Is There A Way To Convert Chase Ultimate Rewards Points Into Delta Miles?

Update: Some offers mentioned below are no longer available. View the current offers here.

TPG reader Paris recently reached out on Twitter with an interesting question about when it might make sense to transfer Chase points to a non-transfer partner like Delta.

"Is there a way to transfer Chase Ultimate Reward points to non-transfer partners like Delta?" The answer is yes, but at a terrible ratio, let me explain.

I actually get similar questions a lot about whether there are ways to convert miles on one airline to miles on another, or to convert one kind of hotel points to another, and the answer is usually no. It gets a little trickier when we're talking about transferable points like Chase Ultimate Rewards, though.

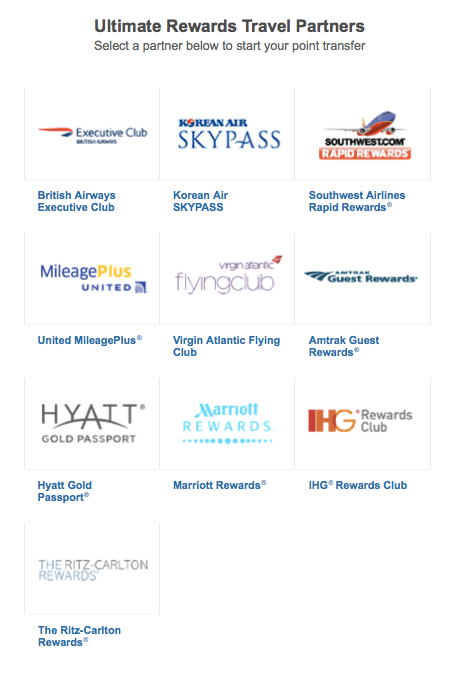

That's because most hotel programs will let you transfer points to airlines, and these ratios have been decreasing in recent years. Club Carlson just hacked away at their point to airline ratio. You can transfer Chase Ultimate Rewards points to Hyatt, Marriott, Ritz-Carlton or IHG Rewards and then from there to airline miles, but it's pretty awful.

For example, Hyatt will let you convert points to miles at a ratio of 2.5 points to 1 miles in increments of 5,000 points, and if you convert 50,000 points they'll give you a bonus of 5,000 miles so that you end up with 25,000 miles. Even with that, your transfer ratio is 2:1 - still not great. So what you can do is transfer Ultimate Rewards points to Hyatt at a 1:1 ratio then transfer them to Delta at a 2.5:1 ratio (or 2:1 if you transfer 50,000). At best, you're using 50,000 Ultimate Rewards points to end up with 25,000 Delta miles - so I would not suggest doing that.

On the whole, when you're going through another program to transfer miles, you are going to lose a lot of value. There are a couple of exceptions. For instance, if you want to transfer Amex Membership Rewards (which you earn with cards like the Platinum Card from American Express) into US Airways miles there is a way to do so by transferring them to Aeroplan and then converting those Aeroplan miles to US Airways miles via Points.com that I outline in this post. In that example, you're using 100,000 Amex points and ending up with 86,000 US Airways miles - still a loss, but not too bad. However, there are limits to these conversions so read into it before you start transferring by this method.

In general, I recommend building up points in transferable programs like Amex Membership Rewards (17 airline partners), Starwood Preferred Guest (over 30 airline partners, though transfer times can be slow) and Chase Ultimate Rewards (10 travel partners including 5 airlines such as United and Southwest if you have cards like the Sapphire Preferred, Ink Bold and Ink Plus).

The real goal is to get as much flexibility as possible, diversify your points and focus on those transferable points programs which will give you a lot of different options when it comes time to redeem. For more information, check out these posts:

Why Transferable Points are Best

The Ultimate Guide to American Express Membership Rewards Airline Transfers

The Ultimate Guide to Chase Ultimate Rewards Airline Transfers

Ranking the Chase Ultimate Rewards Transfer Partners

The Ultimate Guide to Starwood Preferred Guest Airline Transfers

Maximizing Starwood Preferred Guest Airline Transfers

Let me know if you have any other questions by messaging me on Facebook, tweeting me or emailing me at info@thepointsguy.com

TPG featured card

Rewards

| 2X miles | 2 miles per dollar on every purchase |

| 5X miles | 5 miles per dollar on flights and vacation rentals booked through Capital One Business Travel |

| 10X miles | 10 miles per dollar on hotels and rental cars booked through Capital One Business Travel |

Intro offer

Annual Fee

Recommended Credit

Why We Chose It

The Capital One Venture X Business Card has all the Capital One Venture X Rewards Credit Card has to offer and more. It offers an incredible welcome bonus and requires an equally impressive spend to qualify. In addition, the card comes with premium travel perks like annual travel credit. (Partner offer)Pros

- The Capital One Venture X business card has a very lucrative welcome offer.

