Everything You Need to Know About American's 2017 Elite Status Spend Requirements

In 2016 American Airlines announced major changes to its AAdvantage frequent flyer program, affecting both redeemable miles and elite status. Now that we're into 2017, most of those changes are officially in effect.

With all that's new, it's important to know exactly what you'll need to do in 2017 if you want to earn elite status on American for 2018 and beyond. Let's take a look at all the ins and outs of the new system, keeping in mind that these new rules apply to earning status starting now for the 2017-18 program year.

The Basics of Elite Status

For the first time, American has four elite status tiers instead of three — a new "Platinum Pro" level has been added for 2017.

While you couldn't qualify for Platinum Pro for 2017 with your 2016 travel, if you reach the Platinum Pro requirements anytime during the 2017 calendar year, you'll get the status for the rest of 2017 along with all of 2018 — which is true of all the elite status levels.

Platinum Pro roughly splits the difference between the benefits of the higher Executive Platinum status and the lower Platinum one (yes, the names are confusing). With Platinum Pro, you'll get complimentary domestic upgrades — no 500-mile stickers needed — a 72-hour upgrade window, 4 extra redeemable miles per dollar spent on top of the standard 5 for a total of 9 miles per dollar, complimentary Main Cabin Extra and preferred seats and two free checked bags.

American has long been missing a fourth elite tier, as Delta and United have had four standard tiers for several years already, so it's not surprising to see this added for 2017.

Elite Qualifying Dollars

In addition to flying a certain number of miles (EQMs) or segments (EQSs) in 2017, in order to earn elite status you'll need to spend a certain amount of money on tickets with American as well. This new additional rubric is called "Elite Qualifying Dollars" or EQDs.

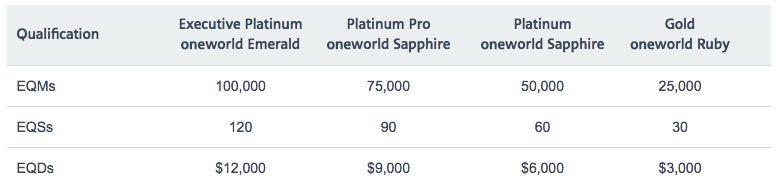

These are the EQD requirements for each American status level in 2017:

As you can see, the higher the elite level, the more you'll be required to spend with American. For basic Gold status you'll have to buy $3,000 in tickets during the calendar year as well as fly either 25,000 miles or 30 segments. But to get top-tier Executive Platinum status, you're required to shell out $12,000 in airfare with American in addition to flying 100,000 miles or 120 segments.

When it comes to Elite Qualifying Dollars, keep in mind that government-imposed taxes and fees are not included, so don't expect your entire airfare to be credited as EQDs. On the other hand, carrier-imposed fees do count, so you don't have to worry about fuel surcharges not applying.

So is there any way around this new requirement? Glad you asked.

EQDs via Credit Card Spend

Like Delta and United, American has tied Elite Qualifying Dollars in some manner to its co-branded credit cards. Unfortunately it's neither as simple nor as generous as the other two airlines.

First, the ability to earn EQDs via credit card spend is only possible via one of American's bank partnerships. Specifically, the following information applies only to the Barclaycard versions of the AAdvantage cards, not the Citibank ones. To get AA EQDs with a credit card you'll need at least one of either the AAdvantage Aviator Red, Aviator Silver, Aviator Blue or Aviator Business MasterCards.

Second, you will not be able to earn enough EQDs this way to completely eliminate the requirement at the top two elite tiers. American and Barclaycard have decided that by spending $25,000 in a calendar year on either the Aviator Red, Blue or Business cards, you'll earn $3,000 in Elite Qualifying Dollars.

You cannot "double up" on these three cards — you can only earn $3,000 on one of them for the year. However, if you also have an Aviator Silver, you can earn an additional $3,000 in EQDs for another $25,000 in spend. It's also possible to put the entire $50,000 on the Aviator Silver and earn $6,000 in EQDs that way, but then you can't add any more from the other Aviator cards — $6,000 EQDs is the maximum for the year across all credit cards.

