Amex Platinum Cardholders Update Your $200 Airline Credit Choice By January 31

Update: Some offers mentioned below are no longer available. View the current offers here.

The Mercedes-Benz Platinum, American Express Platinum Card, and Business Platinum all have many valuable benefits, which I've outlined before, including the $200 annual airline fee credit, that all help make that $450 annual fee worth it in my opinion. Hopefully a lot of you got in on the recent one-day 100,000-point sign-up bonus offer (when you spend $3,000 in 3 months) on the card because I don't think anything like it is coming back soon, but everyone should keep an eye out for targeted offers. Even at 25,000 points for a sign-up bonus, though, the benefits of this card can really pay off, especially since I value 25,000 Amex points at $450 off the bat (1.8 cents a piece), but you get way more than just points with this card.

To take advantage of the $200 airline credit, you have to designate which airline you want to use it on, and if you would like to choose a different airline for 2013 than in previous years, you only have from now through January 31st to do so. If you do not make any changes during the period in which Amex will allow cardholders to change their airline from last year, your credit will automatically be for the same airline.

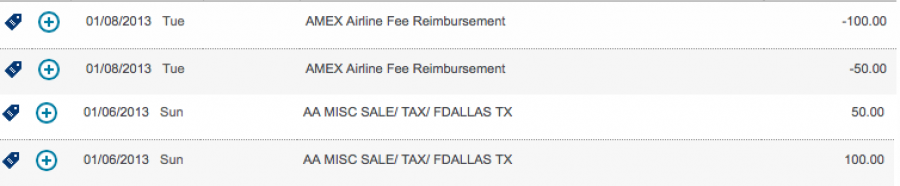

What can you use the $200 for? Technically, you're not supposed to get credit for airline vouchers, but a lot of cardholders report getting statement credits for them when they buy in small increments like $100 or $50 each. I decided to test this out for myself and since American Airlines is my designated airline, I purchased both a $100 flight voucher and a $50 flight voucher to see if either or both would trigger an automatic statement credit.

I checked my Amex Platinum statement a couple days later, and sure enough both vouchers were reimbursed - so this could be a good way for folks to put that credit towards airfare as long as you don't mind dealing with the extra layer of having to use a voucher.

There are multiple reports on Flyertalk that gift cards purchased for Alaska Airlines and United Airlines have been reimbursed by Amex. There are also reports that with Delta, if you apply any sort of travel voucher to a reservation, then pay for the rest of your ticket, it shows up as an additional collection rather than a ticket charge, resulting in the remaining balance of the ticket being reimbursed as well.

Read through the 70+ comments on my post last year to see examples of TPG readers who have had success doing the same. Flyertalk is also a great resource and has a thread for Alaska, American, Delta, Southwest, United, and US Airways on specific examples and if they have been credited. Please also share your experience getting refunded in the comments section to help people think about different ways they can maximize the value of this benefit.

Apart from that, officially the approved items are:

- Checked baggage fees

- Overweight/oversize baggage fees

- Change fees

- Phone reservation fees

- Pet flight fees

- Airport lounge day passes and annual memberships

- Seat assignment fees

- In-flight amenity fees (beverages, food, pillows/blankets, etc)

- In-flight entertainment fees (excluding wireless internet)

This credit is officially not applicable for the following charges:

- Airline tickets

- Charges processed by merchants other than the airline the Cardmember is enrolled in (for example, inflight Internet services providers such as GoGo)

- Charges made by airline partners (for example, Cardmember purchase ticket on enrolled airline Delta, but purchases food on an Air France flight)

- Trip insurance / baggage insurance

- Ticket upgrades (Including American Airlines Upgrade Stickers)

- Travel agent fees

- Point transfer fees

- Duty free purchase

- Award ticket fees

Allow 2-4 weeks after the qualifying incidental air travel fee is charged to your card account for statement credit to be posted to the account (but typically in my experience it has been less than that). American Express relies on airlines to submit the correct information on airline transactions, so call the number on the back of the card if statement credits have not posted after 4 weeks from the date of purchase, and they will manually adjust it.

