AirAsia Asean Pass - Travel Southeast Asia at a Discount

Update: Some offers mentioned below are no longer available. View the current offers here.

Air Travel Passes can be a great way to maximize your travel to a specific region. Today, TPG Contributor Richard Kerr looks at a new product from AirAsia.

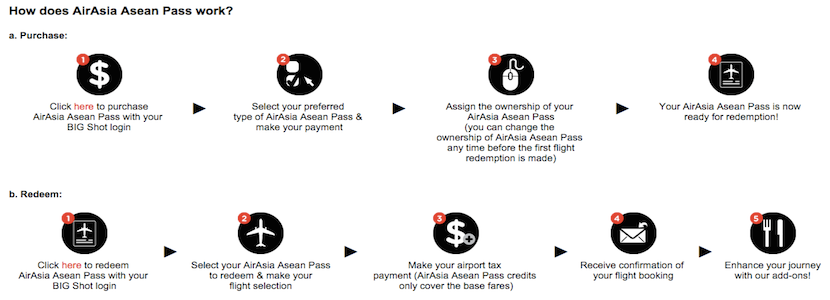

Last week I wrote about Travel Rewards Credit Card Combinations to Explore East Asia, and one of my suggestions was to check out Air Asia's new Asean Pass and redeem miles from the Barclaycard Arrival Plus World Elite Mastercard to cover the cost. This new product from Malaysia-based AirAsia encompasses flights to countries that are members of the Association of South East Asian Nations, and offers flyers the ability to book a flexible combination of flights over a 30 or 60 day period. In this post, I'll further investigate the value of the Asean Pass to determine how much value you can get from it.

At first glance, the Asean Pass presents a simple operating plan: you buy either a 10 credit Asean Pass or 20 credit Asean Pass +, and then choose a window of 30 days (60 days for the pass +) to redeem your credits for flights. Each flight costs 1 or 3 credits, As the name implies, you can redeem credits for flights to the 10 ASEAN members: Malaysia, Thailand, Singapore, Brunei, Myanmar, The Phillipines, Vietnam, Indonesia, Cambodia, and Laos. A 10 credit pass costs 499 Malaysian Ringgit (~$135) and a 20 credit pass costs 888 Malaysian Ringgit (~$241).

All flights need to be booked at least 14 days in advance. You can buy the pass yourself and assign it to someone else (assuming he or she is at least 12 years old). The pass is valid to begin your 30 or 60 day flight window for one year after purchase, and you will earn AirAsia's BIG Points for flying on the Asean Pass.

Sounds fantastic and reasonably priced right? Well, there are a few obstacles ...

1. Lack of Availability

You can't check availability until you buy the pass! In order to see what kind of use you'll get out of it and plan your travels, you have to put your money down first. That's not too enticing to me. After purchasing the pass, flight availability using your credits can be tough to find. Weekends, holidays, Bali and Phuket routes, and The Philippines reportedly show only a few days with available seats to redeem your credits, even when there are plenty of revenue fares available (HT: Dreamtravelonpoints). With fixed 30 day and 60 day windows to redeem all credits, it can be tough to put together the itinerary you want. Unused credits are nonrefundable.

2. Only the Base Fare is Covered

The first item in the terms and conditions for the pass is that it can only be redeemed to cover the base fare. Airport fees and taxes like 700 Thai Baht when leaving Bangkok (DMK not BKK) are still your responsibility. While not particularly expensive, these can add up and erase savings over the course of your free flights. Checked baggage, seat selection, and any onboard purchases will also come out of your pocket.

3. No Repeat Segments

If you have a month long period where you need to fly from Kuala Lumpur to Singapore multiple times and think utilizing the pass would save you some cash, think again. "Each route can only be redeemed once using an AirAsia Asean Pass." The pass is intended for travelers who want to crisscross the region, not for commuters.

4. Some Routes Lead to a Dead End

It'd be great to knock Brunei off my list of countries visited, but it would also cost me 6 out of 10 credits just to see one destination, as AirAsia only flies there from Kuala Lumpur. If you aren't intimately familiar with Southeast Asian geography, you'll need a map, notebook, slide rule, graphing calculator, and a few hours to make a complete routing that gives you the best value for your credits and ensures you don't have to backtrack in order to see multiple destinations.

