MyVegas Rewards: Free Hotel Rooms, Show Tickets and More via Facebook

New TPG contributor and assistant editor Peter Rothbart brings us through the art of scoring free Las Vegas perks via MyVegas Rewards.

Opportunities to earn and redeem hotel points in Las Vegas are improving, especially with the recent partnerships forged between prominent hotel brands (like Hyatt, Marriott, Starwood and IHG) and premier properties on the Vegas strip. Still, as one of the top 5 most visited travel destinations in the US, we welcome more options to explore Sin City using points and miles.

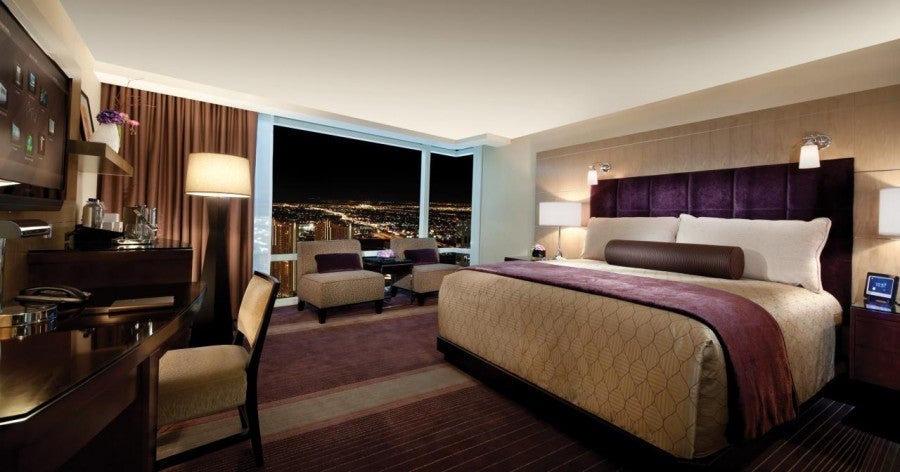

Enter MyVegas Rewards. MyVegas is a Facebook game presented by MLife, the rewards program for MGM Resorts, which operates myriad Las Vegas casino properties including Aria, Bellagio, and MGM Grand. MyVegas launched in 2011, and presently boasts over 5.5 million players. The game itself is a cartoonish webscape rendition of the Las Vegas Strip, in which you play an assortment of free slots and table games, "build" casino properties and level up to earn real comps, including free hotel rooms, show tickets, restaurant credits and more.

Rewards come in the form of Loyalty Points, which are redeemable for a variety of comps, the most glamorous of which are free or discounted nights at Las Vegas MLife properties. Like most points and miles programs, redemption rates vary with demand. Mid-week nights cost less (sometimes much less) than weekend nights; for example, a regular mid-week night at Luxor costs 30,000 Loyalty Points, while the weekend equivalent costs 96,000.

Most properties also offer dramatically discounted "Bonus" dates for both mid-week and weekend redemptions. A regular weekend redemption at the MGM Grand costs 227,500 Loyalty Points, while a Bonus weekend redemption costs only 122,500. Bonus dates are plentiful and are posted months in advance, so taking advantage of the reduced rates is easy.

For those who have flexible schedules and aren't necessarily seeking luxury, a room on the Vegas Strip can be had for as little as 12,000 Loyalty Points (for a mid-week Bonus redemption at Circus Circus). The table below shows the current redemption rates for hotel stays through MyVegas Rewards. Free nights are not presently available at Bellagio or Vdara, though both offer discount rewards. Also, note that all of these properties have nightly resort fees that are charged separately.

MyVegas Loyalty Point hotel redemption options:

Midweek Bonus | Midweek | Weekend Bonus | Weekend | |

|---|---|---|---|---|

Circus Circus | 12,000 | 20,000 | 34,000 | 68,000 |

Excalibur | 15,000 | 25,000 | 42,000 | 84,000 |

Luxor | 18,000 | 30,000 | 48,000 | 96,000 |

Monte Carlo | 30,000 | 52,500 | 81,000 | 135,000 |

New York, New York | 32,000 | 56,000 | 101,500 | 145,000 |

Mirage | 52,500 | - | - | - |

Mandalay Bay | 67,500 | 121,500 | 115,500 | 181,500 |

MGM Grand | 47,500 | 85,500 | 122,500 | 227,500 |

Aria | 99,000 | 165,000 | 215,000 | - |

Bellagio | 25% off room rate for 10,000 Loyalty Points | |||

Vdara | $75 (mid-week) or $125 (weekend) suites for 1,000 Loyalty Points |

Further redemption options include Cirque du Soleil and other show tickets (ranging from 28,000-78,000 Loyalty Points depending on the show and seating class for Zumanity, O, Zarkana, Ka and Love), buffet passes, club entries, restaurant credits, monorail passes and more. Reward prices are subject to change and new rewards appear frequently, so check the rewards menu within the MyVegas game app to see current redemption options.

