Accessing Priority Pass Lounges at London Heathrow with Amex Platinum

Update: Some offers mentioned below are no longer available. View the current offers here.

Priority Pass membership is a perk of certain credit cards, and it allows members entry into multiple airport lounges around the world. Today, TPG Contributor Cindy Gossett discusses her experience with Priority Pass lounges at London's Heathrow airport.

I recently picked up The Platinum Card® from American Express, which comes with a ton of benefits, including a membership to Priority Pass Select, a program that gives flyers access to more than 850 airport lounges all over the world. I signed up for Priority Pass membership shortly after receiving my Platinum card and vaguely remember getting my membership card in the mail — after which, I promptly lost it.

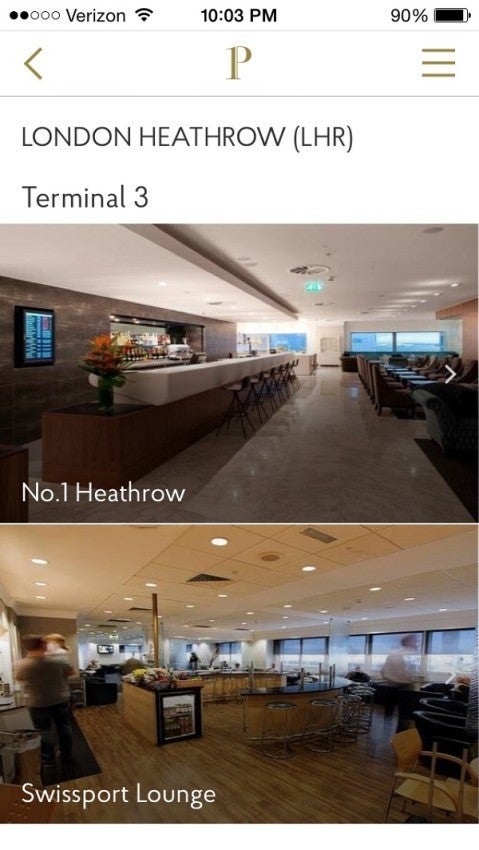

I couldn't find my card before my last trip, but luckily I remembered that Priority Pass has an app with a digital membership card that allows you to travel without your physical card — though it's probably a good idea to keep it with you, assuming you can find it.

I was recently in London's Heathrow airport, flying out of Terminal 3, so I decided to check out the two lounges available with my membership in that terminal: Swissport and the No. 1 Lounge. The lounges are right next to each other, so once you find one, you find the other. Once past security, look for the Airport Lounges signs, then F Lounges, then follow the signs for "Lounges – no invitation required." At that point, take the elevator to your right or the stairs to your left to access Swissport and No. 1.

SWISSPORT LOUNGE

There isn't much to the Swissport lounge, which means there isn't much to say about it. It's small. It's quiet. There's a little bit of free booze and a few snacks.

There are just two small rooms in the Swissport lounge. The first has a circular bar with a few snacks and access to some self-serve drinks. The second, smaller room has seating. I can't think of any reason you'd want to visit the Swissport lounge unless every other option is too crowded.

Swissport lounge hours are 5:45am - 10:15pm (subject to change, so check the app or website for updates).

NO. 1 LOUNGE

The No. 1 Lounge couldn't be more different from Swissport. This lounge is fairly large, with several different conveniences and amenities to pass the time. Just inside the lounge is a fully stocked bar, with complimentary beer, wine and spirits.

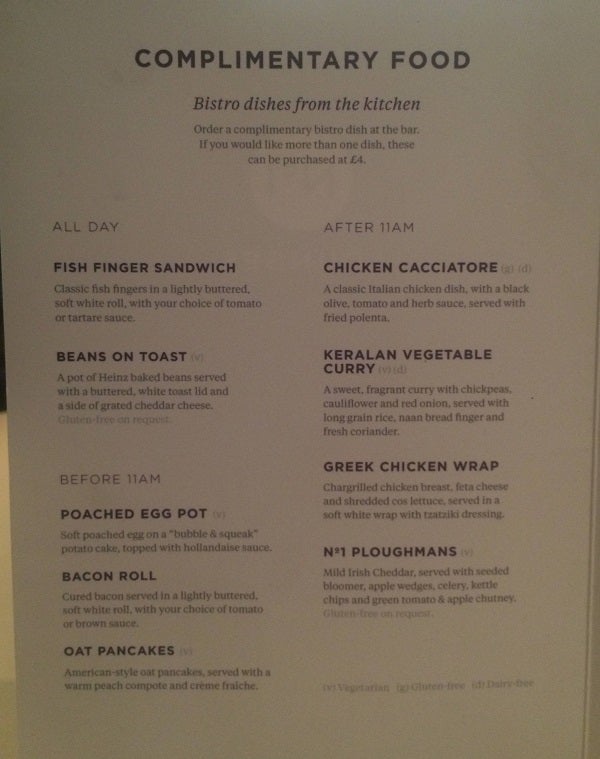

There's a buffet with a respectable amount of continental breakfast options (I was there early so I only saw breakfast) and a self-serve coffee machine. They also offer one complimentary made-to-order plate, and additional options can be ordered for £4 each:

