Transfer ThankYou Points to Virgin Atlantic With a 25% Bonus

Update: Some offers mentioned below are no longer available. View the current offers here.

In the past, we've seen opportunities to transfer points with a 25% bonus to Virgin Atlantic with Amex Membership Rewards and Citi ThankYou points, and one such bonus has now returned. ThankYou points have been becoming increasingly valuable because of additional transfer partners and transfer bonuses — currently, you can transfer ThankYou points to Hilton at a 1:1.5 ratio. And now through April 6, you'll also be able to transfer Citi ThankYou points to Virgin Atlantic with a 25% bonus once again.

ThankYou points normally transfer at a 1:1 ratio in increments of 1,000. However, with the 25% bonus, each 1,000 points you transfer will get you 1,250 Virgin Atlantic Flying Club miles. But is it worth it to transfer your ThankYou points to Virgin Atlantic even with this bonus? In short, you may be able to get some good value out of this opportunity, especially if you're redeeming for the airline's Upper Class product.

TPG values Virgin Atlantic Flying Club miles at 1.5 cents each. By comparison, Citi ThankYou points are valued at 1.6 cents each. Normally with the 1:1 transfer ratio, you'd get 1.5 cents for every 1.6-cent ThankYou point transfer. However, with this bonus, you'll get 1.88 cents for every 1.6-cent ThankYou point — which, on the surface, seems like a pretty good deal.

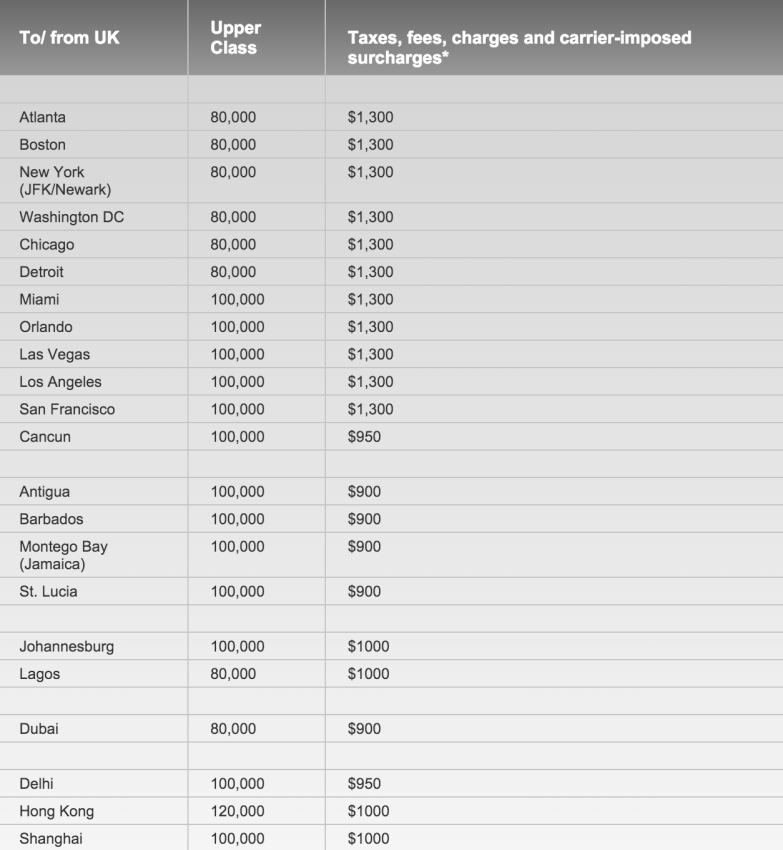

Here's Virgin's Upper Class award chart for round-trip flights to/from the UK:

As you can see above, you'd need 100,000 Flying Club miles to fly Upper Class between Los Angeles and London Heathrow, 70,000 for premium economy or 42,500 for coach. You could get that by transferring the following ThankYou points to Virgin Atlantic:

- Economy: 42,500 miles = 34,000 ThankYou points

- Premium Economy: 70,000 miles = 56,000 ThankYou points

- Upper Class: 100,000 miles = 80,000 ThankYou points

And while that may seem really appealing up front — only 80,000 ThankYou points for an Upper Class ticket between Los Angeles and London Heathrow — there's more to the story. Don't forget that Virgin Atlantic is notorious for its high taxes and surcharges — on this trip, an additional $1,300! If you're paying cash, a round-trip Upper Class flight will run you $4,700 at the low end, so in this case you'd be getting 3.4 cents in value from each mile or 4.25 cents in value from each ThankYou point, after deducting the taxes and fees. If you're redeeming for economy, however, you may be better off paying cash.

If you want to build up your ThankYou points stash, consider signing up for a ThankYou points-earning credit card, such as the Citi Prestige, which will earn you 40,000 ThankYou points after you spend $4,000 in the first three months or the Citi Premier® Card, which will earn you 50,000 ThankYou points after you spend $4,000 in the first three months.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app