Just How Much is an Airline Mile or Hotel Point Worth?

Update: Some offers mentioned below are no longer available. View the current offers here.

TPG reader Mahon112 tweeted me to ask:

"What do you consider a valuable point redemption for airline and hotel (cents per point)?"

So just how much are airline miles and hotel points worth? There's no easy answer to that question and there's no set value, which is at the heart of what I talk about every day on ThePointsGuy.com.

Everyone gets a different value out of their redemptions, and people argue all the time about whether they're getting the full value of the face value of a ticket or hotel room from the miles or points they redeem for it. A lot of people say that they'd never pay for a super expensive business or first class ticket, so you're not actually getting that value from that kind of award. But at the end of the day, the fair market value of the ticket is probably the easiest indicator to determine the value of your award. Because whether you want to pay for it or ever would, the airline still sells those tickets for those prices.

However, depending on whether you are basing your redemption off the market value of a ticket or hotel night, or based on the price you would pay for it, your value will vary.

Now for Mahon's question. When it comes to credit card spending, you get 2.2% back on the Barclaycard Arrival Plus World Elite Mastercard when you redeem the miles you earn with it for travel purchases. Arrival miles are fixed-value points since you always get the same value from them for travel redemptions, and I would use them as a benchmark for what kind of value you get from the points or miles you generate from spending on your other credit cards.

That's actually why I suggest the Barclaycard Arrival Plus as one of the top travel credit cards out there, because you earn 2X miles per $1 on all purchases and you can redeem them for travel - pretty much any travel that you can't normally redeem airline miles or hotel points for, such as rail tickets, car rentals, even the fees and taxes on award tickets - at a fixed rate of 1 cent per mile plus a 5% mileage refund, and know you're getting a very decent fixed value or 2.2% back on your spending.

To contrast, let's say you're using a Gold Delta SkyMiles® Credit Card from American Express and you're getting 1 mile per $1 on all purchases except Delta ones (2X per $1), and you redeem those miles at a rate of 1 cent per mile with Delta's Pay With Miles feature, you have to think, "Why would I do that when I could be getting more than double in value from those Arrival miles?"

In fact, you could purchase that Delta ticket using your Arrival card (which has roughly the same annual fee as the Amex Delta SkyMiles Gold card), redeem your Arrival miles for the purchase and still earn Delta award and elite-qualifying miles on your flight!

The Delta card does give you some perks that the Arrival would not, like free checked bags, priority boarding, and things like that. But you should definitely be getting more than 1 cent per mile with your airline miles, because otherwise you could just be using a fixed-value card like the Arrival or another like the Capital One Venture Rewards card - or even a card like the Ink Bold or Chase Sapphire Preferred, which let you redeem your Ultimate Rewards points for travel at 1.25 cents apiece if you don't want to transfer them to the program's travel partners. Delta miles are at the low end of the spectrum, but other miles, like American or United (at least until next month's devaluation) can be worth a lot more than that, especially on premium awards.

This whole equation is thrown off by big sign-up bonuses as well, because generally cash back and fixed-value points cards don't have big sign-up bonuses of 50,000 or 60,000 points, but are closer to the 10,000-20,000 mark. However, the Arrival is the exception here as well since it offers a sign-up bonus of 40,000 miles when you spend $3,000 in first 90 days - the equivalent of $440 worth of travel.

Additionally, elite status also provides some equation-skewing factors like bonus flown miles and other perks - so as you can see, there are a lot of variables to take into consideration!

However, if you're looking for a rule of thumb, I'd say that in general, you should be getting more than 1 cent per mile in value from your airline miles.

With hotel points - the value range can be huge. For instance, with Hilton HHonors points, where you could be using 40,000 points to pay for a $239 hotel room like in the example below, you're only getting a value of about 0.6 cents per point.

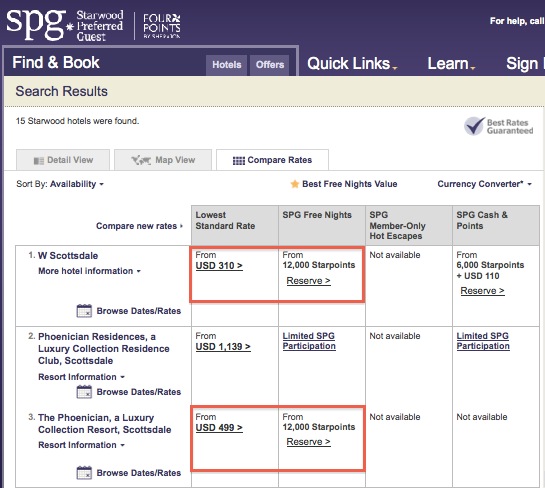

While I'd put Starwood points at a much higher value, like anywhere from 2-4 cents like in this similar example below.

Here are my "rough" valuations of various miles and points below - and please feel free to comment with your own valuations. Because when you get down to it, the value really depends on how you like to travel, where you want to go, and what matters most - convenience or price. Sometimes the best redemptions aren't for the most expensive tickets or rooms, but being able to redeem for the travel you want or need. However, do be smart about it and make sure that you are getting some value from your points or miles, because that's what they're for!

My Miles and Points Valuations - I'll be reevaluating soon once various devaluations take place including Delta, United, Hyatt and others.

Aeroplan Miles: 1.7-2 cents each

Alaska Airlines Miles: 1.9 cents each

American Airlines Miles: 1.8 cents each

Amex Membership Rewards Points: 1.9 cents per point

Barclaycard Arrival Miles: 2.2 cents per dollar return in value

British Airways Avios: 1.5 cents each

Capital One Miles: 2 cents per dollar return in value with Venture card

Chase Ultimate Rewards: 2 cents per point

Citi ThankYou Points: 1.25 cents per point

Club Carlson: 0.7 cents per point

Delta SkyMiles: 1.5 cents each

Marriott: 0.5-0.7 cents each

Hilton HHonors Points: 0.6 cents each

Hyatt Gold Passport Points: 2 cents per point

Southwest Rapid Rewards: 1.8 cents per mile

Starwood Preferred Guest Points: 2 cents each

United Miles: 2 cents per mile, 1.5 cents post-devaluation

US Airways miles: 1.8 cents per mile

US Bank Flexperks Points: 1.33-2 cents each

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app