- In addition, the card comes with many premium travel perks such as an annual $300 credit for bookings through Capital One Business Travel.

- Business owners are also able to add employee cards for free.

Cons

- The card requires significant spending to earn the welcome offer.

- Another drawback is that the annual travel credit can only be used on bookings made through Capital One Business Travel.

- LIMITED-TIME OFFER: Earn up to 400K bonus miles: 200K miles when you spend $30K in the first 3 months, and an additional 200k miles when you spend $150k in the first 6 months

- Earn unlimited 2X miles on every purchase, everywhere—with no limits or category restrictions

- Earn 10X miles on hotels and rental cars and 5X miles on flights and vacation rentals booked through Capital One Business Travel

- With no preset spending limit, enjoy big purchasing power that adapts so you can spend more and earn more rewards

- Empower your teams to make business purchases while earning rewards on their transactions, with free employee and virtual cards. Plus, automatically sync your transaction data with your accounting software and pay your vendors with ease

- Redeem your miles on flights, hotels and more. Plus, transfer your miles to any of the 15+ travel loyalty programs

- Every year, you'll get 10,000 bonus miles after your account anniversary date. Plus, receive an annual $300 credit for bookings made through Capital One Business Travel

- Receive up to a $120 credit for Global Entry or TSA PreCheck®. Enjoy access to 1,300+ airport lounges worldwide, including Capital One Lounge locations and Priority Pass™ lounges, after enrollment

- Enjoy a $100 experience credit and other premium benefits with every hotel and vacation rental booked from the Premier Collection

- This is a pay-in-full card, so your balance is due in full every month

- Top rated mobile app

Rewards Rate

| 2X miles | 2 miles per dollar on every purchase |

| 5X miles | 5 miles per dollar on flights and vacation rentals booked through Capital One Business Travel |

| 10X miles | 10 miles per dollar on hotels and rental cars booked through Capital One Business Travel |

Intro Offer

Earn 200K miles when you spend $30K in the first 3 months, and an additional 200K miles when you spend $150K in the first 6 monthsLIMITED-TIME OFFER: Earn up to 400K bonus milesAnnual Fee

$395Recommended Credit

Credit ranges are a variation of FICO® Score 8, one of many types of credit scores lenders may use when considering your credit card application.740-850Excellent

Why We Chose It

The Capital One Venture X Business Card has all the Capital One Venture X Rewards Credit Card has to offer and more. It offers an incredible welcome bonus and requires an equally impressive spend to qualify. In addition, the card comes with premium travel perks like annual travel credit. (Partner offer)Pros

- The Capital One Venture X business card has a very lucrative welcome offer.

- In addition, the card comes with many premium travel perks such as an annual $300 credit for bookings through Capital One Business Travel.

- Business owners are also able to add employee cards for free.

Cons

- The card requires significant spending to earn the welcome offer.

- Another drawback is that the annual travel credit can only be used on bookings made through Capital One Business Travel.

- LIMITED-TIME OFFER: Earn up to 400K bonus miles: 200K miles when you spend $30K in the first 3 months, and an additional 200k miles when you spend $150k in the first 6 months

- Earn unlimited 2X miles on every purchase, everywhere—with no limits or category restrictions

- Earn 10X miles on hotels and rental cars and 5X miles on flights and vacation rentals booked through Capital One Business Travel

- With no preset spending limit, enjoy big purchasing power that adapts so you can spend more and earn more rewards

- Empower your teams to make business purchases while earning rewards on their transactions, with free employee and virtual cards. Plus, automatically sync your transaction data with your accounting software and pay your vendors with ease

- Redeem your miles on flights, hotels and more. Plus, transfer your miles to any of the 15+ travel loyalty programs

- Every year, you'll get 10,000 bonus miles after your account anniversary date. Plus, receive an annual $300 credit for bookings made through Capital One Business Travel

- Receive up to a $120 credit for Global Entry or TSA PreCheck®. Enjoy access to 1,300+ airport lounges worldwide, including Capital One Lounge locations and Priority Pass™ lounges, after enrollment

- Enjoy a $100 experience credit and other premium benefits with every hotel and vacation rental booked from the Premier Collection

- This is a pay-in-full card, so your balance is due in full every month

- Top rated mobile app