To sum it up, $50,000 in spend across one or two Barclaycard Aviator cards can get you enough EQDs to make AAdvantage Gold or Platinum (along with the corresponding EQMs or EQSs), but will only get you partway to Platinum Pro or Executive Platinum.

So is there any other way around this new requirement? Again, glad you asked.

EQDs via Partner Airlines, Special Fares and Missing Fares

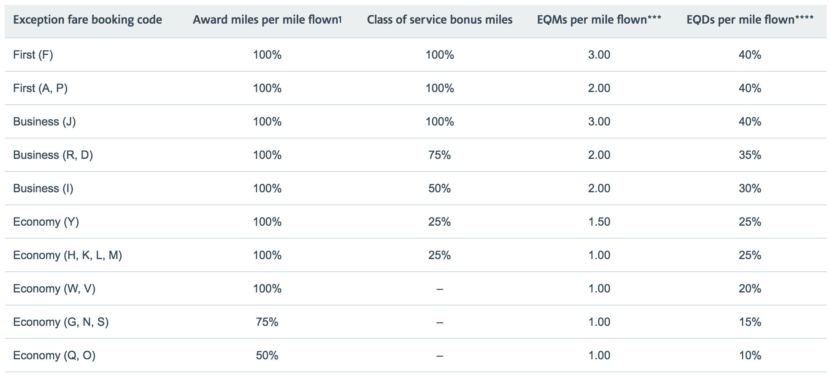

Since American can only determine EQDs when it knows how much you paid for the ticket, this becomes a problem when you credit a flight on an American partner back to the AAdvantage program since the other airline likely won't tell American how much the ticket cost. To solve this dilemma, AA has added an EQD calculation to its partner earning charts, which is based on the old system of miles actually flown.

If you're hoping this is where this new EQD system becomes simple and straightforward, you're about to be extremely disappointed. Because American has come up with a different EQD calculation for every partner, which also takes into account the fare class your ticket was booked in.

Oh, but we're not done yet. There are also cases where you might buy a ticket for an American flight, but AA still doesn't know how much you paid for it because the fare info is missing. This can sometimes happen when the ticket is rebooked during irregular operations or for other reasons, and the original fare info doesn't get added to the changed ticket.

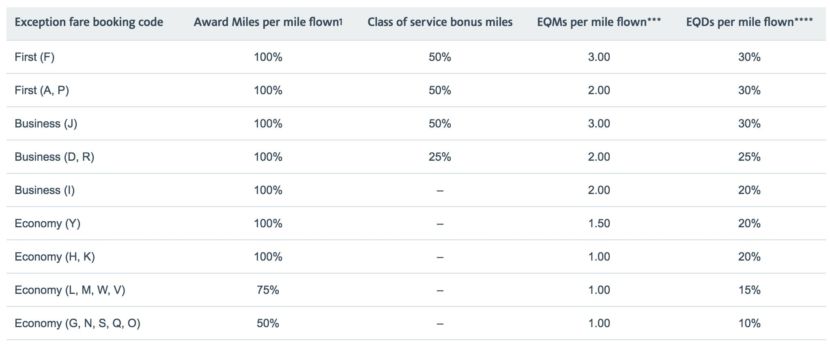

So to handle tickets without fare info, American created another formula based on fare class and included a calculation for EQDs. Which would be fine except that apparently AA quickly decided it didn't like that formula and — wait for it — came up with yet another formula for flights departing after January 11, 2017, on American metal when American doesn't know the fare.

Think we're done? Not yet! Sometimes American doesn't have information on your airfare because it's a bulk ticket. Bulk tickets are often sold as part of AA Vacations packages, but you can also get one when booking with flexible bank points through travel portals such as Chase Ultimate Rewards or Citi ThankYou Travel.

So rather than just use the same calculation as when the fare is missing, American created another formula to determine EQDs when traveling on a bulk fare. Of course, you can guess what happened next. When AA decided it didn't like its missing fares formula and changed it for flights departing on or after January 11, it went ahead and did the same for the "Special Fares" formula, which means there is yet another chart for those tickets.

