Deal Alert: New York to San Juan from $216 Round-Trip

Update: Some offers mentioned below are no longer available. View the current offers here.

Airfare deals are typically only available on limited dates. We recommend that you use Google Flights to find dates to fly, then book through an online travel agency, such as Orbitz, which allows you to cancel flights without penalty by 11pm Eastern Time within one day of booking. Remember: Fares may disappear quickly, so book right away and take advantage of Orbitz's courtesy cancellation if you're unable to travel. Additionally, keep in mind that discounted partner fares may not earn miles with US-based carriers.

If you're not thrilled with the chilly winter weather in NYC, here's a great opportunity for a cheap beach escape. Delta, JetBlue and United are currently offering discounted fares from New York (JFK) and Newark (EWR) to San Juan, Puerto Rico (SJU), with nonstop flights starting around $216 round-trip on limited dates over the next few weeks. If you're looking to travel during a different period this winter, you can expect to find flights in the $280 range. Some flights, such as those on Delta, might have a short connection, however there are plenty of itineraries with nonstop service. Cheap flights are available between January and April.

Airlines: Delta, JetBlue, United

Routes: EWR and JFK to SJU

Cost: $216-$280+ round-trip in economy

Dates: January 2016 through April 2016

Elite Mileage Earning: At least 3,194 medallion-qualifying miles or 3,216 premier-qualifying miles

Fare Class: K (United), T and V (Delta)

Booking Link: Orbitz

Pay With: American Express Premier Rewards Gold, Citi Prestige or Chase Sapphire Preferred Card

Search for your flight here:

Here are a few examples of what you can book:

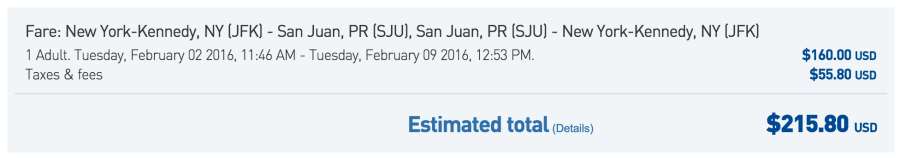

New York (JFK) to San Juan (SJU) for $216 on JetBlue:

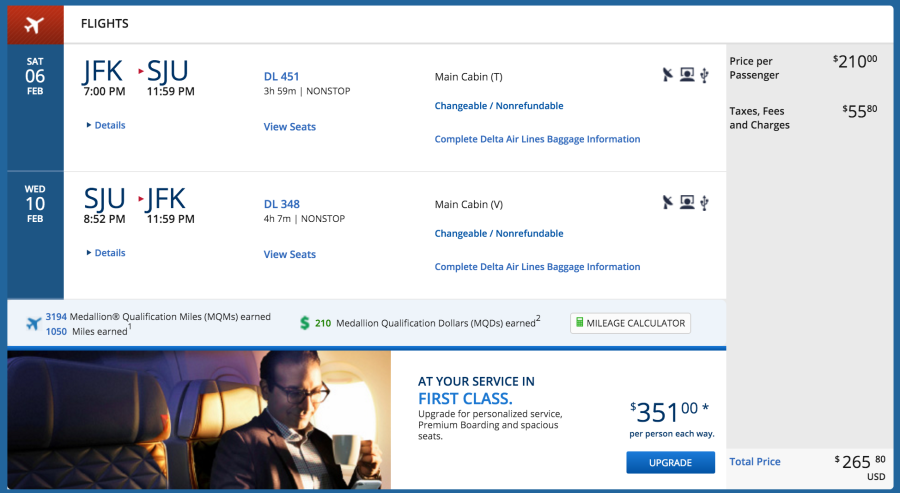

New York (JFK) to San Juan (SJU) for $266 on Delta (earns 3,194 MQMs):

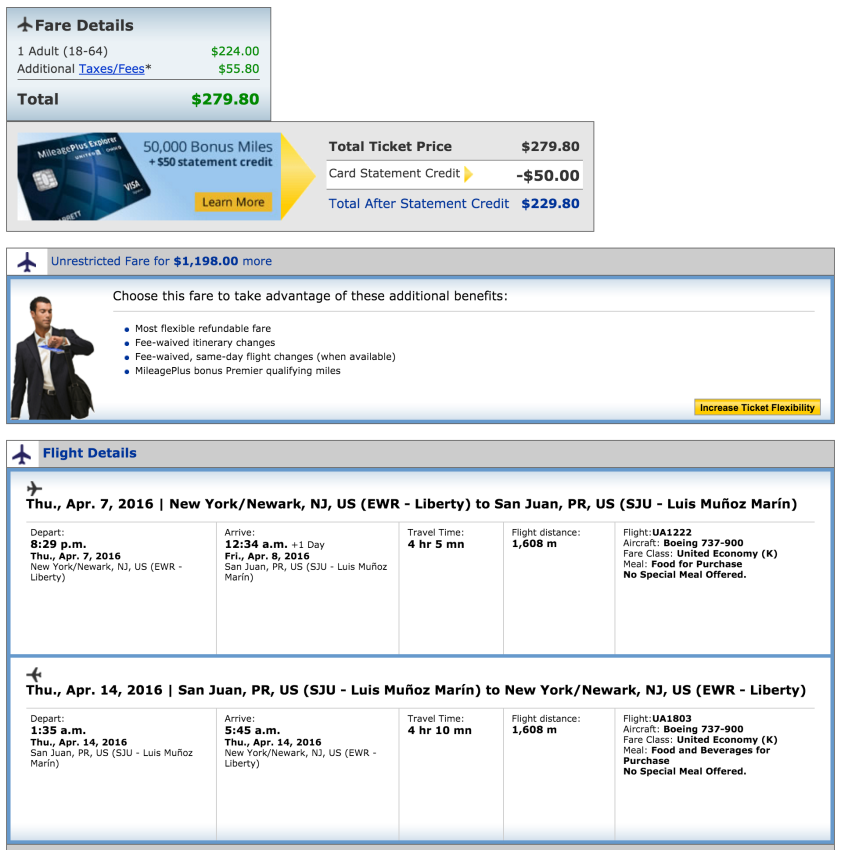

Newark (EWR) to San Juan (SJU) for $280 on United (earns 3,216 PQMs):

Maximize Your Purchase

Don't forget to use a credit card that earns additional points on airfare purchases, such as the American Express Premier Rewards Gold or Citi Prestige (3x on airfare) or the Chase Sapphire Preferred Card (2x on all travel purchases). Check out this post for more on maximizing airfare purchases.

H/T: The Flight Deal

If you're able to score one of these tickets, please share the good news in the comments below!

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app