Buying Vanilla Reloads With a Credit Card: Alternatives To CVS

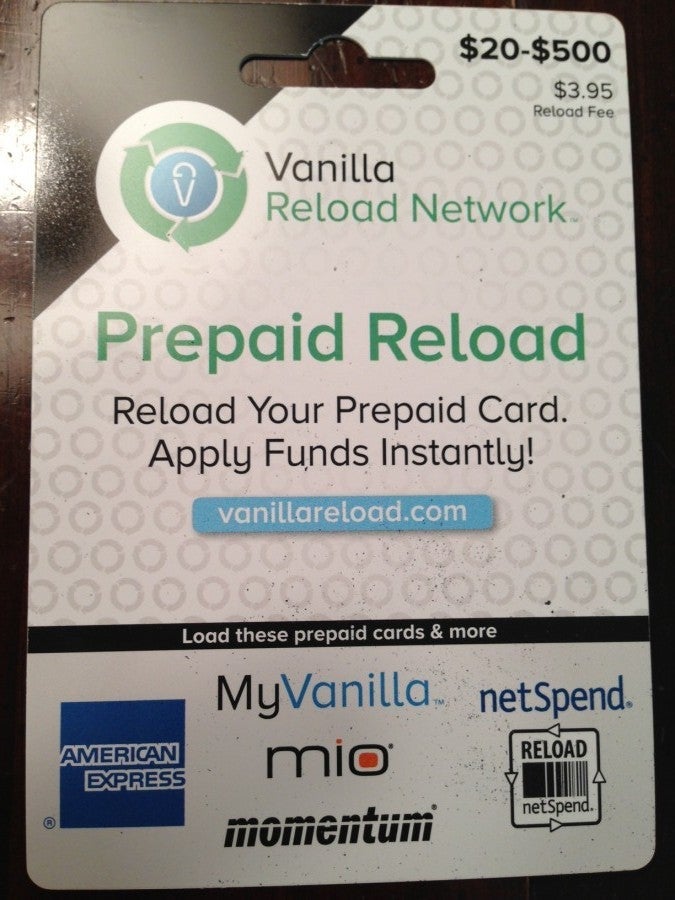

Buying Vanilla Reloads has been an important part of a lot of people's credit card strategy of late. Unfortunately, CVS has stopped accepting credit cards for Vanilla Reload purchases, but TPG contributor Jason Steele shares some strategies and tips on where else you can find them and still buy them with points-earning cards.

Friday was a sad day for those who have been purchasing Vanilla Reload cards at CVS, as registers were hardcoded not to accept credit cards. Not having any CVS stores in Denver where I live, I have long sought other places to buy these valuable products with my credit card.

Other places to buy Vanilla Reloads

According to their web site, there are 38 stores that sell Vanilla Reloads, other than CVS. The problem is finding those that accept credit cards for their purchase.

After searching my local area stores, as well as reports on the Internet, this is what I know about who does and does not sell Vanilla Reloads with a credit card.

Stores that are known to be hardcoded against purchasing Vanilla Reloads with a credit card:

- 7-Eleven - It was possible until earlier this year.

- Dollar General - I don't believe that it was ever possible.

- Family Dollar - I don't believe that it was ever possible.

- Walgreens - I was able to until sometime last year.

- Walmart - I don't believe that it was ever possible, although you can load your Bluebird from the registers using a debit card.

- Office Depot - Possible until late 2012.

- Kum N Go - Seems to have worked until mid 2013.

- H-E-B has over 150 stores in Texas, but reports like this one on FlyerTalk indicate that it is hardcoded not to accept credit cards.

- Sunoco is a large gasoline chain in 23 states along the east coast and the Midwest. Reports like this one on FlyerTalk say that it is hardcoded not to accept credit card purchases.

- The Pantry operates under the Kangaroo Express name in 13 states in the southeast and Midwest, but this report on FlyerTalk says it doesn't work.

Stores that may allow purchases with a credit card:

As with nearly all products sold for manufactured spending, unless it is hardcoded, the acceptance of a credit card at a particular chain can vary based on the location and even the cashier who helps you.

- TA Petro - This is a chain of 252 truck stops throughout the United States. I have made credit card purchases in the past, but the biggest issue I find is that many stores do not keep the products in stock. Here is a link to their store locator.

- Valero - This is a large, nationwide gasoline retailer. In my experience, these gas stations are not hardcoded against credit card purchases, but many have policies forbidding cashiers from allowing customers to use credit cards. Here is a link to their store locator.

- Spartan Stores operates grocery stores under many different brand names in the upper Midwest. There are reports of Family Fare stores accepting credit card purchases of Vanilla Reloads recently.

- Cumberland Farms 600 stores in 11 states, largely in former Gulf gas stations in the northeast, but this report on FlyerTalk seems to exclude it.