Got all that? Great, because I'm exhausted.

Upgrade and boarding priority changes

So once you've earned elite status, what other changes can you expect in 2017? Well, later in the year American will implement a new system for upgrades in which EQDs over a rolling 12-month period will be considered as part of the priority criteria. This will only apply to priority within elite tier levels — if you're an Executive Platinum, you'll still get upgraded ahead of Platinum Pros, Platinums and Golds regardless of your EQD status.

Also, the news is good on award tickets for Executive Platinum members who travel on award tickets. Starting later in 2017, those top-tier elites will be eligible for complimentary upgrades on tickets redeemed with miles. Delta has had this benefit for all its elite tiers for a few months now, so American is still playing catch up by only implementing it for Executive Platinums.

Finally, American has updated its boarding priority to specifically allow Concierge Key members (which is an invite-only elite status even higher than the highest public status) to board first ahead of everyone else and also allow Executive Platinum members to board with business class and ahead of the rest of the elites.

What have we learned about American's elite changes?

Clearly there are a lot of ways to earn Elite Qualifying Dollars on American, and a whole bunch of them have nothing to do with how much you paid for your ticket. Remember also that these different strategies can be combined. Perhaps you'll want to use an Aviator card for a portion of the EQDs, partner travel for another portion and actual spend on American for some as well.

Regardless, if you're hoping to earn elite status on American this year but aren't sure how you might spend enough money, you've got a lot of options to choose from that might make things easier.

TPG featured card

Rewards

| 4X | Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 4X | Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 3X | Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com. |

| 2X | Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com. |

| 1X | Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases. |

Intro offer

Annual Fee

Recommended Credit

Why We Chose It

There’s a lot to love about the Amex Gold. It’s a fan favorite thanks to its fantastic bonus-earning rates at restaurants worldwide and at U.S. supermarkets. If you’re hitting the skies soon, you’ll also earn bonus Membership Rewards points on travel. Paired with up to $120 in Uber Cash annually (for U.S. Uber rides or Uber Eats orders, card must be added to Uber app and you can redeem with any Amex card), up to $120 in annual dining statement credits to be used with eligible partners, an up to $84 Dunkin’ credit each year at U.S. Dunkin Donuts and an up to $100 Resy credit annually, there’s no reason that foodies shouldn’t add the Amex Gold to their wallet. These benefits alone are worth more than $400, which offsets the $325 annual fee on the Amex Gold card. Enrollment is required for select benefits. (Partner offer)Pros

- 4 points per dollar spent on dining at restaurants worldwide and U.S. supermarkets (on the first $50,000 in purchases per calendar year; then 1 point per dollar spent thereafter and $25,000 in purchases per calendar year; then 1 point per dollar spent thereafter, respectively)

- 3 points per dollar spent on flights booked directly with the airline or with amextravel.com

- Packed with credits foodies will enjoy

- Solid welcome bonus

Cons

- Not as useful for those living outside the U.S.

- Some may have trouble using Uber and other dining credits

- You may be eligible for as high as 100,000 Membership Rewards® Points after you spend $6,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved and find out your exact welcome offer amount – all with no credit score impact. If you’re approved and choose to accept the Card, your score may be impacted.

- Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com.

- Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com.

- Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases.

- $120 Uber Cash on Gold: Add your Gold Card to your Uber account and get $10 in Uber Cash each month to use on orders and rides in the U.S. when you select an American Express Card for your transaction. That’s up to $120 Uber Cash annually. Plus, after using your Uber Cash, use your Card to earn 4X Membership Rewards® points for Uber Eats purchases made with restaurants or U.S. supermarkets. Point caps and terms apply.

- $84 Dunkin' Credit: With the $84 Dunkin' Credit, you can earn up to $7 in monthly statement credits after you enroll and pay with the American Express® Gold Card at U.S. Dunkin' locations. Enrollment is required to receive this benefit.

- $100 Resy Credit: Get up to $100 in statement credits each calendar year after you pay with the American Express® Gold Card to dine at U.S. Resy restaurants or make other eligible Resy purchases. That's up to $50 in statement credits semi-annually. Enrollment required.