There's also a large seating area, including a bar for working and charging electronics:

Then there are these fun pod chairs for relaxing:

And a room called "the snug" that looked like a kids' hideout but whose purpose was otherwise unclear:

There is a family room for kids:

A game room with computers and a foosball table:

And a theater with movies at designated show times:

Finally, No. 1 has complimentary showers:

There are other paid services at No. 1, including a spa and bedrooms, which cost £20 per hour for a minimum of three hours:

No. 1 Lounge is open from 4:30am to 10:30pm daily, and Priority Pass members are entitled to three hours in the lounge, though it isn't entirely apparent how the staff keeps tabs on each visitor. The complimentary drinks and snacks, paired with the free WiFi, make this a great place to get work done (or play foosball, or watch a movie) while waiting for your flight.

OTHER TERMINALS AT HEATHROW

I only visited Terminal 3, but here is a brief overview of the lounges available to Priority Pass members in other terminals. For a look at some of the best lounges you can access at other airports, see Nick Ewen's post, Top 8 Priority Pass Lounges That Are Worth a Layover.

Terminal 2

There are two Plaza Premium Lounges in Terminal 2: a departures lounge and an arrivals lounge. The departures lounge is airside and is open from 5am to 11pm daily. The maximum stay is three hours.

The arrivals lounge is landside, and is open from 5am to 10pm daily. It has showers, a nice touch for those arriving from an overnight flight too early to check in to a hotel.

Terminal 4

There's another Plaza Premium Lounge for passengers departing or transiting through Terminal 4. This lounge is open from 5am to 10:30pm daily.

Terminal 4 is also home to a SkyTeam Lounge. Open from 5am till the last departing flight daily, this location has showers and day beds.

Terminal 5

Terminal 5 has an Aspire Lounge, which is open 5am to 11pm daily and has showers and rest pods.

CARDS THAT OFFER COMPLIMENTARY PRIORITY PASS MEMBERSHIP

The following cards give you complimentary Priority Pass membership, allowing you to enjoy the lounges mentioned above and many more. Note that all three American Express cards provide lounge access for the cardmember only, though you can pay to have authorized users receive their own card and therefore their own Priority Pass Select membership.

Platinum Card from American Express — This card has a $550 annual fee but comes with a variety of benefits; aside from Priority Pass membership, cardholders can also access Centurion lounges and get a $200 airline fee credit per year. The current sign-up bonus is for 60,000 Membership Rewards points after spending $5,000 in the first three months of account opening.

Business Platinum Card from American Express — Like with the personal card above, there's a $450 annual fee, and benefits include Centurion lounge access and a $200 annual airline fee credit. The current sign-up bonus is for 40,000 Membership Rewards after spending $5,000 in the first three months of account opening. (Note the higher spending requirement.)

The Platinum Card from American Express Exclusively for Mercedes-Benz – Of the three Amex cards with Priority Pass membership, this one has the heftiest annual fee ($475) and includes the same lounge benefits described above.

Citi Prestige — Unlike with the Amex card, Citi Prestige cardholders can bring guests into the lounge for free — either a partner and kids under 18 or any two guests.

Bottom Line

Priority Pass can be of limited use in the US, given the relatively few lounges available in this country, some of which are restricted to flyers transiting a specific terminal. Still, having a complimentary membership is a nice perk, and it's a great way to visit lounges if you don't have access otherwise.

I really liked the No. 1 Lounge and wished that I was traveling with my family, since my children would've loved the kids' room, eggs chairs and game room (though you'll have to pay for kids over two to enter the lounge). Remember, though, that there are no flight announcements in the general lounges since they're not connected to a single airline. I spent the last half hour or so before my flight at the Admirals Club Flagship Lounge, where they do announce boardings.

Just remember that holding a credit card that offers Priority Pass membership doesn't give you access to all the lounges; you need to register with Priority Pass and get your member number before you can take advantage of this perk.

Have you visited any of the Priority Pass lounges at Heathrow? Share your thoughts in the comments below.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app