What Will 60,000 Chase Ultimate Rewards Points Get You?

Update: Some offers mentioned below are no longer available. View the current offers here.

The Chase Ink Bold and Ink Plus cards currently offer 50,000 points after $5,000 spent within the first 3 months. At a minimum you will have 55,000 points after meeting the minimum spend and could potentially earn over 60,000 Ultimate Rewards points if you max out the bonus categories which include 5x on the first $50,000 spent in combined purchases at office supply stores and on cellular phone, landline, internet and cable TV services and 2x on the first $50,000 spent annually at gas stations and for hotel accommodations when purchased directly with the hotel.

We thought it would be fun to put together a list of things you can do with 60,000 Chase Ultimate Rewards points since that's an easy number to attain with such lucrative sign up bonuses.

What Are 60,000 Ultimate Rewards Points Worth?

Earlier this month I wrote about how I value each credit card currency and Chase Ultimate Rewards was valued at 2 cents per point and will increase in next month's valuation because they just added a valuable new transfer partner: Singapore Airlines KrisFlyer. Taking the 2 cent per point valuation- the 60,000 points is worth $1,200- not too shabby considering the $95 annual fee is even waived the first year. Even if you don't value Ultimate rewards points as high as I do (because I know how to maximize their 11 transfer partners: United, British Airways, Virgin Atlantic, Korean, Southwest, Hyatt, Ritz-Carlton, Marriott, Priority Club and Amtrak), you can book travel directly through Ultimate Rewards travel at 1.25 cents per piece, so 60,000 UR points = $750 in travel and you generally earn miles/points on travel booked through Ultimate Rewards. Note: Ultimate Rewards points earned from Ink Cash are not transferable to partners and can only be used for gift cards/statement credit of 1 cent per point, unless you have a Ink Bold, Ink Plus or Sapphire Preferred, in which case you can combine all of your Ultimate Rewards points and transfer them.

Here are 10 different ways that you could use 60,000 Ultimate Rewards points to get great value (click here for our updated list of award charts so you can analyze other options for your preferred Chase transfer partner):

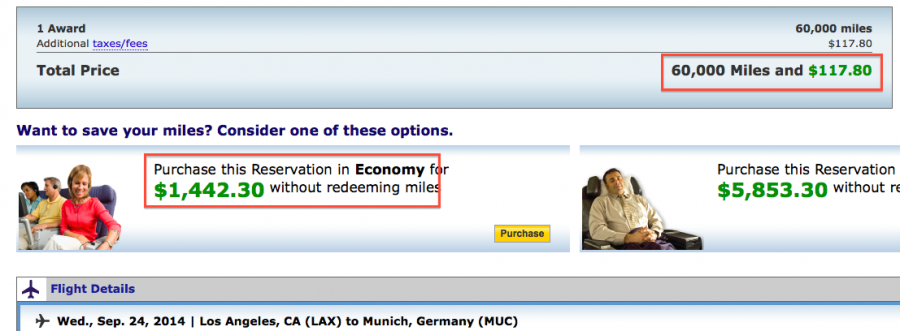

1. Roundtrip economy from the US to Europe via United. United made some nasty changes to their frequent flyer program in February, but economy class awards, even on partners, were largely unaffected. Since United does not tack on crazy fuel surcharges or fees, redeeming for economy awards can still be a great value. Take this trip from Los Angeles to Munich over Oktoberfest- only 60,000 miles and $117.80 (~$85 of that is from German taxes, so you can get this lower by going to other destinations). The same itinerary to purchase would cost $1,442.30, so take out the $117 and those 60,000 miles are saving you $1,324 or 2.2 cents a piece. Granted, you don't earn miles on award tickets so you need to take the miles/elite miles you forego into account, but still- United miles can still save a bundle- even for economy redemptions.

2. Southwest Awards: 60,000 Chase to Southwest is worth ~960 in Wanna Get Away fares.

Southwest also devalued their Wanna Get Away awards at the end of March, but you can still get pretty decent value- especially if you're lucky enough to be the owner of a Southwest Companion Pass which essentially doubles the value of every ticket you buy, whether with cash or points.

