Fees Waived For Limited Time on Chase Prepaid Visa Debit Cards - Good Way To Pay Taxes

Note: I am not a tax advisor, so before you make any decisions, you need to consult your personal tax professional.

Update: You can no longer purchase Vanilla Reload cards using a credit card and Vanilla Reloads are no longer available in Office Depot.

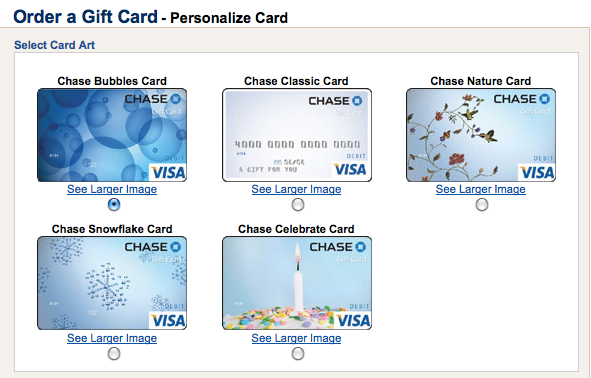

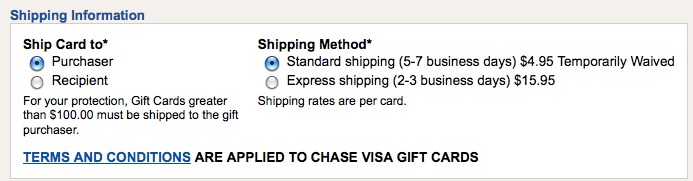

Chase is now offering Visa gift cards of denominations up to $500 and waiving the $4.95 shipping fee. Just note, you need to be a Chase customer (meaning you have to use a Chase credit card) to purchase these.

What makes this a really great offer, in addition to the fact that you're basically getting these cards for free, is that per the terms & conditions, they are prepaid Visa debit cards and will be assigned PIN numbers. That's useful for a couple of reasons.

Since these are debit cards, they can be used to load your Amex Bluebird, though you are restricted to using debit cards to load up to $100 per transaction or per day and $1,000 per month (and each transaction incurs a $2 fee), so it's a last resort, but if you're desperate to meet that minimum spend, it's a possibility. If you load your Bluebird with a debit card at Walmart, you get out of paying the $2 fee and your daily load limit goes up to $1,000 with a debit card with monthly at $5,000.

However, the terms of the card state that "You agree not to use the Card at any automatic teller machines (ATMs), at merchants or financial institutions to obtain cash back," but by transferring the funds to Bluebird, it's not exactly going for cash back and people have reported success, so this is a possibility. Note, this is not a cash advance, which I would never recommend doing.

Third, it's tax season and if you're considering paying your taxes using a credit or debit card, this could be a good option for you although we are down to the wire and the cards say it make take 5-7 business days, though they could come quicker. That's because the sites that you can use to pay your taxes with a credit or debit card charge anywhere from 1.88-2.35% for using a credit card, but flat fees of between $2.99-$3.95 for using a debit card. Even though you'll incur that charge every time you use one of these cards, if you were to use 20 of them to pay a $10,000 bill, you'd be racking up just about $60-$80 in charges (.6-.8 cents per point) as opposed to $189-$235 (1.88-2.35 cents per point) barring any bonuses. Though it's a bit of extra work, you're saving a chunk of change, and if you're using them to meet minimum spending to boot, that's a great way to double dip and maximize your points while minimizing the fees you incur.

The 5-7 business days that shipping will take, could make it a bit of a tight situation if you are looking to pay your taxes on or by Tax Day next Monday, but the cards could come faster than that, and if you're already planning on filing for an extension, they're something to consider, though note that you will pay interest on extensions so this could be a losing value proposition for you. You can also pay quarterly business taxes all year long, even after the April 15 tax deadline, so it might make sense to stock up on these now for future payments.

Hat tip: Milepoint and The Points Traveler.

[card card-name='Ink Plus® Business Credit Card' card-id='22129636' type='javascript' bullet-id='1']

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app