5. You're Locked into AirAsia

Once you've redeemed your first credit for a flight, your 30 or 60 day window begins. If you run into the availability problems mentioned above, you may be pressured to go somewhere other than where you heart takes you, since the clock is ticking on your Asean Pass credits. While AirAsia's route network is impressive for the region, it's not your only option. Tiger Air, Lion Air, Nok Air, Jetstar, and Cebu Pacific compete on many of AirAsia's routes, and can offer inexpensive fares that allow you to travel where you want, when you want.

Given these less than ideal stipulations on the pass, is all hope lost? Not entirely, I think the pass can be useful, but you have to be a certain type of traveler.

In order to maximize the pass and your time in each city, you want to travel for as close to 30 or 60 days as possible. The pass could still be useful even if you're unable to travel for that long, but you'll sacrifice some of the value. You also need to be flexible about your destinations and itinerary, which can complicate hotel bookings. If you have your heart set on a popular destination like Bali, the pass could be more of a frustration than an innovation. So if you don't mind some element of uncertainty in your plans, what is an itinerary that would maximize your credits and what kind of value would it offer?

Sample Itinerary

Based on the fact of limited availability and the challenges of routing out a 20 credit itinerary, I believe all but the most die-hard travelers should stick to the 10 credit pass. Below is my favorite itinerary I came up with for 10 credits, and would require first getting to Ho Chi Minh City, the origin of my Asean Pass itinerary.

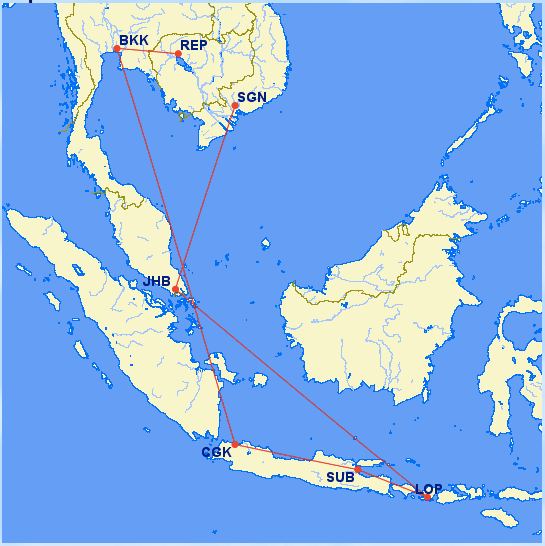

Ho Chi Minh - Johor Bahru - Lombok - Surabaya - Jakarta - Bangkok - Siem Reap

With Johor Bahru just a hop across the Johor Straits from Singapore, this means you could hit Saigon, Singapore, Lombok, Jakarta, Bangkok, and Cambodia on one 10 credit pass. To catch your return flight from Ho Chi Minh, you could find a cheap flight from Siem Reap back to SGN. I think this would make for a pretty stellar trip!

What would taxes cost you on this route? I looked it up route by route and arrived at $91.91. Add in $135 for the cost of the Asean Pass for a total $226.91. Assuming you paid for each flight in the respective departing country's foreign currency with a credit card that has no foreign transaction fee, that same itinerary paid in cash would cost you $339.55, for a savings of $112.64. (Keep in mind that those prices do not include checked baggage or other add-on fees.)

So would this itinerary be easily bookable with Asean Pass credits? Unfortunately, since you can't look at availability in advance, the simple answer is that you won't know until you buy it. I wouldn't be surprised if at least one of the legs were unavailable, so you should have a contingency plan in place.

This strategy of using the pass in conjunction with cash flights is where I believe you could gain the most value. This would free you up to book with other airlines when AirAsia isn't the best deal, and keep the credits in your back pocket if you have sufficient time to visit the region and take a flight when availability shows up (14 days in advance) to a destination that catches your eye.

Verdict?

I applaud AirAsia for its ingenuity in creating a flight pass that offers travelers some value while remaining sustainable for the airline, as sufficient controls are in place to prevent it from becoming a liability. The Asean Pass isn't for everyone, as it requires a certain style of travel (with the freedom to weather unpredictable availability) to gain maximum value. Given its limitations and the unexceptional savings, I think the pass falls a little flat. Locking in the itinerary I want to the destinations I want is worth an extra $100 to me.

What experiences have you had flying with the Asean Pass?

[card card-name='Barclaycard Arrival™ World MasterCard®' card-id='22089566' type='javascript' bullet-id='1']

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app