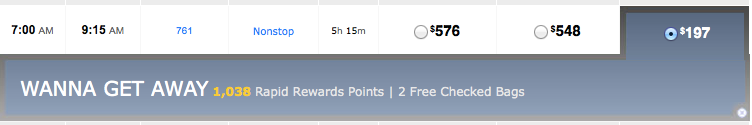

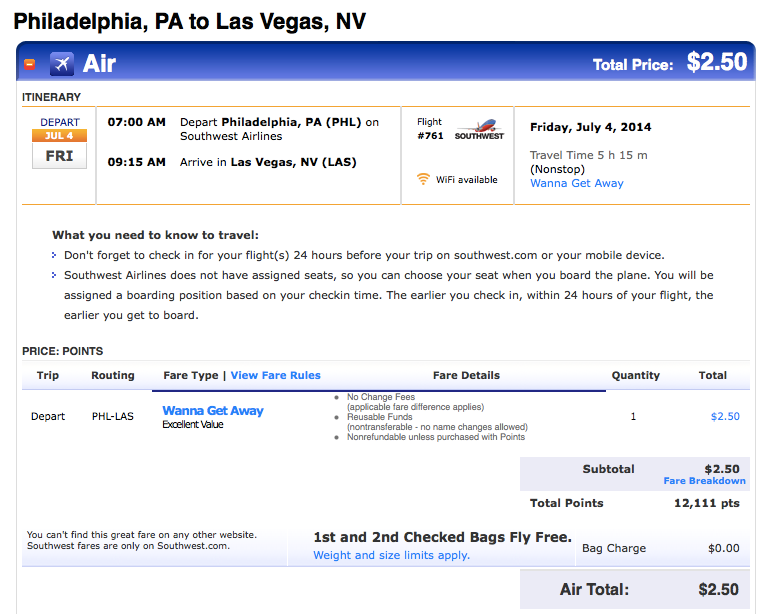

Take for example a one-way flight Philadelphia to Las Vegas on July 4, 2014- you can either pay $197 (and earn 1,038 points) or use 12,111 and $2.50 to redeem for an award. With taxes taken out, 12,111 points saves you $194.50, so just over 1.6 cents a point.

This value can be doubled if you have the Southwest Companion Pass status, which gives a free flight (just pay taxes) whenever you pay for one or redeem points. So a Companion Pass holder could pay 12,111 points for two tickets on this Philadelphia to Las Vegas non-stop at a value of $394.

3. Hyatt Redemptions: 2 nights at a top Park Hyatt for 60,000 points, ~$2,000 in value.

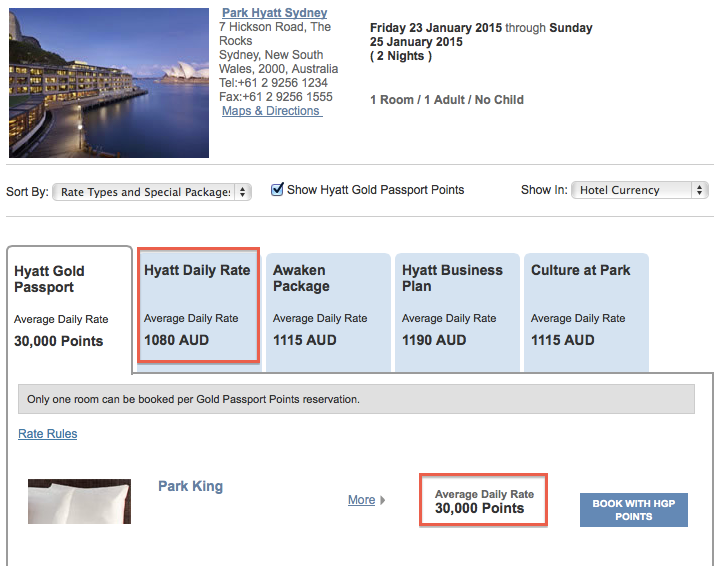

Hyatt also made some chart adjustments that went into effect January 7, 2014. Six Park Hyatts were now a part of a 30,000 point a night category 7: Beaver Creek, Milan, Paris, Sydney, Tokyo and Zurich and a bunch of other hotels would shift categories, so there were winners and losers.

With 60,000 points transferred to Hyatt at a 1:1 ratio, you’d have enough to stay 2 nights in a Category 7 property like the Park Hyatt Sydney, where I stayed this past February. I priced out January 23-25, 2015 and the average daily rate is $1,080 AUD ($996 US).

So 60,000 points would save you $1,992, or 3.3 cents a point.

4. British Airways Short-Hauls: British Airways is one of the programs that hasn't changed for the worst and has gotten better with the inclusion of new partners like US Airways, Qatar Airlines and TAM.