- Sheetz is a convenience store chain in the mid-Atlantic states but it appears to be cash only now when it comes to Vanilla Reloads

No Data Points

Since I have no information on many of these stores that are in places that I don't live or visit, please feel free to add your experiences to the comments, and we can update the list:

Associated Food Stores - This is not a chain, but it appears to be a supplier for independent grocers around the country. Here is a link to their store locator.

Basha's is a grocery store chain in Arizona. Here is a link to their store locator.

Brookshire Brothers is a grocery and pharmacy store based in Texas. Here is a link to their store locator.

Dash In Food Stores - This is a chain of convenience stores in the mid-Atlantic. Here is a link to their store locator.

Discount Drug Mart is an Ohio chain. Here is a link to their store locator.

Fas Mart operates convenience stores in Virginia, Connecticut, Delaware, Maryland, Pennsylvania, North Carolina, South Carolina, Rhode Island, New Jersey and Tennessee. Here is a link to their store locator.

Fiesta Mart is a chain of grocery stores in the Houston area. Here is a link to their store locator.

Flash Foods operates over 170 convenience stores in Georgia and Florida. Here is a link to their store locator.

Food City is a growing supermarket chain in Southwest Virginia and east Tennessee Here is a link to their home page with a store locator.

Holiday Station Stores has locations in Alaska, Idaho, Michigan, Minnesota, Montana, North Dakota, South Dakota, Washington, Wisconsin, and Wyoming. Here is a link to their store locator.

Hucks is a chain of gas stations and convenience stores in Missouri, Illinois, Indiana, Kentucky, and Tennessee. Here is a link to their store locator.

Kerr Drugs is a pharmacy chain in the Raleigh North Carolina area that was recently purchased by Walgreens. The merger is expected to be completed by June, so if they will sell you Vanilla Reloads with a credit card, they probably won't for long. Here is a link to their store locator.

Kwik Fill is a chain of gas stations in New York, Pennsylvania, and Ohio. Here is a link to their store locator.

Kwik Trip operates over 450 Kwik Trip, Kwik Star, Hearty Platter and Tobacco Outlet Plus stores throughout Wisconsin, Minnesota and Iowa. Here is a link to their store locator.

Murphy USA operates gas stations in 23 stores throughout the west, Midwest, and southeast. Here is a link to their store locator.

Save Mart Supermarkets is a California based chain with 226 stores. Here is a link to their home page with a store locator.

Spinx Stores is a convenience store chain in North and South Carolina. Here is a link to their store locator.

Stripes is a convenience store chain in Texas, Oklahoma, and New Mexico. Here is a link to their store locator.

Town Pump is a chain of 26 gas stations in Montana. Here is a link to their store locator.

Village Pantry and the Next Door Store has 167 locations in Michigan, Ohio, Indiana, Illinois, and Kentucky. Here is a link to their store locator.

Wesco is a gas station chain in Michigan. Here is a link to their store locator.

Worsley operates stores in the Southeast under the brand names BreadBox, Scothchman, Li'l Cricket, Youngs's Everyday Shop, and Cigarette City. Here is a link to their store locator.

Have you continued buying Vanilla Reloads with a credit card? If so, where and what are the details?

[card card-name='Ink Plus® Business Credit Card' card-id='22129636' type='javascript' bullet-id='1']

TPG featured card

Rewards

| 4X | Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 4X | Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 3X | Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com. |

| 2X | Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com. |

| 1X | Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases. |

Intro offer

Annual Fee

Recommended Credit

Why We Chose It

There’s a lot to love about the Amex Gold. It’s a fan favorite thanks to its fantastic bonus-earning rates at restaurants worldwide and at U.S. supermarkets. If you’re hitting the skies soon, you’ll also earn bonus Membership Rewards points on travel. Paired with up to $120 in Uber Cash annually (for U.S. Uber rides or Uber Eats orders, card must be added to Uber app and you can redeem with any Amex card), up to $120 in annual dining statement credits to be used with eligible partners, an up to $84 Dunkin’ credit each year at U.S. Dunkin Donuts and an up to $100 Resy credit annually, there’s no reason that foodies shouldn’t add the Amex Gold to their wallet. These benefits alone are worth more than $400, which offsets the $325 annual fee on the Amex Gold card. Enrollment is required for select benefits. (Partner offer)Pros

- 4 points per dollar spent on dining at restaurants worldwide and U.S. supermarkets (on the first $50,000 in purchases per calendar year; then 1 point per dollar spent thereafter and $25,000 in purchases per calendar year; then 1 point per dollar spent thereafter, respectively)

- 3 points per dollar spent on flights booked directly with the airline or with amextravel.com

- Packed with credits foodies will enjoy

- Solid welcome bonus

Cons

- Not as useful for those living outside the U.S.

- Some may have trouble using Uber and other dining credits

- You may be eligible for as high as 100,000 Membership Rewards® Points after you spend $6,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved and find out your exact welcome offer amount – all with no credit score impact. If you’re approved and choose to accept the Card, your score may be impacted.

- Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com.

- Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com.

- Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases.

- $120 Uber Cash on Gold: Add your Gold Card to your Uber account and get $10 in Uber Cash each month to use on orders and rides in the U.S. when you select an American Express Card for your transaction. That’s up to $120 Uber Cash annually. Plus, after using your Uber Cash, use your Card to earn 4X Membership Rewards® points for Uber Eats purchases made with restaurants or U.S. supermarkets. Point caps and terms apply.

- $84 Dunkin' Credit: With the $84 Dunkin' Credit, you can earn up to $7 in monthly statement credits after you enroll and pay with the American Express® Gold Card at U.S. Dunkin' locations. Enrollment is required to receive this benefit.

- $100 Resy Credit: Get up to $100 in statement credits each calendar year after you pay with the American Express® Gold Card to dine at U.S. Resy restaurants or make other eligible Resy purchases. That's up to $50 in statement credits semi-annually. Enrollment required.

- $120 Dining Credit: Satisfy your cravings, sweet or savory, with the $120 Dining Credit. Earn up to $10 in statement credits monthly when you pay with the American Express® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, and Five Guys. Enrollment required.

- Explore over 1,000 upscale hotels worldwide with The Hotel Collection and receive a $100 credit towards eligible charges* with every booking of two nights or more through AmexTravel.com. *Eligible charges vary by property.

- No Foreign Transaction Fees.

- Annual Fee is $325.

- Terms Apply.

Rewards Rate

| 4X | Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 4X | Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 3X | Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com. |

| 2X | Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com. |

| 1X | Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases. |

Intro Offer

You may be eligible for as high as 100,000 Membership Rewards® Points after spending $6,000 in eligible purchases on your new Card in your first 6 months of Membership. Welcome offers vary and you may not be eligible for an offer.As High As 100,000 points. Find Out Your Offer.Annual Fee

$325Recommended Credit

Credit ranges are a variation of FICO® Score 8, one of many types of credit scores lenders may use when considering your credit card application.Excellent to Good

Why We Chose It

There’s a lot to love about the Amex Gold. It’s a fan favorite thanks to its fantastic bonus-earning rates at restaurants worldwide and at U.S. supermarkets. If you’re hitting the skies soon, you’ll also earn bonus Membership Rewards points on travel. Paired with up to $120 in Uber Cash annually (for U.S. Uber rides or Uber Eats orders, card must be added to Uber app and you can redeem with any Amex card), up to $120 in annual dining statement credits to be used with eligible partners, an up to $84 Dunkin’ credit each year at U.S. Dunkin Donuts and an up to $100 Resy credit annually, there’s no reason that foodies shouldn’t add the Amex Gold to their wallet. These benefits alone are worth more than $400, which offsets the $325 annual fee on the Amex Gold card. Enrollment is required for select benefits. (Partner offer)Pros

- 4 points per dollar spent on dining at restaurants worldwide and U.S. supermarkets (on the first $50,000 in purchases per calendar year; then 1 point per dollar spent thereafter and $25,000 in purchases per calendar year; then 1 point per dollar spent thereafter, respectively)

- 3 points per dollar spent on flights booked directly with the airline or with amextravel.com

- Packed with credits foodies will enjoy

- Solid welcome bonus

Cons

- Not as useful for those living outside the U.S.

- Some may have trouble using Uber and other dining credits

- You may be eligible for as high as 100,000 Membership Rewards® Points after you spend $6,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved and find out your exact welcome offer amount – all with no credit score impact. If you’re approved and choose to accept the Card, your score may be impacted.

- Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com.

- Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com.

- Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases.

- $120 Uber Cash on Gold: Add your Gold Card to your Uber account and get $10 in Uber Cash each month to use on orders and rides in the U.S. when you select an American Express Card for your transaction. That’s up to $120 Uber Cash annually. Plus, after using your Uber Cash, use your Card to earn 4X Membership Rewards® points for Uber Eats purchases made with restaurants or U.S. supermarkets. Point caps and terms apply.

- $84 Dunkin' Credit: With the $84 Dunkin' Credit, you can earn up to $7 in monthly statement credits after you enroll and pay with the American Express® Gold Card at U.S. Dunkin' locations. Enrollment is required to receive this benefit.

- $100 Resy Credit: Get up to $100 in statement credits each calendar year after you pay with the American Express® Gold Card to dine at U.S. Resy restaurants or make other eligible Resy purchases. That's up to $50 in statement credits semi-annually. Enrollment required.

- $120 Dining Credit: Satisfy your cravings, sweet or savory, with the $120 Dining Credit. Earn up to $10 in statement credits monthly when you pay with the American Express® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, and Five Guys. Enrollment required.

- Explore over 1,000 upscale hotels worldwide with The Hotel Collection and receive a $100 credit towards eligible charges* with every booking of two nights or more through AmexTravel.com. *Eligible charges vary by property.

- No Foreign Transaction Fees.

- Annual Fee is $325.

- Terms Apply.