Update: Beginning March 22, 2014, American Express Card Members will no longer have access to American Airlines Admiral Club and US Airways Club airport lounges through Airport Club Access / Airport Lounge Program. This means that Card Members will no longer be able to gain complimentary access to the American Airlines airport lounges (known as Admirals Club lounges) or the US Airways Club airport lounges as a benefit of their Platinum Card Membership. Cardmembers will continue to receive access to participating Delta Sky Club lounges, Priority Pass Select (enrollment is required), and Airspace lounges in JFK, CLE and BWI airports.

Even if you're not planning to use the card for airline vouchers, that credit really takes a big chunk out of expenses like lounge membership (although you get access to American, Delta and US Airways clubs just for carrying the card) or checked baggage fees, and it includes a host of other value-added perks like a $100 reimbursement for Global Entry as well as great purchase protections. It also doesn't carry any foreign transaction fees, and now that you can get it with a SmartChip it makes it an even better choice to carry abroad.

TPG featured card

Rewards

| 4X | Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 4X | Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 3X | Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com. |

| 2X | Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com. |

| 1X | Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases. |

Intro offer

Annual Fee

Recommended Credit

Why We Chose It

There’s a lot to love about the Amex Gold. It’s a fan favorite thanks to its fantastic bonus-earning rates at restaurants worldwide and at U.S. supermarkets. If you’re hitting the skies soon, you’ll also earn bonus Membership Rewards points on travel. Paired with up to $120 in Uber Cash annually (for U.S. Uber rides or Uber Eats orders, card must be added to Uber app and you can redeem with any Amex card), up to $120 in annual dining statement credits to be used with eligible partners, an up to $84 Dunkin’ credit each year at U.S. Dunkin Donuts and an up to $100 Resy credit annually, there’s no reason that foodies shouldn’t add the Amex Gold to their wallet. These benefits alone are worth more than $400, which offsets the $325 annual fee on the Amex Gold card. Enrollment is required for select benefits. (Partner offer)Pros

- 4 points per dollar spent on dining at restaurants worldwide and U.S. supermarkets (on the first $50,000 in purchases per calendar year; then 1 point per dollar spent thereafter and $25,000 in purchases per calendar year; then 1 point per dollar spent thereafter, respectively)

- 3 points per dollar spent on flights booked directly with the airline or with amextravel.com

- Packed with credits foodies will enjoy

- Solid welcome bonus

Cons

- Not as useful for those living outside the U.S.

- Some may have trouble using Uber and other dining credits

- You may be eligible for as high as 100,000 Membership Rewards® Points after you spend $6,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved and find out your exact welcome offer amount – all with no credit score impact. If you’re approved and choose to accept the Card, your score may be impacted.

- Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com.

- Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com.

- Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases.

- $120 Uber Cash on Gold: Add your Gold Card to your Uber account and get $10 in Uber Cash each month to use on orders and rides in the U.S. when you select an American Express Card for your transaction. That’s up to $120 Uber Cash annually. Plus, after using your Uber Cash, use your Card to earn 4X Membership Rewards® points for Uber Eats purchases made with restaurants or U.S. supermarkets. Point caps and terms apply.

- $84 Dunkin' Credit: With the $84 Dunkin' Credit, you can earn up to $7 in monthly statement credits after you enroll and pay with the American Express® Gold Card at U.S. Dunkin' locations. Enrollment is required to receive this benefit.

- $100 Resy Credit: Get up to $100 in statement credits each calendar year after you pay with the American Express® Gold Card to dine at U.S. Resy restaurants or make other eligible Resy purchases. That's up to $50 in statement credits semi-annually. Enrollment required.

- $120 Dining Credit: Satisfy your cravings, sweet or savory, with the $120 Dining Credit. Earn up to $10 in statement credits monthly when you pay with the American Express® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, and Five Guys. Enrollment required.

