Save with IHG's New Member-Exclusive Rate

Update: Some offers mentioned below are no longer available – IHG Rewards Club Select Credit Card

Offering member-exclusive rates is the latest trend in the hotel industry. Recently, Marriott, Hilton and Hyatt all announced their own versions of member-exclusive rates — the discount varies from one chain to the next, but you can expect to save as much as 10%. And now, IHG is the most recent hotel chain to change its terms and conditions to include a member-exclusive rate when booking a stay directly through IHG's site.

IHG is calling its member-exclusive rate YOUR RATE, and the discounts don't look to be all that significant — the most I found was about 3%. However, the rate is available to use as of this week, and if you're looking at booking a cash stay, the small discount could help. IHG hasn't released many details beside the fact that it exists and availability varies based on brand and region. In order to take advantage, you must book directly through IHG — whether that be its website, app, central reservations office or at an IHG hotel's front desk.

Keep in mind that you're sometimes better off using another discount rate, such as AAA. As always, it's best to check and compare rates to see what the better option is for your stay.

Sample Bookings

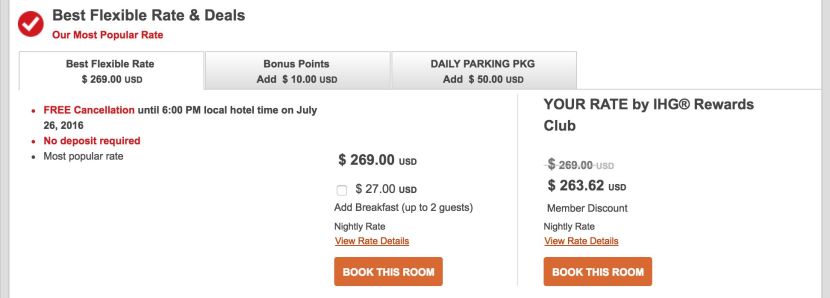

For a one-night weeknight stay in July, the Chicago Magnificent Mile is going for $269 per night for both flexible rates and AAA. However, YOUR RATE is slightly lower at $264 per night — a $5, or a nearly 2% discount. If booking an award stay, this property requires 50,000 Rewards Club points for a free night.

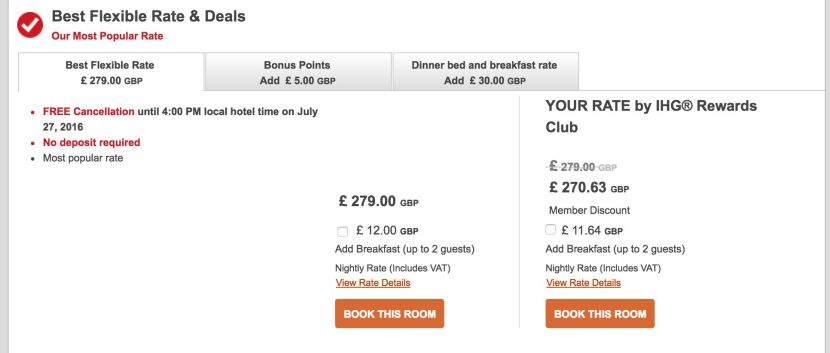

For a one-night weeknight stay in July, rates at the Holiday Inn London - Mayfair are going for £279 per night (around $406), and YOUR RATE is slightly lower at £271 per night (around $395). YOUR RATE will save you £8 (around $11), or approximately 3%. However, the AAA rate is your best option at just £252 per night (around $367). If booking an award stay, this property requires 40,000 Rewards Club points for a free night.

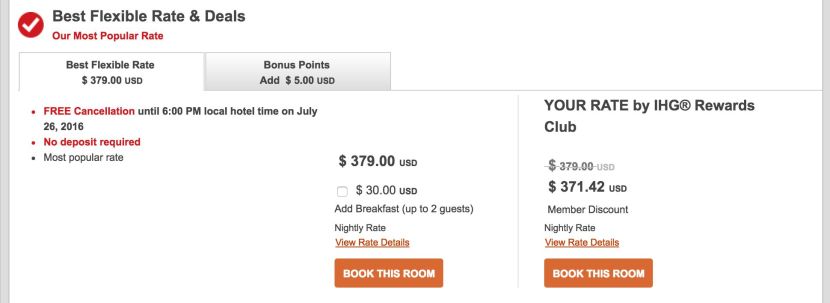

The Crowne Plaza Times Square Manhattan is going for $379 per night for a one-night stay in July, and YOUR RATE is $371 per night. The member-exclusive rate will save you $8, or approximately 2%. However, the AAA is again the best option, at just $304 per night. If booking an award stay, this property costs 50,000 Rewards Club points for a free night.

As you can see, in many cases you'll save with YOUR RATE, however, sometimes that can be overshadowed by other discounted rates, such as AAA. As always, if you're considering booking a stay, it's best to check and compare rates with all discounts.

If you're planning on using Rewards Club points for an IHG stay, there can also be great value had with IHG's PointBreaks list, which was just announced and is active through July 31. The promotion offers hotel stays at select properties for just 5,000 Rewards Club points for a free night. If you're looking to boost your IHG Rewards Club balance, consider signing up for the IHG Rewards Club Select Credit Card. The card is currently offering 60,000 points after you spend $1,000 in the first three months. You'll also get 5,000 points when you add an authorized user and make a purchase within the first three months, in addition to a free night every account anniversary and 5x points on every dollar you spend at IHG hotels.

H/T: View From The Wing

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app