Worth It?

Transferring hotel rewards to airline miles are usually a poor use of points. The "Airline and Travel Rewards" program is one of these poor uses. This option is typically only useful to clear points out of a Marriott account that you're not going to use.

However, Marriott's "Hotel + Air Packages" can offer excellent value. If you have at least 200,000 Marriott points (or 66,667 Starpoints), you can transfer Marriott points to one of dozens of airlines and get both airline miles and a seven-night hotel stay.

At the 270,000-point level (90,000 Starpoints), you'll generally get 120,000 AAdvantage miles plus seven nights at a Category 1-5 Marriott hotel. After this limited-time 20% bonus is applied, you'll end up with 144,000 AAdvantage miles. That's effectively a transfer ratio of 1 Starpoint to 1.6 AAdvantage miles — with a seven-night hotel stay to boot!

Starpoints typically transfer to American Airlines at 1:1. Even after the 5,000-mile bonus for transferring 20,000 Starpoints, you'd only get a maximum 1:1.25 transfer ratio. By transferring Starpoints to Marriott and then transferring Marriott points to AAdvantage through the Hotel + Air Package, you're getting a much better return, plus free nights.

Since the choices can be a bit overwhelming, let's do a quick comparison of transfer options. Here's what you can get from various levels of Marriott points. We included an approximate value of the options based on TPG's latest valuation of American Airlines miles at 1.5 cents and a flat $100 value per free hotel night.

| Marriott Points | AAdvantage miles | Hotel nights | Hotel Category | Approx Value | Value per Marriott point | ||

|---|---|---|---|---|---|---|---|

10,000 | => | 2,400 | $36 | 0.36 | |||

20,000 | => | 6,000 | $90 | 0.45 | |||

30,000 | => | 12,000 | $180 | 0.60 | |||

70,000 | => | 30,000 | $450 | 0.64 | |||

140,000 | => | 60,000 | $900 | 0.64 | |||

200,000 | => | 60,000 | + | 7 | 1 to 5 | $1,600 | 0.80 |

220,000 | => | 84,000 | + | 7 | 1 to 5 | $1,960 | 0.89 |

250,000 | => | 120,000 | + | 7 | 1 to 5 | $2,500 | 1.00 |

270,000 | => | 144,000 | + | 7 | 1 to 5 | $2,860 | 1.06 |

For those traveling with a companion and mostly domestically, it's likely going to be a better deal to transfer the 270,000 Marriott points to Southwest using the Hotel + Air Package. For 270,000 Marriott points (or 90,000 Starpoints), you can get a Southwest Companion Pass, 120,000 Southwest points and seven nights at a Marriott Category 1-5 hotel. The Companion Pass is good through the end of the year after you earn it, so you might want to wait until January to take advantage of this offer to get the Companion Pass for two years.

Bottom Line

This transfer bonus can be an excellent option if you have enough Marriott or SPG points, can get great value out of your AAdvantage miles (i.e., by flying international business/first class) and wouldn't get better value by generating the Southwest Companion Pass with your Marriott points.

If you're planning on transferring 90,000+ Starpoints to AAdvantage anyway, you'll get more miles and a free seven-night hotel stay by transferring points to Marriott and then using the Hotel + Air package.

Are you planning to transfer Marriott points to AAdvantage during this promo?

[card card-name='Marriott Rewards® Premier Credit Card' card-id='221210955' type='javascript' bullet-id='1']

TPG featured card

Rewards

| 4X | Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 4X | Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 3X | Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com. |

| 2X | Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com. |

| 1X | Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases. |

Intro offer

Annual Fee

Recommended Credit

Why We Chose It

There’s a lot to love about the Amex Gold. It’s a fan favorite thanks to its fantastic bonus-earning rates at restaurants worldwide and at U.S. supermarkets. If you’re hitting the skies soon, you’ll also earn bonus Membership Rewards points on travel. Paired with up to $120 in Uber Cash annually (for U.S. Uber rides or Uber Eats orders, card must be added to Uber app and you can redeem with any Amex card), up to $120 in annual dining statement credits to be used with eligible partners, an up to $84 Dunkin’ credit each year at U.S. Dunkin Donuts and an up to $100 Resy credit annually, there’s no reason that foodies shouldn’t add the Amex Gold to their wallet. These benefits alone are worth more than $400, which offsets the $325 annual fee on the Amex Gold card. Enrollment is required for select benefits. (Partner offer)Pros

- 4 points per dollar spent on dining at restaurants worldwide and U.S. supermarkets (on the first $50,000 in purchases per calendar year; then 1 point per dollar spent thereafter and $25,000 in purchases per calendar year; then 1 point per dollar spent thereafter, respectively)

- 3 points per dollar spent on flights booked directly with the airline or with amextravel.com

- Packed with credits foodies will enjoy

- Solid welcome bonus

Cons

- Not as useful for those living outside the U.S.

- Some may have trouble using Uber and other dining credits

- You may be eligible for as high as 100,000 Membership Rewards® Points after you spend $6,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved and find out your exact welcome offer amount – all with no credit score impact. If you’re approved and choose to accept the Card, your score may be impacted.

- Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com.

- Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com.

- Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases.

- $120 Uber Cash on Gold: Add your Gold Card to your Uber account and get $10 in Uber Cash each month to use on orders and rides in the U.S. when you select an American Express Card for your transaction. That’s up to $120 Uber Cash annually. Plus, after using your Uber Cash, use your Card to earn 4X Membership Rewards® points for Uber Eats purchases made with restaurants or U.S. supermarkets. Point caps and terms apply.

- $84 Dunkin' Credit: With the $84 Dunkin' Credit, you can earn up to $7 in monthly statement credits after you enroll and pay with the American Express® Gold Card at U.S. Dunkin' locations. Enrollment is required to receive this benefit.

- $100 Resy Credit: Get up to $100 in statement credits each calendar year after you pay with the American Express® Gold Card to dine at U.S. Resy restaurants or make other eligible Resy purchases. That's up to $50 in statement credits semi-annually. Enrollment required.

- $120 Dining Credit: Satisfy your cravings, sweet or savory, with the $120 Dining Credit. Earn up to $10 in statement credits monthly when you pay with the American Express® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, and Five Guys. Enrollment required.

- Explore over 1,000 upscale hotels worldwide with The Hotel Collection and receive a $100 credit towards eligible charges* with every booking of two nights or more through AmexTravel.com. *Eligible charges vary by property.

- No Foreign Transaction Fees.

- Annual Fee is $325.

- Terms Apply.

Rewards Rate

| 4X | Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 4X | Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 3X | Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com. |

| 2X | Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com. |

| 1X | Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases. |

Intro Offer

You may be eligible for as high as 100,000 Membership Rewards® Points after spending $6,000 in eligible purchases on your new Card in your first 6 months of Membership. Welcome offers vary and you may not be eligible for an offer.As High As 100,000 points. Find Out Your Offer.Annual Fee

$325Recommended Credit

Credit ranges are a variation of FICO® Score 8, one of many types of credit scores lenders may use when considering your credit card application.Excellent to Good

Why We Chose It

There’s a lot to love about the Amex Gold. It’s a fan favorite thanks to its fantastic bonus-earning rates at restaurants worldwide and at U.S. supermarkets. If you’re hitting the skies soon, you’ll also earn bonus Membership Rewards points on travel. Paired with up to $120 in Uber Cash annually (for U.S. Uber rides or Uber Eats orders, card must be added to Uber app and you can redeem with any Amex card), up to $120 in annual dining statement credits to be used with eligible partners, an up to $84 Dunkin’ credit each year at U.S. Dunkin Donuts and an up to $100 Resy credit annually, there’s no reason that foodies shouldn’t add the Amex Gold to their wallet. These benefits alone are worth more than $400, which offsets the $325 annual fee on the Amex Gold card. Enrollment is required for select benefits. (Partner offer)Pros

- 4 points per dollar spent on dining at restaurants worldwide and U.S. supermarkets (on the first $50,000 in purchases per calendar year; then 1 point per dollar spent thereafter and $25,000 in purchases per calendar year; then 1 point per dollar spent thereafter, respectively)

- 3 points per dollar spent on flights booked directly with the airline or with amextravel.com

- Packed with credits foodies will enjoy

- Solid welcome bonus

Cons

- Not as useful for those living outside the U.S.

- Some may have trouble using Uber and other dining credits

- You may be eligible for as high as 100,000 Membership Rewards® Points after you spend $6,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved and find out your exact welcome offer amount – all with no credit score impact. If you’re approved and choose to accept the Card, your score may be impacted.

- Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com.

- Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com.

- Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases.

- $120 Uber Cash on Gold: Add your Gold Card to your Uber account and get $10 in Uber Cash each month to use on orders and rides in the U.S. when you select an American Express Card for your transaction. That’s up to $120 Uber Cash annually. Plus, after using your Uber Cash, use your Card to earn 4X Membership Rewards® points for Uber Eats purchases made with restaurants or U.S. supermarkets. Point caps and terms apply.

- $84 Dunkin' Credit: With the $84 Dunkin' Credit, you can earn up to $7 in monthly statement credits after you enroll and pay with the American Express® Gold Card at U.S. Dunkin' locations. Enrollment is required to receive this benefit.

- $100 Resy Credit: Get up to $100 in statement credits each calendar year after you pay with the American Express® Gold Card to dine at U.S. Resy restaurants or make other eligible Resy purchases. That's up to $50 in statement credits semi-annually. Enrollment required.

- $120 Dining Credit: Satisfy your cravings, sweet or savory, with the $120 Dining Credit. Earn up to $10 in statement credits monthly when you pay with the American Express® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, and Five Guys. Enrollment required.

- Explore over 1,000 upscale hotels worldwide with The Hotel Collection and receive a $100 credit towards eligible charges* with every booking of two nights or more through AmexTravel.com. *Eligible charges vary by property.

- No Foreign Transaction Fees.

- Annual Fee is $325.

- Terms Apply.