The redemption process is straightforward: after using your Loyalty Points in MyVegas, you'll receive an email with instructions on how to book your hotel stay, buy tickets, etc. You can generally redeem rewards on short notice so long as there is sufficient availability. Rewards that require advance booking (like hotel rooms) can be redeemed by phone; others (like buffet passes) can be redeemed at any MLife desk upon arrival. MLife also tends to be easygoing about refunds and cancellations; they'll willingly credit your MyVegas account with the appropriate number of Loyalty Points if your travel plans change. Accounts are limited to one per person, so you can't redeem rewards for someone else. Also, each individual is limited to 3 total redemptions in a rolling 30-day period.

Loyalty Points are predominantly earned in the following ways:

- Game play – you earn Loyalty Points just by playing slots and table games. The more chips you bet, the faster you earn. You can earn a maximum of 2,000 Loyalty Points per day via game play. MyVegas routinely offers promotions (oriented around holidays or major events) that reward you with extra Loyalty Points for playing a certain amount each day.

- Leveling up – As you play, you gain experience points. Once you accumulate enough experience, you graduate to the next level and receive a bonus (typically some combination of chips and Loyalty Points). Initially the amount of experience needed to level up is triflingly small, and the bonuses at lower levels are accordingly meager. More experience is needed to advance at higher levels, but you'll earn as much as 1,000 Loyalty Points each time you level up. (Leveling up also unlocks the critical auto-spin feature, which lets you play up to 200 spins with one click.)

- Daily spin bonus – Every 22 hours MyVegas offers you a Wheel-of-Fortune-style spin to earn bonus chips or Loyalty Points. The daily spin bonus is increased when you "like" the MyVegas Facebook page, and is further augmented based on how many Facebook friends you have and how many consecutive days you have played. Like the level up bonuses, daily spins start off small. At higher levels, however, you can pull jackpots of 5,000 Loyalty Points or more.

- Property bonus – As you play the game, you'll "build" MLife properties on your MyVegas strip. Each of these properties has a clickable button that periodically offers bonus chips or Loyalty Points. Lesser properties offer small, frequent bonuses, while the more renowned properties offer much larger (but less frequent) bonuses.

- Bonus links – MyVegas occasionally sends out links to coupons redeemable (by clicking) for chips and Loyalty Points. While points earned this way don't add up quickly, they are virtually effortless.

Loyalty Points are surprisingly easy to earn, especially if you're often at your computer and can have the game running in the background. Earning is slow at the outset, but picks up quickly. In roughly 6 months of casual game play I've earned over 300,000 Loyalty Points. Once you level up to unlock higher Daily Spin and Property bonuses, you could plausibly abandon game play all together and still average a few hundred Loyalty Points each day, enough for a few free nights and buffet passes on the occasional Las Vegas jaunt.

Pro Tips

- MyVegas will spam your Facebook newsfeed relentlessly. Every time you hit a jackpot, advance a level, or reach some other achievement within the game, you'll be prompted to share the good news with your friends. You can tediously deny all these requests, but the more elegant solution used by many MyVegas players is to create a separate Facebook account. This strategy is triply beneficial: it keeps your newsfeed clean, speeds up your game play, and enables you to "friend" other MyVegas players (which earns you more chips as described above). This is technically a violation of Facebook user policy, but one that is generally overlooked (or has minimal consequences when enforced).

- Each of the slot games offers a bonus round, in which you play a game within the game to win extra chips. While the additional chips are helpful, the bonus rounds generally require your attention, and time spent playing the side games dramatically lowers your earning rate for Loyalty Points. To maximize your ROI, play the game Lucky Birds, which has a bonus round that only takes a few seconds.

- The "bet more, earn more" nature of the game might tempt you to bet the maximum, but as any slot player will tell you, that's a fast way to go broke. These games function more or less as real slots, and you will lose chips in the long run. If you bet a modest amount, those losses are tempered by the steady cascade of free chips that get thrown your way via the bonuses described above. Slow and steady definitely wins this race, so nurse your chip stack and don't get tempted to overbet.

- There are many MyVegas Facebook groups offering help for beginners, news, strategy, chip sharing and a legion of MyVegas friends. They're worth checking out from time to time, even if only for the free chips.

Bottom Line

MyVegas Rewards can't match the large bonuses available through credit card signups, but it does offer a fairly easy and risk-free way to earn comps in Las Vegas. The earning rate is such that it's probably not worthwhile if you have to dedicate significant time to game play, but if you can run the games in the background while doing other work, you'll get a good return on your time investment and be well on your way to taking Vegas by storm!

[card card-name='Chase Sapphire® Card' card-id='22089398' type='javascript' bullet-id='1']

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app