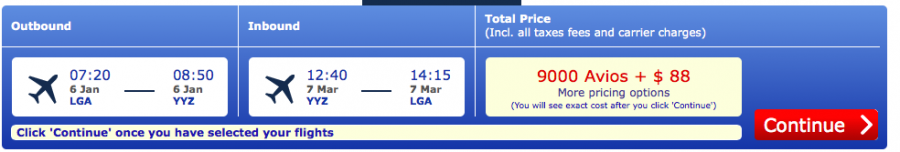

British Airways prices flights 1-650 miles at only 4,500 Avios each way. So a roundtrip New York to Toronto is only 9,000 Avios and $88 (mostly Canadian taxes- they come down for all US awards). Still, you can get 6.67 roundtrip short haul awards for 60,000 Chase points- not bad considering British Airways does not charge last minute award booking fees ($75+ with most carriers).

5. Amtrak: Amtrak is one of the most overlooked Membership Rewards transfer partners, but can provide great value if you know how to use them. Check out this post on Amtrak redemptions, but basically you can get a bedroom suite from New York to Los Angeles (hey, it's not the quickest, but could be a fun?!) for 60,000 points and they retail for over $2,067 one-way, getting over 3.47 cents per point.

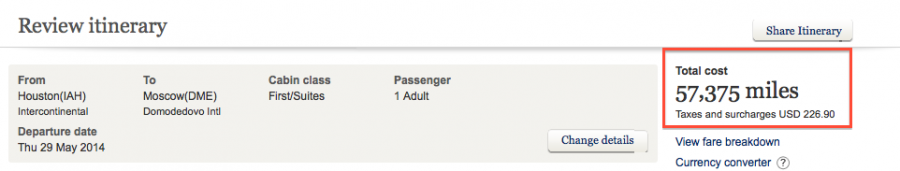

6. Singapore Airlines: First Class Suites from Houston to Moscow 57,375 miles and $227 for a $7,507 flight- over 12.6 cents per point! Check outthis post for more information on when Singapore KrisFlyer can provide great value.

There are myriad more way to juice 2+ cents per point in value from Chase Ultimate rewards- what are your best redemptions to date?

Related Posts:

Detailed Look at the Benefits of the Ink Bold and Ink Plus Cards

Top 10 Benefits of the Ink Bold and Ink Plus Cards,

Can You Get Both The Ink Bold and Ink Plus?

Top 10 Ways To Maximize Each Ultimate Rewards Transfer Partner

Why I Love Chase Ultimate Rewards

TPG featured card

Rewards

| 4X | Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 4X | Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 3X | Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com. |

| 2X | Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com. |

| 1X | Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases. |

Intro offer

Annual Fee

Recommended Credit

Why We Chose It

There’s a lot to love about the Amex Gold. It’s a fan favorite thanks to its fantastic bonus-earning rates at restaurants worldwide and at U.S. supermarkets. If you’re hitting the skies soon, you’ll also earn bonus Membership Rewards points on travel. Paired with up to $120 in Uber Cash annually (for U.S. Uber rides or Uber Eats orders, card must be added to Uber app and you can redeem with any Amex card), up to $120 in annual dining statement credits to be used with eligible partners, an up to $84 Dunkin’ credit each year at U.S. Dunkin Donuts and an up to $100 Resy credit annually, there’s no reason that foodies shouldn’t add the Amex Gold to their wallet. These benefits alone are worth more than $400, which offsets the $325 annual fee on the Amex Gold card. Enrollment is required for select benefits. (Partner offer)Pros

- 4 points per dollar spent on dining at restaurants worldwide and U.S. supermarkets (on the first $50,000 in purchases per calendar year; then 1 point per dollar spent thereafter and $25,000 in purchases per calendar year; then 1 point per dollar spent thereafter, respectively)

- 3 points per dollar spent on flights booked directly with the airline or with amextravel.com

- Packed with credits foodies will enjoy

- Solid welcome bonus

Cons

- Not as useful for those living outside the U.S.

- Some may have trouble using Uber and other dining credits

- You may be eligible for as high as 100,000 Membership Rewards® Points after you spend $6,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved and find out your exact welcome offer amount – all with no credit score impact. If you’re approved and choose to accept the Card, your score may be impacted.

- Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com.

- Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com.

- Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases.

- $120 Uber Cash on Gold: Add your Gold Card to your Uber account and get $10 in Uber Cash each month to use on orders and rides in the U.S. when you select an American Express Card for your transaction. That’s up to $120 Uber Cash annually. Plus, after using your Uber Cash, use your Card to earn 4X Membership Rewards® points for Uber Eats purchases made with restaurants or U.S. supermarkets. Point caps and terms apply.

