American Further Devalues AAdvantage Awards Routed via Hawaii

Although American's award redemption amounts are quite reasonable compared with Delta and United's, the airline isn't known for its generous routing rules. Earlier this year, American announced that it would no longer offer award tickets between the US mainland and Hawaii on Hawaiian airlines, but in its latest changes to multi-region award travel, flyers will now have to change their award-ticket strategy when connecting in Honolulu.

As of September 1, it's no longer possible to combine American and Hawaiian flights on a single award ticket — meaning if you're flying to a destination in Asia or the South Pacific (or elsewhere) and you stop in Honolulu, you must book the trip as two separate awards. In other words, you'll pay many more miles than you would have just a few weeks ago.

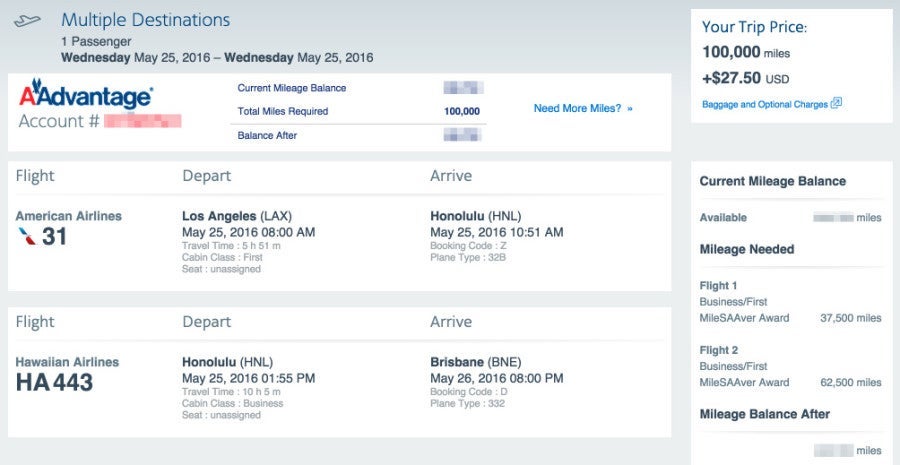

For example, if you were to book an award ticket departing from Los Angeles (LAX) to Brisbane, Australia (BNE) with a connection in Honolulu (HNL), that trip would usually cost 62,500 miles on a business saver award ticket. Following this change, however, that flight now costs 100,000 miles — 37,500 miles from Los Angeles to Honolulu and 62,500 miles from HNL to Brisbane (or another destination in Australia).

If you're planning a trip to Australia, or another country that this change may effect, you can still fly nonstop and avoid shelling out the extra miles. For example, American is launching nonstop service between Los Angeles and Sydney later this year, which will be one of the cheapest ways to get to Australia on an award ticket — if you're able to find availability, that is. Rather than shelling out the 100,000 miles that the two flights demand, you'll pay 62,500 each way for a business saver award ticket on that nonstop flight, including connections from elsewhere in the US.

Ultimately, this isn't a significant program devaluation, although this specific change wasn't communicated when AA announced that it would be discontinuing awards on Hawaiian Air from the continental US. Still, connecting in Hawaii had been a useful way to get from the United States to Australia and New Zealand, with decent availability and the ability to stop in Honolulu (for up to 23 hours and 59 minutes) en-route to the South Pacific.

H/T: BoardingArea

[card card-name='Citi® / AAdvantage® Executive World Elite™ MasterCard®' card-id='221410949' type='javascript' bullet-id='1']

TPG featured card

at American Express's secure site

Terms & restrictions apply. See rates & fees.

| 3X | Earn 3X Miles on Delta purchases. |

| 1X | Earn 1X Miles on all other eligible purchases. |

Pros

- Delta SkyClub access when flying Delta

- Annual companion ticket for travel on Delta (upon renewal)

- Ability to earn MQDs through spending

- Various statement credits for eligible purchases

Cons

- Steep annual fee of $650

- Other Delta cobranded cards offer superior earning categories

- Earn 100,000 Bonus Miles after you spend $6,000 or more in purchases with your new Card within the first 6 months of Card Membership and an additional 25,000 bonus miles after you make an additional $3,000 in purchases on the Card within your first 6 months, starting from the date that your account is opened. Offer Ends 04/01/2026.

- Delta SkyMiles® Reserve American Express Card Members receive 15 Visits per Medallion® Year to the Delta Sky Club® when flying Delta and can unlock an unlimited number of Visits after spending $75,000 in purchases on your Card in a calendar year. Plus, you’ll receive four One-Time Guest Passes each Medallion Year so you can share the experience with family and friends when traveling Delta together.

- Enjoy complimentary access to The Centurion® Lounge in the U.S. and select international locations (as set forth on the Centurion Lounge Website), Sidecar by The Centurion® Lounge in the U.S. (see the Centurion Lounge Website for more information on Sidecar by The Centurion® Lounge availability), and Escape Lounges when flying on a Delta flight booked with the Delta SkyMiles® Reserve American Express Card. § To access Sidecar by The Centurion® Lounge, Card Members must arrive within 90 minutes of their departing flight (including layovers). To access The Centurion® Lounge, Card Members must arrive within 3 hours of their departing flight. Effective July 8, 2026, during a layover, Card Members must arrive within 5 hours of the connecting flight.

- Receive $2,500 Medallion® Qualification Dollars with MQD Headstart each Medallion Qualification Year and earn $1 MQD for each $10 in purchases on your Delta SkyMiles® Reserve American Express Card with MQD Boost to get closer to Status next Medallion Year.

- Enjoy a Companion Certificate on a Delta First, Delta Comfort, or Delta Main round-trip flight to select destinations each year after renewal of your Card. The Companion Certificate requires payment of government-imposed taxes and fees of between $22 and $250 (for itineraries with up to four flight segments). Baggage charges and other restrictions apply. Delta Basic experiences are not eligible for this benefit.

- $240 Resy Credit: When you use your Delta SkyMiles® Reserve American Express Card for eligible purchases with U.S. Resy restaurants, you can earn up to $20 each month in statement credits. Enrollment required.

- $120 Rideshare Credit: Earn up to $10 back in statement credits each month after you use your Delta SkyMiles® Reserve American Express Card to pay for U.S. rideshare purchases with select providers. Enrollment required.

- Delta SkyMiles® Reserve American Express Card Members get 15% off when using miles to book Award Travel on Delta flights through delta.com and the Fly Delta app. Discount not applicable to partner-operated flights or to taxes and fees.

- With your Delta SkyMiles® Reserve American Express Card, receive upgrade priority over others with the same Medallion tier, product and fare experience purchased, and Million Miler milestone when you fly with Delta.

- Earn 3X Miles on Delta purchases and earn 1X Miles on all other eligible purchases.

- No Foreign Transaction Fees. Enjoy international travel without additional fees on purchases made abroad.

- $650 Annual Fee.

- Apply with confidence. Know if you're approved for a Card with no impact to your credit score. If you're approved and you choose to accept this Card, your credit score may be impacted.

- Terms Apply.

- See Rates & Fees