- $120 Dining Credit: Satisfy your cravings, sweet or savory, with the $120 Dining Credit. Earn up to $10 in statement credits monthly when you pay with the American Express® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, and Five Guys. Enrollment required.

- Explore over 1,000 upscale hotels worldwide with The Hotel Collection and receive a $100 credit towards eligible charges* with every booking of two nights or more through AmexTravel.com. *Eligible charges vary by property.

- No Foreign Transaction Fees.

- Annual Fee is $325.

- Terms Apply.

Rewards Rate

| 4X | Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 4X | Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 3X | Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com. |

| 2X | Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com. |

| 1X | Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases. |

Intro Offer

You may be eligible for as high as 100,000 Membership Rewards® Points after spending $6,000 in eligible purchases on your new Card in your first 6 months of Membership. Welcome offers vary and you may not be eligible for an offer.As High As 100,000 points. Find Out Your Offer.Annual Fee

$325Recommended Credit

Credit ranges are a variation of FICO® Score 8, one of many types of credit scores lenders may use when considering your credit card application.Excellent to Good

Why We Chose It

There’s a lot to love about the Amex Gold. It’s a fan favorite thanks to its fantastic bonus-earning rates at restaurants worldwide and at U.S. supermarkets. If you’re hitting the skies soon, you’ll also earn bonus Membership Rewards points on travel. Paired with up to $120 in Uber Cash annually (for U.S. Uber rides or Uber Eats orders, card must be added to Uber app and you can redeem with any Amex card), up to $120 in annual dining statement credits to be used with eligible partners, an up to $84 Dunkin’ credit each year at U.S. Dunkin Donuts and an up to $100 Resy credit annually, there’s no reason that foodies shouldn’t add the Amex Gold to their wallet. These benefits alone are worth more than $400, which offsets the $325 annual fee on the Amex Gold card. Enrollment is required for select benefits. (Partner offer)Pros

- 4 points per dollar spent on dining at restaurants worldwide and U.S. supermarkets (on the first $50,000 in purchases per calendar year; then 1 point per dollar spent thereafter and $25,000 in purchases per calendar year; then 1 point per dollar spent thereafter, respectively)

- 3 points per dollar spent on flights booked directly with the airline or with amextravel.com

- Packed with credits foodies will enjoy

- Solid welcome bonus

Cons

- Not as useful for those living outside the U.S.

- Some may have trouble using Uber and other dining credits

- You may be eligible for as high as 100,000 Membership Rewards® Points after you spend $6,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved and find out your exact welcome offer amount – all with no credit score impact. If you’re approved and choose to accept the Card, your score may be impacted.

- Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com.

- Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com.

- Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases.

- $120 Uber Cash on Gold: Add your Gold Card to your Uber account and get $10 in Uber Cash each month to use on orders and rides in the U.S. when you select an American Express Card for your transaction. That’s up to $120 Uber Cash annually. Plus, after using your Uber Cash, use your Card to earn 4X Membership Rewards® points for Uber Eats purchases made with restaurants or U.S. supermarkets. Point caps and terms apply.

- $84 Dunkin' Credit: With the $84 Dunkin' Credit, you can earn up to $7 in monthly statement credits after you enroll and pay with the American Express® Gold Card at U.S. Dunkin' locations. Enrollment is required to receive this benefit.

- $100 Resy Credit: Get up to $100 in statement credits each calendar year after you pay with the American Express® Gold Card to dine at U.S. Resy restaurants or make other eligible Resy purchases. That's up to $50 in statement credits semi-annually. Enrollment required.

- $120 Dining Credit: Satisfy your cravings, sweet or savory, with the $120 Dining Credit. Earn up to $10 in statement credits monthly when you pay with the American Express® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, and Five Guys. Enrollment required.

- Explore over 1,000 upscale hotels worldwide with The Hotel Collection and receive a $100 credit towards eligible charges* with every booking of two nights or more through AmexTravel.com. *Eligible charges vary by property.

- No Foreign Transaction Fees.

- Annual Fee is $325.

- Terms Apply.