7 Ways to Save Money on Museum Admissions

Museums are a great indoor activity for learning more about a city, history, culture or creatures—plus escaping any less-than-lovely weather—and most offer a number of money-saving options that enable visitors to see more while spending less. TPG Contributor Michele Herrmann shares seven ways for finding deals on museum admissions, nationwide.

1. The Museums on US Program. Are you a Bank of America or Merrill Lynch credit or debit cardholder? Bank of America's Museums on US program lets these customers get free general admission on the first full weekend of every month (that is, with a consecutive Saturday and Sunday) at more than 150 participating institutions around the country. For example, you could kick off 2015 with a free visit on January 3 or 4 to the currently-included Museum of Fine Arts, Boston, or the National Cowboy & Western Heritage Museum in Oklahoma City. This master list changes often, so keep checking back—and bring your bank card and photo ID when you go!

2. Multi-attraction pass booklets. Essentially coupon books for major cities, multi-attraction booklets provide good discounts for tourists who want to experience/see/do as much as possible when they're on vacation. One of the most popular options is CityPASS, which offers five or six pre-paid admission tickets to top attractions in New York City, Chicago, Houston, Philadelphia, San Francisco, Seattle, Tampa Bay, Toronto or Southern California. Another multiple-museum choice is Smart Destinations, which offers an assortment of options such as a build-your-own pass or the All-Inclusive Inclusion Pass for Boston, Chicago, Los Angeles, Miami, New York City, Oahu, San Diego, Orlando and San Francisco.

3. Pay as you wish. If you want to lend support to a favorite institution, by all means pay in full—but many museums allow you to pay any amount you'd like, rather than a set price for general admission; examples include New York City's Metropolitan Museum of Art (recommended donation: $25) and the American Museum of Natural History (recommended donation: $22). Other institutions may offer this option only on/at certain days/times, such as The Philadelphia Museum of Art's Pay What You Wish program, which is offered on the first Sunday of the month and every Wednesday after 5 p.m., and New York's The Frick Collection, where Sundays visitors can pay what they wish from 11 a.m. to 1 p.m.

4. Free or reduced days/nights. A number of museums have special monthly or weekly public events that offer general admission either for free or at reduced rates. Don't have Friday night plans? The National Aquarium in Baltimore has a Fridays After Five series with special-admission pricing now through March 27, 2015, while New York City's MOMA keeps their doors open for their UNIQLO Free Friday Nights series from 4-8 p.m. In Seattle, the Museum of Flight's Free First Thursdays program takes off on the first Thursday of each month between 5-9 p.m., and on the first Wednesday of each month, the Bay Area Discovery Museum in Sausalito, California offers free entrance for all visitors.

At some museums, general admission is always free. The most significant example is the Smithsonian portfolio of museums in Washington, D.C., which includes the National Portrait Gallery and the United States Holocaust Memorial Museum. Other free-to-enter museums include The Getty Center in Los Angeles (though note that advance parking reservations cost $15 per car), the Kimball Art Museum in Fort Worth, Missouri's Saint Louis Art Museum, and the Virginia Museum of Fine Arts in Richmond.

5. State residency. Being a state resident has its perks, as some museums give its locals a price break (with required proof of residency). Once a month, the San Francisco Zoo offers free admission to residents of the City by the Bay; check their calendar for confirmed dates. Chicago's Field Museum, Shedd Aquarium and Museum of Science and Industry offer free or discounted admission on certain days to Illinois residents. For one weekend in June, Portsmouth's Strawbery Banke Museum holds a New Hampshire Weekend that invites all the Granite State's residents to come to the museum at no cost.

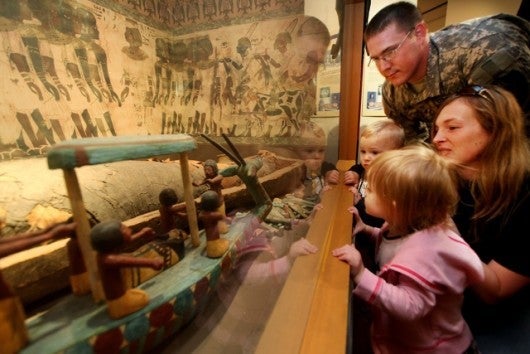

6. Sponsored programs. Target sponsors a wide variety of free or reduced-price days at institutions around the country, providing a great way to save money while soaking up some culture. Smithsonian Magazine's Museum Day Live! program provides free admission for two people per household to participating museums nationwide, usually in late September; register in advance for your special ticket and then bring it to your specific museum for approved entrance. The annual Blue Star Museum program offers free admission for members of America's active duty military personnel (including the National Guard and Reserve) and up to five of their family members to more 2,000 participating museums nationwide, from Memorial Day through Labor Day. (Information for 2015 will be available closer to the start date.)

7. Tourism bureau discounts. City tourism bureaus and visitors centers are a consistent source for discounts at museums and other cultural attractions. For instance, Nashville's perennial Music City Total Access Pass includes up to four attractions as well as free admission to the city's Parthenon. New York City's New York Pass is a smartcard valid for a variable number of days (depending on the amount of your purchase) and offers free entry to more than 80 attractions, including a few tours, while San Antonio's SAVE (San Antonio Vacation Experience) Program features coupons for admission to The Institute of Texan Cultures, the San Antonio Museum of Art, and more. Be sure to check your destination's tourism website before you travel!

What are your favorite American museums—and your favorite ways to save money when visiting them?

[card card-name='Chase Sapphire Preferred® Card' card-id='22125056' type='javascript' bullet-id='1']

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app