- Explore over 1,000 upscale hotels worldwide with The Hotel Collection and receive a $100 credit towards eligible charges* with every booking of two nights or more through AmexTravel.com. *Eligible charges vary by property.

- No Foreign Transaction Fees.

- Annual Fee is $325.

- Terms Apply.

Rewards Rate

| 4X | Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 4X | Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 3X | Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com. |

| 2X | Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com. |

| 1X | Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases. |

Intro Offer

You may be eligible for as high as 100,000 Membership Rewards® Points after spending $6,000 in eligible purchases on your new Card in your first 6 months of Membership. Welcome offers vary and you may not be eligible for an offer.As High As 100,000 points. Find Out Your Offer.Annual Fee

$325Recommended Credit

Credit ranges are a variation of FICO® Score 8, one of many types of credit scores lenders may use when considering your credit card application.Excellent to Good

Why We Chose It

There’s a lot to love about the Amex Gold. It’s a fan favorite thanks to its fantastic bonus-earning rates at restaurants worldwide and at U.S. supermarkets. If you’re hitting the skies soon, you’ll also earn bonus Membership Rewards points on travel. Paired with up to $120 in Uber Cash annually (for U.S. Uber rides or Uber Eats orders, card must be added to Uber app and you can redeem with any Amex card), up to $120 in annual dining statement credits to be used with eligible partners, an up to $84 Dunkin’ credit each year at U.S. Dunkin Donuts and an up to $100 Resy credit annually, there’s no reason that foodies shouldn’t add the Amex Gold to their wallet. These benefits alone are worth more than $400, which offsets the $325 annual fee on the Amex Gold card. Enrollment is required for select benefits. (Partner offer)Pros

- 4 points per dollar spent on dining at restaurants worldwide and U.S. supermarkets (on the first $50,000 in purchases per calendar year; then 1 point per dollar spent thereafter and $25,000 in purchases per calendar year; then 1 point per dollar spent thereafter, respectively)

- 3 points per dollar spent on flights booked directly with the airline or with amextravel.com

- Packed with credits foodies will enjoy

- Solid welcome bonus

Cons

- Not as useful for those living outside the U.S.

- Some may have trouble using Uber and other dining credits

- You may be eligible for as high as 100,000 Membership Rewards® Points after you spend $6,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved and find out your exact welcome offer amount – all with no credit score impact. If you’re approved and choose to accept the Card, your score may be impacted.

- Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com.

- Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com.

- Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases.

- $120 Uber Cash on Gold: Add your Gold Card to your Uber account and get $10 in Uber Cash each month to use on orders and rides in the U.S. when you select an American Express Card for your transaction. That’s up to $120 Uber Cash annually. Plus, after using your Uber Cash, use your Card to earn 4X Membership Rewards® points for Uber Eats purchases made with restaurants or U.S. supermarkets. Point caps and terms apply.

- $84 Dunkin' Credit: With the $84 Dunkin' Credit, you can earn up to $7 in monthly statement credits after you enroll and pay with the American Express® Gold Card at U.S. Dunkin' locations. Enrollment is required to receive this benefit.

- $100 Resy Credit: Get up to $100 in statement credits each calendar year after you pay with the American Express® Gold Card to dine at U.S. Resy restaurants or make other eligible Resy purchases. That's up to $50 in statement credits semi-annually. Enrollment required.

- $120 Dining Credit: Satisfy your cravings, sweet or savory, with the $120 Dining Credit. Earn up to $10 in statement credits monthly when you pay with the American Express® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, and Five Guys. Enrollment required.

- Explore over 1,000 upscale hotels worldwide with The Hotel Collection and receive a $100 credit towards eligible charges* with every booking of two nights or more through AmexTravel.com. *Eligible charges vary by property.

- No Foreign Transaction Fees.

- Annual Fee is $325.

- Terms Apply.