- $84 Dunkin' Credit: With the $84 Dunkin' Credit, you can earn up to $7 in monthly statement credits after you enroll and pay with the American Express® Gold Card at U.S. Dunkin' locations. Enrollment is required to receive this benefit.

- $100 Resy Credit: Get up to $100 in statement credits each calendar year after you pay with the American Express® Gold Card to dine at U.S. Resy restaurants or make other eligible Resy purchases. That's up to $50 in statement credits semi-annually. Enrollment required.

- $120 Dining Credit: Satisfy your cravings, sweet or savory, with the $120 Dining Credit. Earn up to $10 in statement credits monthly when you pay with the American Express® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, and Five Guys. Enrollment required.

- Explore over 1,000 upscale hotels worldwide with The Hotel Collection and receive a $100 credit towards eligible charges* with every booking of two nights or more through AmexTravel.com. *Eligible charges vary by property.

- No Foreign Transaction Fees.

- Annual Fee is $325.

- Terms Apply.

Rewards Rate

| 4X | Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 4X | Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 3X | Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com. |

| 2X | Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com. |

| 1X | Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases. |

Intro Offer

You may be eligible for as high as 100,000 Membership Rewards® Points after spending $6,000 in eligible purchases on your new Card in your first 6 months of Membership. Welcome offers vary and you may not be eligible for an offer.As High As 100,000 points. Find Out Your Offer.Annual Fee

$325Recommended Credit

Credit ranges are a variation of FICO® Score 8, one of many types of credit scores lenders may use when considering your credit card application.Excellent to Good

Why We Chose It

There’s a lot to love about the Amex Gold. It’s a fan favorite thanks to its fantastic bonus-earning rates at restaurants worldwide and at U.S. supermarkets. If you’re hitting the skies soon, you’ll also earn bonus Membership Rewards points on travel. Paired with up to $120 in Uber Cash annually (for U.S. Uber rides or Uber Eats orders, card must be added to Uber app and you can redeem with any Amex card), up to $120 in annual dining statement credits to be used with eligible partners, an up to $84 Dunkin’ credit each year at U.S. Dunkin Donuts and an up to $100 Resy credit annually, there’s no reason that foodies shouldn’t add the Amex Gold to their wallet. These benefits alone are worth more than $400, which offsets the $325 annual fee on the Amex Gold card. Enrollment is required for select benefits. (Partner offer)Pros

- 4 points per dollar spent on dining at restaurants worldwide and U.S. supermarkets (on the first $50,000 in purchases per calendar year; then 1 point per dollar spent thereafter and $25,000 in purchases per calendar year; then 1 point per dollar spent thereafter, respectively)

- 3 points per dollar spent on flights booked directly with the airline or with amextravel.com

- Packed with credits foodies will enjoy

- Solid welcome bonus

Cons

- Not as useful for those living outside the U.S.

- Some may have trouble using Uber and other dining credits

- You may be eligible for as high as 100,000 Membership Rewards® Points after you spend $6,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved and find out your exact welcome offer amount – all with no credit score impact. If you’re approved and choose to accept the Card, your score may be impacted.

- Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com.

- Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com.

- Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases.

- $120 Uber Cash on Gold: Add your Gold Card to your Uber account and get $10 in Uber Cash each month to use on orders and rides in the U.S. when you select an American Express Card for your transaction. That’s up to $120 Uber Cash annually. Plus, after using your Uber Cash, use your Card to earn 4X Membership Rewards® points for Uber Eats purchases made with restaurants or U.S. supermarkets. Point caps and terms apply.

- $84 Dunkin' Credit: With the $84 Dunkin' Credit, you can earn up to $7 in monthly statement credits after you enroll and pay with the American Express® Gold Card at U.S. Dunkin' locations. Enrollment is required to receive this benefit.

- $100 Resy Credit: Get up to $100 in statement credits each calendar year after you pay with the American Express® Gold Card to dine at U.S. Resy restaurants or make other eligible Resy purchases. That's up to $50 in statement credits semi-annually. Enrollment required.

- $120 Dining Credit: Satisfy your cravings, sweet or savory, with the $120 Dining Credit. Earn up to $10 in statement credits monthly when you pay with the American Express® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, and Five Guys. Enrollment required.

- Explore over 1,000 upscale hotels worldwide with The Hotel Collection and receive a $100 credit towards eligible charges* with every booking of two nights or more through AmexTravel.com. *Eligible charges vary by property.

- No Foreign Transaction Fees.

- Annual Fee is $325.

- Terms Apply.